1. Introduction

In recent years, the global cosmetics industry has been navigating increasingly turbulent waters as international trade tensions rise and tariff policies shift dramatically. The implementation of new tariffs, particularly between major economic powers like the United States and China, has sent ripples throughout the cosmetics supply chain, affecting everything from raw material sourcing to final product pricing. These tariffs represent a significant challenge for an industry that has long relied on global supply networks and international trade to deliver innovative products to consumers worldwide.

The cosmetics market, valued at hundreds of billions of dollars globally, faces unique vulnerabilities to tariff policies due to its complex supply chains and reliance on specialized ingredients and packaging components sourced from around the world. Many American brand cosmetic companies manufacture their products almost entirely in China, while European luxury brands export significant volumes to markets across Asia and North America. This international interdependence means that tariff changes can quickly cascade through the entire industry ecosystem.

For manufacturers, suppliers, and consumers, tariffs present multifaceted challenges. Manufacturers face increased costs for raw materials and packaging components, potentially squeezing profit margins or forcing price increases. Suppliers must navigate disrupted supply chains and changing customer demands. Consumers ultimately may encounter higher prices, reduced product availability, or reformulated products as brands adapt to the new economic realities.

The purpose of this article is to provide a comprehensive exploration of how tariffs are reshaping the global cosmetics landscape, with particular attention to their impact on the Chinese cosmetics market—both as a manufacturing hub and as a consumer market. More importantly, we will offer practical guidance for cosmetics packaging manufacturers on how to respond strategically to these challenges. By understanding the nature of tariffs, their specific impacts on the cosmetics industry, and the adaptive responses already emerging in major markets like China, packaging manufacturers can develop resilient strategies to not only survive but potentially thrive amid these trade disruptions.

2. Understanding Tariffs on Cosmetics

Global Tariff Trends

The global landscape of cosmetic-related tariffs has become increasingly complex and volatile in recent years. Trade tensions between major economies have resulted in a series of tariff impositions and retaliatory measures that have created a challenging environment for international commerce, including the cosmetics industry.

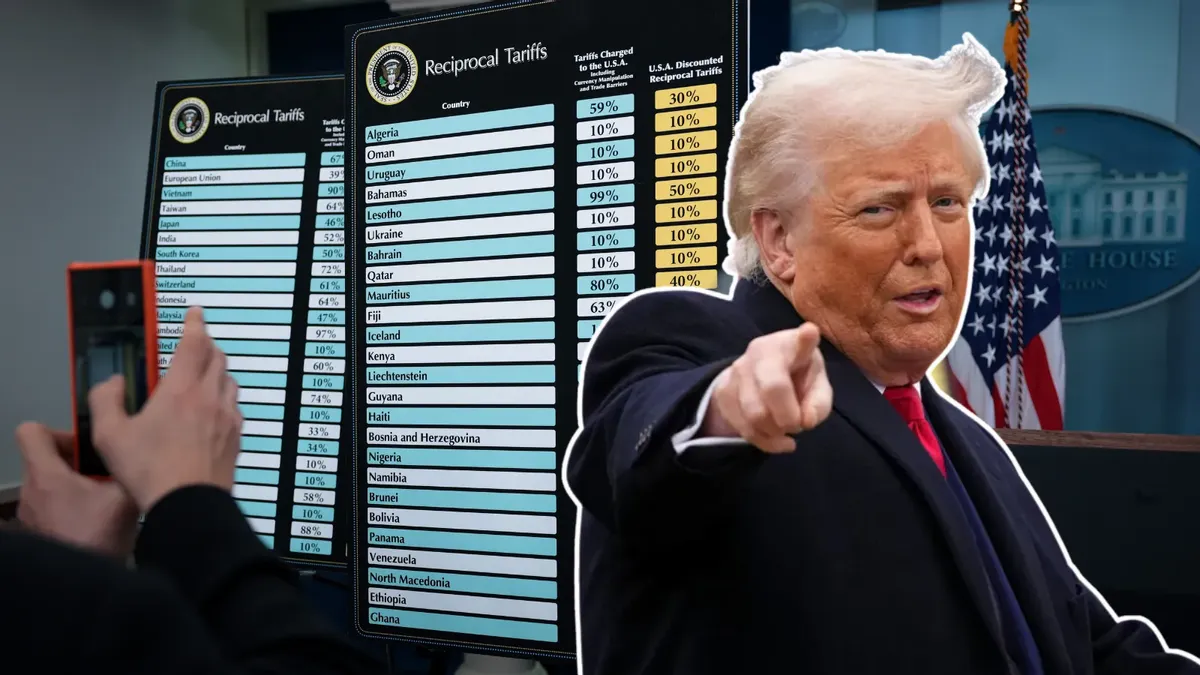

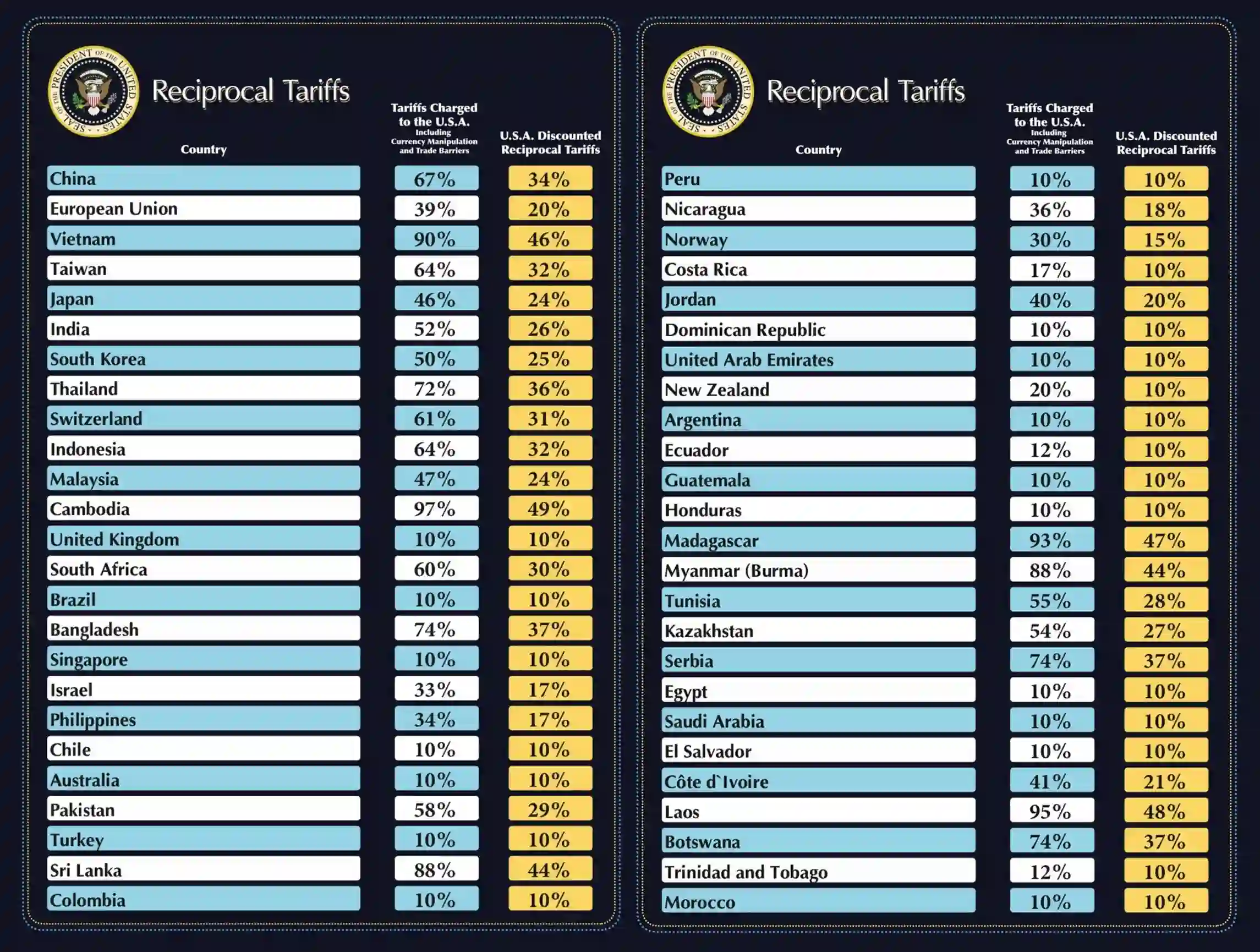

As of April 7, 2025, the tariff situation includes:

– Products from China being hit with a 34% tariff by the United States

– A 20% tariff on goods from the European Union entering the U.S.

– A 46% tariff on imports from Vietnam

– A 25% tariff on goods from South Korea

– A 26% tariff on products from India

– A baseline 10% tax on imports from all countries

In response to these measures, China has announced reciprocal 34% tariffs on all imports from the United States, creating a classic trade war scenario that further complicates the global cosmetics supply chain.

These tariff trends represent a significant shift from the relatively stable trade environment that the cosmetics industry enjoyed for many years. The unpredictability of current trade policies has forced companies to reconsider their global sourcing strategies, manufacturing locations, and market entry approaches.

Cosmetics as a Target of Tariffs

Cosmetics and personal care products are frequently targeted by tariffs for several reasons. First, these products often represent discretionary consumer spending rather than essential goods, making them politically easier targets for tariff policies. Second, the cosmetics industry is highly globalized, with complex international supply chains that create multiple points where tariffs can be applied. Third, many countries view their domestic cosmetics industries as sectors worth protecting or developing, leading to protectionist tariff policies.

The luxury segment of the cosmetics market is particularly vulnerable to tariffs. High-end beauty products from France, Italy, Germany, and the UK face significant headwinds in markets like the United States due to tariffs on European goods. These premium products often have less flexibility to absorb tariff costs without price increases, potentially making them less competitive against domestic alternatives.

Additionally, the cosmetics industry’s reliance on specialized ingredients and packaging components from specific global regions makes it difficult to quickly pivot supply chains in response to tariff changes. This structural characteristic of the industry amplifies the impact of tariffs and extends their effects throughout the value chain.

Scope of Tariffs

The scope of tariffs affecting the cosmetics industry is broad, touching virtually every product category and component of the supply chain. Specific product categories affected include:

1. Skincare: Facial creams, serums, masks, and treatments that often contain specialized ingredients sourced globally.

2.Makeup: Foundations, lipsticks, eye products, and other color cosmetics that rely on pigments and formulation components from various countries.

3.Haircare: Shampoos, conditioners, styling products, and treatments that incorporate a wide range of botanical and synthetic ingredients.

4.Packagingmaterials: Perhaps most significantly for packaging manufacturers, tariffs affect glass containers, plastic components, pumps, droppers, caps, and decorative elements that are frequently sourced from countries like China.

The impact on packaging is particularly noteworthy. According to industry experts, packaging is already a substantial portion of the cost of making beauty products, and China-made packaging is where the beauty industry could take the biggest hit from tariffs. Many beauty brands source their packaging from China due to cost advantages and manufacturing capabilities that are difficult to replicate elsewhere.

Beyond finished products and packaging, tariffs also affect raw materials used in cosmetics formulation. While most beauty brands source ingredients for U.S. products from American suppliers, exceptions include plant-based ingredients like coconut oil or palm oil (commonly used in foundation, concealer, lipstick, and more) and exotic ingredients like Madagascar vanilla for perfumes. Products containing these ingredients may see price spikes as a result of tariffs.

The comprehensive scope of these tariffs means that virtually no segment of the cosmetics industry remains untouched by their effects. From luxury brands to mass-market products, from skincare specialists to color cosmetics manufacturers, companies throughout the industry must develop strategies to address the challenges posed by this evolving tariff landscape.

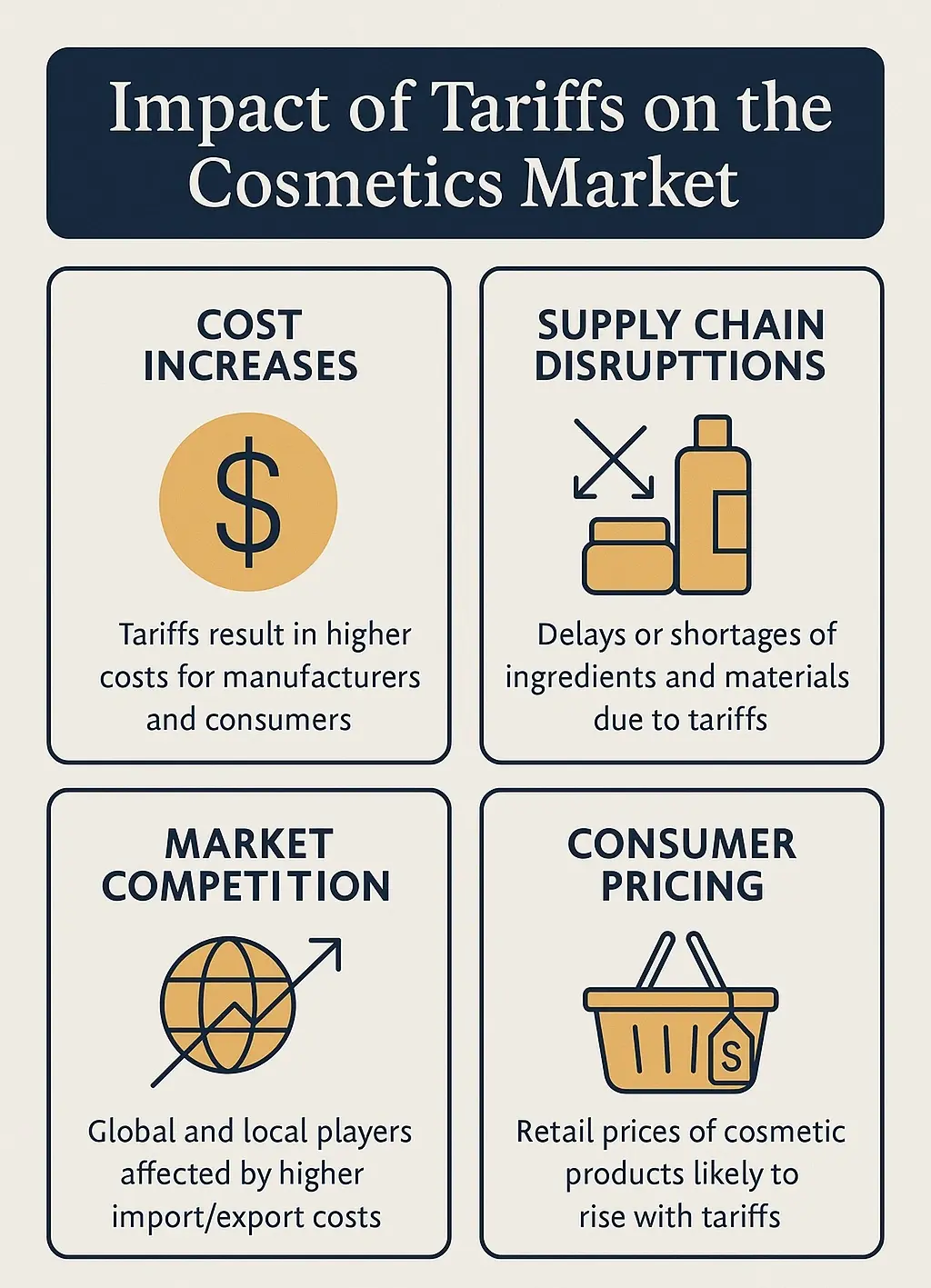

3. Impact of Tariffs on the Cosmetics Market

Cost Increases

The implementation of tariffs on cosmetics and related materials has triggered a cascade of cost increases throughout the industry’s supply chain. Depending on the origin country of the goods, American consumers could pay a premium ranging from 10% to over 60% on imported skin care, makeup, and other personal care items. For example, a $60 moisturizer imported from Europe could cost $72 under a 20% tariff. Economists predict that prices would likely increase by the amount of the tariff, creating immediate financial pressure on both businesses and consumers.

These cost increases affect multiple points in the supply chain:

1.Raw Material Sourcing: Tariffs on imported ingredients raise the base cost of product formulation. While many beauty brands source ingredients for U.S. products from American suppliers, certain specialized or exotic ingredients must be imported, creating unavoidable cost increases.

2.Packaging Components: Packaging represents a substantial portion of the cost of making beauty products, and China-made packaging is where the beauty industry could take the biggest hit from tariffs. With tariffs on Chinese goods reaching 34%, the impact on packaging costs is significant.

3.Manufacturing Processes: Even when products are manufactured domestically, they often rely on imported equipment, technologies, or components that may be subject to tariffs, indirectly raising production costs.

4.Logistics and Distribution: Tariffs can complicate international shipping and distribution networks, potentially increasing costs for customs clearance, freight, and inspection.

For cosmetics brands, these cost increases present difficult choices: absorb the additional expenses and accept reduced profit margins, pass the costs on to consumers through price increases, or find ways to reformulate products or redesign packaging to mitigate the impact of tariffs.

Supply Chain Disruptions

Beyond direct cost increases, tariffs have created significant disruptions in cosmetics supply chains that had been optimized over decades of globalization. These disruptions manifest in several ways:

1.Delays in Material Availability: As companies scramble to adjust to new tariff regimes, bottlenecks can develop in the supply of critical ingredients or packaging components, leading to production delays.

2.Uncertainty in Planning: The volatile nature of trade policies makes long-term planning difficult. Companies hesitate to make major investments or commitments when tariff policies might change suddenly.

3.Complexity in Sourcing: Many cosmetics companies are exploring alternative sourcing options to avoid heavily tariffed regions, but establishing new supplier relationships takes time and introduces quality control challenges.

4.Inventory Management Challenges: Businesses may stockpile materials ahead of tariff implementation dates, creating temporary shortages and inventory management complications.

These disruptions are particularly challenging for smaller brands and manufacturers who lack the resources and flexibility of larger corporations. According to industry experts, dismantling existing supply chains and moving production to avoid tariffs is not easy and involves significant costs and time investments. Companies moving production from one location to another must also ensure compliance with regulations such as the FDA’s Food, Drug, & Cosmetics Act and Fair Packaging and Labeling Act, adding another layer of complexity to supply chain adjustments.

Market Competition

Tariffs have significantly altered the competitive landscape in the cosmetics industry, creating both challenges and opportunities for different types of players:

1.Global Brands vs. Local Players: International brands facing tariffs may lose competitive advantage against local manufacturers who are exempt from these additional costs. This shift can lead to increased market share for domestic companies.

2.Premium vs. Mass Market: Luxury beauty brands often have more pricing flexibility and loyal customer bases that may absorb price increases, while mass-market brands compete in more price-sensitive segments where tariff-induced increases could significantly impact sales.

3.Established Companies vs. Startups: Larger, established companies typically have more resources to navigate tariff challenges, potentially creating higher barriers to entry for new market entrants.

4.Regional Competitive Shifts: As companies relocate production to avoid tariffs, new manufacturing hubs emerge, potentially altering regional competitive dynamics in the global cosmetics industry.

The competitive impact extends to retailers as well. According to industry analysts, retailers may be hesitant to carry or reorder tariff-heavy products due to higher wholesale costs. They might shift their buying to tariff-free brands or private labels, further reshaping market competition.

Consumer Pricing

The ultimate impact of tariffs often falls on consumers through higher retail prices. While some brands may temporarily absorb tariff costs to maintain market share, sustained tariff policies eventually lead to price adjustments at the retail level. Evidence suggests prices would likely go up by the amount of the tariff, though the exact timing and extent of these increases depend on market conditions and company strategies.

Interestingly, even domestically-made products often increase in price when imported competitors’ prices rise. This phenomenon occurs because when foreign-supplied products go up in price, American-made ones often follow suit to maximize profit opportunities. This pattern was observed during previous tariff implementations, such as when tariffs on foreign-made washing machines led to price increases for domestic machines as well.

For consumers, these price increases may lead to changed purchasing behaviors:

1.Trading Down: Consumers might switch from premium to mass-market products to maintain their beauty routines within budget constraints.

2.Reduced Consumption: Some consumers may purchase fewer products or extend the use of existing products to offset higher prices.

3.Shift to Alternatives: Consumers might explore alternative product categories or formulations that are less affected by tariffs.

4.Brand Switching: Loyalty may shift to brands that maintain price stability or offer better value in the new tariff environment.

Despite these potential changes, industry experts note that historically, beauty sales have remained relatively strong during economic downturns due to the “Lipstick Effect,” where consumers continue to purchase affordable luxury items like cosmetics even when cutting back in other areas.

Market Adjustments

In response to tariff-induced challenges, the cosmetics industry has demonstrated remarkable adaptability through various market adjustments:

1.Product Reformulation: Brands are reformulating products to use ingredients that are less affected by tariffs or that can be sourced domestically.

2.Packaging Redesign: Companies are exploring packaging alternatives that reduce weight, size, or reliance on heavily tariffed materials.

3.Supply Chain Restructuring: Manufacturers are diversifying supplier networks and establishing production facilities in regions with more favorable trade conditions.

4.Strategic Pricing: Some brands implement selective price increases across their product lines, raising prices more on items with inelastic demand while maintaining competitive pricing on more price-sensitive products.

5.Market Refocusing: Companies may shift their focus to markets less affected by tariffs or where they have manufacturing capabilities that avoid cross-border shipping.

These adjustments reflect the industry’s resilience but also highlight the significant resources being diverted to address tariff challenges rather than product innovation or market expansion. For many companies, especially smaller brands, these adjustments represent substantial investments with uncertain returns given the unpredictable nature of trade policies.

The cosmetics industry’s response to tariffs illustrates both the challenges of operating in an increasingly fragmented global trade environment and the innovative approaches companies are taking to maintain competitiveness despite these obstacles. As tariff policies continue to evolve, further market adjustments are likely, potentially reshaping the industry’s global footprint and competitive dynamics for years to come.

4. Response of the Chinese Cosmetics Market to Tariffs

Local Production Shift

The Chinese cosmetics market has responded to global tariff challenges with remarkable agility, most notably through a significant shift toward increased domestic production. This strategic pivot serves multiple purposes: it helps avoid tariffs on imported goods, strengthens China’s position as both a producer and consumer in the global cosmetics market, and creates greater self-sufficiency within the industry.

China’s beauty industry has demonstrated unexpected resilience despite trade tensions. According to market data, sales reached ¥963 billion (approximately $136 billion) during the 2024 Double 11 shopping festival, representing a 22.5% year-over-year growth. This strong performance underscores the market’s ability to adapt to changing trade conditions through increased domestic manufacturing capabilities.

The shift toward local production is evident in several key developments:

1.Domestic Brand Growth: Chinese brands like Proya and Comfy have secured top positions across major platforms, indicating growing consumer confidence in locally-produced cosmetics.

2.Manufacturing Infrastructure Expansion: Significant investments in domestic manufacturing facilities have enabled Chinese companies to reduce reliance on imported components and ingredients.

3.Vertical Integration: Many Chinese cosmetics companies have expanded their operations to include more stages of the production process, from ingredient sourcing to packaging manufacturing.

4.Regulatory Adaptation: China’s comprehensive overhaul of cosmetic safety assessments in April 2024, covering 3,578 ingredients and requiring extensive toxicological data, has accelerated the industry’s evolution from price-driven competition to quality-focused development.

This local production shift represents more than just a response to tariffs—it signals China’s strategic intent to develop a more sophisticated, self-reliant cosmetics industry capable of competing on quality rather than just price. The success of domestic brands coinciding with strong performances from international players reflects a maturing market where both international and domestic players are adapting their strategies—international brands becoming more adept at local marketing while domestic brands increase their R&D investments.

Expansion of Exports

While strengthening domestic production, China has simultaneously pursued an aggressive strategy to expand its cosmetics exports, particularly targeting regions unaffected by tariffs. This dual approach allows Chinese manufacturers to maintain growth despite trade barriers in certain markets.

Key aspects of China’s export expansion include:

1.Regional Comprehensive Economic Partnership (RCEP) Focus: Trade with RCEP countries jumped from $980 million in 2021 to $1.76 billion in 2023. RCEP members include Australia, Brunei, Cambodia, China, Indonesia, Japan, South Korea, Laos, Malaysia, Myanmar, New Zealand, the Philippines, Singapore, Thailand, and Vietnam.

2.Institutional Support: The establishment of the “RCEP Cosmetics International Exchange and Cooperation Platform” in 2023 has facilitated regional integration, from product development to standards alignment.

3.Strategic Brand Internationalization: Chinese beauty brands are pursuing international expansion strategies under the concept of “going overseas” (Chu Hai). Companies like Florasis, Perfect Diary, and Into You have established strong presences in Southeast Asian markets by effectively combining cultural understanding with digital innovation.

4.Preemptive Contract Negotiations: Companies like Cosmos Group, a leading Chinese supplier of sunscreen UV filters, have secured long-term contracts with US-based companies like Edgewell Personal Care, signaling preemptive preparation for possible tariff increases.

The United States remains China’s largest overseas market, accounting for 20.5% of total exports in 2023. However, the significant growth in RCEP markets demonstrates China’s success in diversifying its export destinations to mitigate the impact of tariffs in traditional markets. This diversification strategy supports Chinese beauty brands’ international expansion while reducing vulnerability to trade tensions with any single country or region.

Innovation and Adaptation

The Chinese cosmetics industry has responded to tariff pressures with remarkable innovation and adaptation across multiple dimensions of its business model. These creative responses have not only helped mitigate the impact of tariffs but have also accelerated the industry’s overall development and sophistication.

Key areas of innovation include:

1.Product Diversification: Chinese manufacturers have expanded their product lines to include higher-margin items less sensitive to tariff-induced price increases. The “efficacy-first” trend was evident in recent sales data, where consumers prioritized products offering multiple benefits and advanced formulations.

2.Cost-Effective Manufacturing Techniques: Companies have developed more efficient production methods that reduce costs without compromising quality, helping offset the financial impact of tariffs.

3.Formulation Innovation: Chinese brands are increasingly investing in R&D to develop unique formulations that differentiate their products in both domestic and international markets. Domestic brands like Comfy of Juzi Biotechnology, which sold over 70 million collagen stick units on the first day of Double 11, exemplify how companies can leverage scientific investment to meet market demands.

4.Supply Chain Restructuring: The industry’s response to trade pressures has evolved beyond market diversification to include strategic supply chain restructuring. According to local media reports, Chinese manufacturers increasingly invest in regional manufacturing hubs and R&D facilities across ASEAN countries, indicating a more sophisticated approach to international market development.

5.Regulatory Compliance Innovation: The April 2024 regulations covering 3,578 ingredients and requiring extensive toxicological data have accelerated the industry’s evolution from price-driven competition to quality-focused development. Leading ingredient suppliers, OEM/ODM manufacturers, and brands are investing in toxicological testing—either by establishing in-house compliance capabilities or by building partnerships with well-known institutions.

These innovations reflect a deeper transformation in China’s cosmetics industry, moving from a growth-at-all-costs mentality to one demanding more balanced development strategies. The industry is increasingly prioritizing ingredients with complete toxicological data packages, elevating data completeness over traditional cost-effectiveness as the decisive factor in ingredient selection.

Investment in Technology

Technology investments have become a cornerstone of the Chinese cosmetics industry’s response to tariff challenges. By embracing automation, digital solutions, and advanced manufacturing technologies, Chinese companies are streamlining operations, reducing costs, and enhancing their competitive position despite trade barriers.

Significant technology investments include:

1.Automation in Manufacturing: Increased adoption of automated production lines has reduced labor costs and improved efficiency, helping offset tariff-related cost increases.

2.Digital Supply Chain Management: Advanced software solutions enable more precise inventory management and demand forecasting, reducing waste and improving responsiveness to market changes.

3.E-commerce Integration: Chinese cosmetics companies have leveraged digital platforms to reach consumers directly, bypassing traditional distribution channels that might be affected by tariffs. Major e-commerce platforms grew, with Taobao-Tmall commanding 50.1% overall market GMV, Douyin (China’s version of TikTok) capturing 26.7%, and JD securing 11.7%.

4.Data Analytics for Market Intelligence: Investments in big data and analytics capabilities help companies identify emerging opportunities and optimize their product offerings for specific markets.

5.Research and Development Facilities: Establishment of advanced R&D centers focused on developing innovative formulations and packaging solutions that can command premium prices regardless of tariff impacts.

The toxicological testing requirements introduced in April 2024 have further accelerated technology investments. Testing for a single ingredient now reportedly costs over ¥300,000 (around $41,234) and requires 2-6 months to complete. This has created a natural barrier against the rapid product launches that once characterized the market, pushing companies to invest in more sophisticated testing and compliance technologies.

These technology investments represent a strategic pivot rather than merely a tactical response to tariffs. By enhancing their technological capabilities, Chinese cosmetics companies are positioning themselves for long-term competitiveness in the global market, regardless of fluctuations in trade policies. The industry’s evolution from price-driven competition to quality-focused development is being enabled and accelerated by these technological advancements.

The Chinese cosmetics market’s multifaceted response to tariffs—encompassing local production shifts, export expansion, innovation in products and processes, and technology investments—demonstrates remarkable resilience and strategic foresight. Rather than merely reacting to trade barriers, the industry has used these challenges as a catalyst for transformation, emerging stronger and more sophisticated. This evolution offers valuable lessons for cosmetics companies worldwide as they navigate the complexities of an increasingly fragmented global trade landscape.

5. What Should Packaging Manufacturers Do?

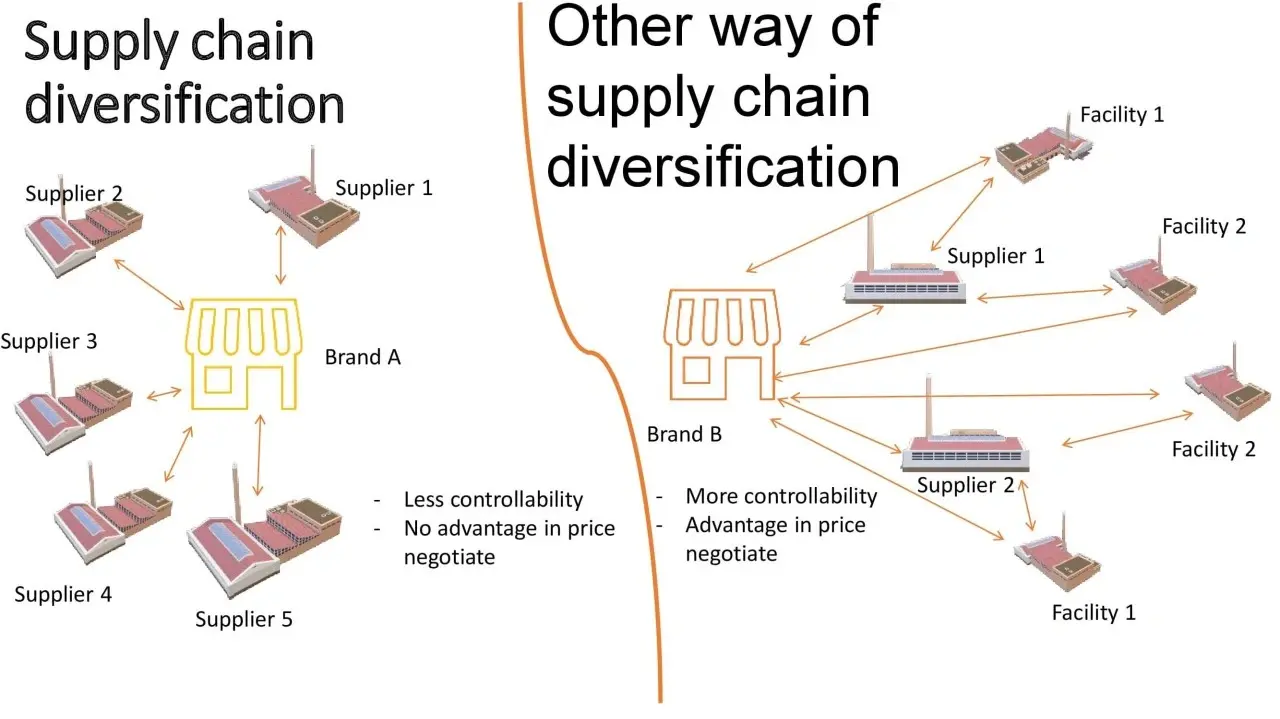

Diversify Supply Sources

In the face of escalating tariffs and trade uncertainties, cosmetics packaging manufacturers must prioritize supply source diversification as a fundamental strategy. Relying on a single region or country for materials creates significant vulnerability to tariff-induced cost increases and supply disruptions.

Effective supply source diversification includes:

1.Geographic Diversification: Packaging manufacturers should build relationships with suppliers across multiple regions to reduce exposure to country-specific tariffs. Looking for vendors with global manufacturing footprints can provide flexibility when trade policies change.

2.Material Diversification: Exploring alternative materials that serve similar functions but may face different tariff classifications or originate from different regions can provide cost advantages. For instance, considering domestic suppliers for materials heavily taxed due to tariffs.

3.Supplier Relationship Management: Developing strong relationships with multiple suppliers ensures better negotiating positions and more reliable supply continuity. As Dan Wolfe, Senior Vice President of Business Development at Cosmopak notes, “Our brand partners task Cosmopak to create a supply chain strategy to produce the highest quality packaging and finished goods at the lowest cost. Cosmopak executes this by tapping its global network and internal processes.”

4.Regional Manufacturing Hubs: Following the example of Chinese manufacturers who are investing in facilities across ASEAN countries, packaging manufacturers should consider establishing production capabilities in strategic locations that provide tariff advantages for their target markets.

5.Dual Sourcing Practices: As one industry expert recommends, “When a company is dealing with offshore suppliers, they need to have dual sourcing in place.” This approach ensures continuity even when one supply source becomes economically unviable due to tariffs.

The shift from China to Mexico or other APAC countries that some companies are making demonstrates the importance of having flexible sourcing options. While these transitions require significant logistical and regulatory adjustments, they can provide substantial cost advantages in a high-tariff environment.

Optimize Packaging Design

Packaging design optimization represents a powerful strategy for mitigating tariff impacts while potentially delivering additional benefits in sustainability and consumer appeal. By rethinking packaging from first principles, manufacturers can reduce costs while maintaining or enhancing functionality.

Key approaches to packaging design optimization include:

1.Weight and Size Reduction: Minimizing material usage through lighter, smaller packaging designs can directly reduce tariff costs, which are often calculated based on weight or value. This approach also yields shipping and storage efficiencies.

2.Modular Systems Development: Creating modular packaging systems allows for quick material substitutions when availability and cost fluctuate due to tariff changes. As one industry expert advises, “Use modular packing systems that allow for quick material substitutions for when availability and cost are at risk.”

3.Material Substitution: Redesigning packaging to use materials that face lower tariffs or can be sourced domestically can significantly reduce costs. This might involve replacing metal components with plastic alternatives or glass with alternative materials.

4.Design for Local Production: Developing packaging designs that can be efficiently produced in multiple regions allows for manufacturing location flexibility as tariff situations evolve.

5.Value Engineering: Systematically analyzing each component of packaging design to eliminate unnecessary elements while preserving essential functionality and brand identity can reduce costs without compromising quality.

Ryan Kenny, President of North America at Aptar Beauty, emphasizes the importance of early-stage design: “Clients are actively seeking ways to right-size costs by exploring alternative supply options and increasing their reliance on local suppliers. They are asking for solutions that can help them navigate these cost pressures without compromising on quality or delivery times.”

By approaching packaging design with tariff considerations in mind from the outset, manufacturers can create solutions that remain economically viable regardless of trade policy fluctuations.

Focus on Sustainability

The growing demand for sustainable packaging presents an opportunity for manufacturers to address both environmental concerns and tariff challenges simultaneously. Sustainability initiatives can provide a competitive edge while potentially reducing exposure to tariff-sensitive materials.

Strategic approaches to sustainability include:

1.Eco-Friendly Material Adoption: Incorporating biodegradable, recyclable, or renewable materials can reduce dependence on petroleum-based plastics or other materials that may face high tariffs. These materials often can be sourced locally, further reducing tariff exposure.

2.Circular Economy Participation: Designing packaging for reuse, refill, or recycling can reduce overall material requirements and associated tariff costs while appealing to environmentally conscious consumers.

3.Value-Aligned Messaging: As industry experts note, “Consumers are willing to pay extra for values that align with theirs.” Emphasizing sustainability credentials can justify premium pricing that helps offset tariff-related cost increases.

4.Regulatory Compliance Advantage: Sustainable packaging often aligns with evolving regulations in major markets, potentially providing easier market access compared to less sustainable alternatives that may face both tariffs and regulatory hurdles.

5.Resource Efficiency: Sustainable design principles typically emphasize material efficiency, which naturally reduces the quantity of imported materials subject to tariffs.

The shift in messaging from “luxury for luxury’s sake” to “luxury with meaning” (e.g., clean, conscious beauty) reflects changing consumer priorities that packaging manufacturers can leverage. By emphasizing sustainability, transparency, cruelty-free certifications, and ethical sourcing, manufacturers can create value propositions that transcend price considerations influenced by tariffs.

6. Conclusion

Tariffs have brought significant challenges to the cosmetics packaging industry, increasing costs, disrupting supply chains, and forcing manufacturers to rethink their sourcing and production strategies. Chinese companies have responded with agility—by boosting local production, targeting new export markets, and embracing innovation and technology—offering a valuable example of resilience. These changes have shown that adversity can spark positive transformation and drive the industry toward higher quality and greater efficiency.

For packaging manufacturers worldwide, adapting to this new trade environment means taking both short-term and long-term actions. By diversifying suppliers, optimizing packaging design, focusing on sustainability, and building strategic partnerships, manufacturers can stay competitive despite ongoing global trade uncertainty. Those who embrace change, prioritize flexibility, and deliver added value to their clients will not only survive the current disruptions but position themselves for long-term success in a rapidly evolving global market.