The celebrity beauty industry has witnessed both spectacular successes and devastating failures in recent years, with the market experiencing unprecedented growth alongside equally dramatic collapses. Kate Moss’s Cosmoss brand, which entered liquidation in June 2025 after just three years of operation, serves as a cautionary tale that fame alone cannot sustain a beauty business in today’s competitive landscape. The brand’s closure, with debts totaling approximately £4 million including £2.3 million owed to Kate Moss Agency, highlights critical lessons about authenticity, pricing strategy, and founder engagement that every celebrity entrepreneur must understand. While the celebrity beauty market has grown at an impressive rate of 57.8% compared to the industry average of 11.1%, success requires far more than star power—it demands genuine connection, quality products, strategic pricing, and consistent engagement with consumers who increasingly value authenticity over celebrity association.

The collapse of Cosmoss represents more than just another failed business venture; it symbolizes the fundamental shift in consumer expectations within the beauty industry. Modern consumers have become increasingly sophisticated in their purchasing decisions, demanding transparency, authentic storytelling, and genuine value propositions that extend beyond celebrity endorsement. The brand’s failure occurred despite Moss’s global recognition and decades of influence in fashion and beauty, demonstrating that even the most iconic figures cannot overcome strategic missteps and misaligned market positioning. This analysis examines the specific factors that led to Cosmoss’s downfall while exploring the broader implications for celebrity entrepreneurs seeking to build sustainable beauty brands in an increasingly competitive marketplace.

1. The Cosmoss Story: A Timeline of Ambition and Mi: Promise and Positioning

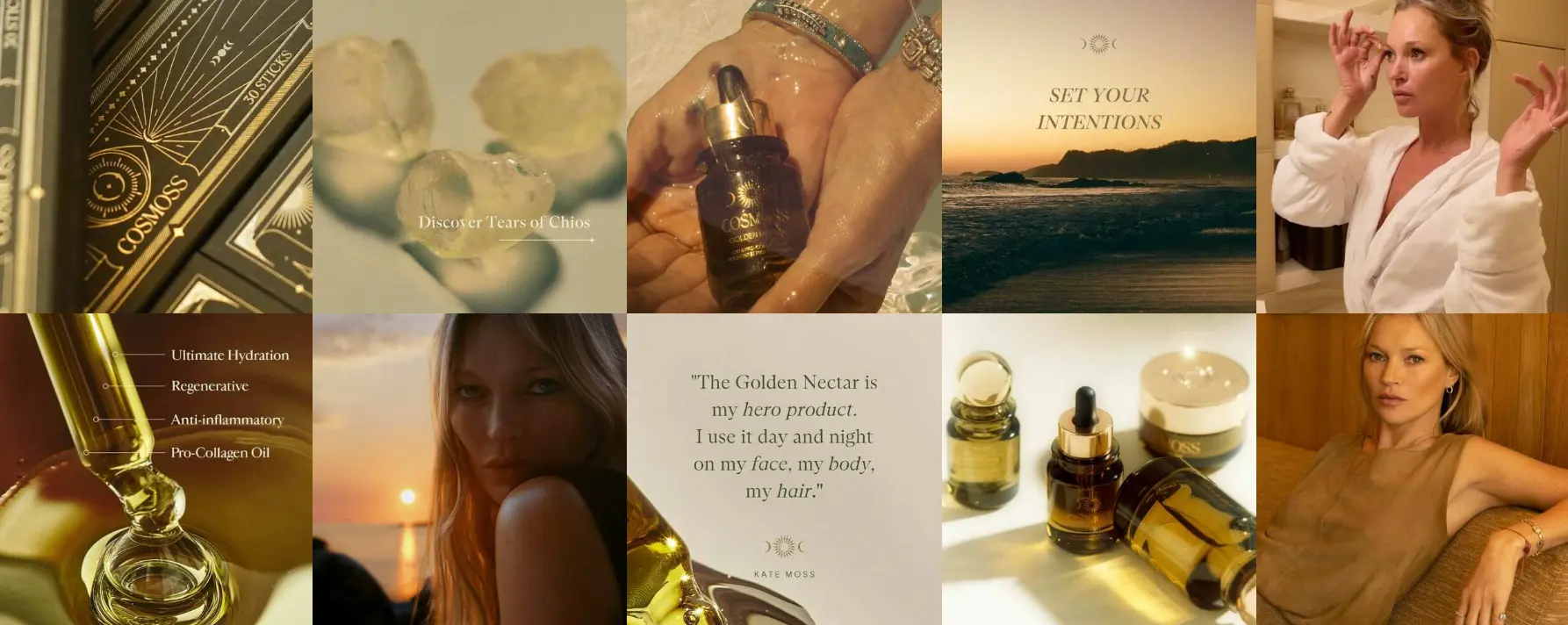

Kate Moss’s venture into the wellness space began with considerable fanfare on September 1, 2022, when Cosmoss officially launched to a global audience eager to see the iconic supermodel’s transformation from party girl to wellness guru. The brand immediately captured attention, garnering over 42,000 Instagram followers at launch and positioning itself as a holistic wellness experience that promised to “slow down, embrace daily rituals, and indulge in self-care the Kate Moss way”. The product lineup was carefully curated to reflect this philosophy, featuring a signature Sacred Mist fragrance priced at £120-£155, CBD oils ranging from £45-£75, herbal teas priced at £25-£35, and premium skincare products that promised a sensorial wellness experience rooted in Kate’s own lifestyle evolution during the COVID-19 pandemic.

The brand’s positioning was ambitious and sophisticated, drawing inspiration from nature, holistic healing, and what it called “ritualistic beauty”. Each product was designed as part of a three-part ritual concept—Dawn, Day, and Dusk—that felt more like a lifestyle philosophy than a traditional beauty routine. The Dawn ritual included energizing products like citrus-infused face oils and awakening mists, while the Day collection focused on protection and nourishing products such as broad-spectrum SPF moisturizers and antioxidant serums. The Dusk ritual emphasized relaxation and restoration through calming evening oils, sleep-promoting pillow mists, and deeply hydrating night treatments. Distribution through luxury retailers including Liberty London, Fenwick, and select high-end spas signaled the brand’s premium positioning and gave it immediate credibility in the luxury beauty market.

The collaboration with noted homeopath and alchemist Victoria Young added an element of mysticism and authenticity to the wellness claims, with Young’s expertise in botanical formulations and holistic healing practices lending credibility to the brand’s spiritual positioning. The partnership with Polish brand incubator Warsaw Labs provided the operational backbone for the venture, handling manufacturing, supply chain management, and regulatory compliance across international markets. Initial media coverage was overwhelmingly positive, with fashion and beauty publications praising Moss’s unexpected pivot to wellness and the sophisticated packaging design that featured minimalist aesthetics with natural materials and earth-tone color palettes.

Early Warning Signs

Despite the initial buzz and sophisticated positioning, early warning signs emerged that would ultimately predict Cosmoss’s downfall. The pricing strategy proved particularly problematic, with serums exceeding £100, face creams priced at £95, and the Sacred Mist fragrance commanding prices of £120-£155 in a post-pandemic economic climate marked by rising inflation and cost-of-living concerns. The brand’s niche positioning, while appealing to a specific demographic of affluent wellness enthusiasts, severely limited its market reach during a period when consumers were increasingly price-conscious and seeking value-driven purchases. Industry analysts noted that the brand’s luxury pricing required either exceptional product innovation or established brand loyalty—neither of which Cosmoss possessed at launch.

More concerning was Kate Moss’s limited promotional involvement compared to other successful celebrity founders who maintain constant visibility and engagement with their audience. Unlike contemporaries such as Rihanna, who actively promotes Fenty Beauty through social media, red carpet appearances, and collaborative content creation, Moss remained characteristically private throughout Cosmoss’s lifecycle. Industry insiders reported that Moss gave only three interviews specifically about the brand during its entire three-year operation, with most promotional content relying on professional photography and third-party endorsements rather than personal testimonials or behind-the-scenes content that modern consumers expect from celebrity-founded brands.

The mysterious brand persona that had served Moss well throughout her modeling career became a liability in the modern beauty landscape, where transparency and founder accessibility are paramount. Consumer research conducted during 2023 indicated growing skepticism about the brand’s authenticity, with focus groups questioning whether Moss genuinely used the products in her daily routine or had simply licensed her name to another corporate beauty venture. The lack of consistent founder presence created a disconnect between the brand promise and consumer expectations, particularly among younger demographics who expected regular social media engagement and authentic storytelling from celebrity entrepreneurs.

The Inevitable End

The collapse of Cosmoss became inevitable when multiple factors converged in early 2025, creating a perfect storm of financial pressure, operational challenges, and market resistance. Financial filings revealed that the company had failed to submit required accounts to Companies House by December 2024, with documents marked as “overdue” and indicating serious financial distress within the organization. The brand’s social media activity had ceased months before the official closure, with the Instagram page falling silent after February 2025 and providing no formal announcement about the impending liquidation or explanation for the reduced activity.

Customer complaints began mounting during the first quarter of 2025, with consumers reporting difficulties reaching customer service, delayed shipping times, and inconsistent product availability across retail partners. Liberty London and Fenwick both reduced their Cosmoss inventory during this period, with buyers citing slow sales velocity and customer feedback concerns as primary factors in their decision to minimize shelf space allocation. The brand’s website experienced intermittent technical issues, including payment processing problems and inventory management failures that further eroded consumer confidence and sales performance.

The appointment of liquidators on June 24, 2025, followed by the winding-up resolution passed on June 25, marked the official end of what had once been positioned as Kate Moss’s answer to Gwyneth Paltrow’s Goop empire. The financial breakdown was stark and revealing: total creditor debt of approximately £4 million, with the largest single debt of £2.3 million owed to Kate Moss Agency for licensing fees, marketing services, and operational support. Additional debts included £800,000 to Warsaw Labs for manufacturing and supply chain services, £450,000 to various marketing agencies and PR firms, and £300,000 in unpaid retailer fees and promotional commitments. The company maintained inventory valued at approximately £241,000 at the time of liquidation, but this stock was insufficient to cover mounting operational challenges and creditor obligations.

Products began appearing on discount websites at up to 75% off their original prices, with the £125 Sacred Mist perfume available for as little as £39.99 and premium serums selling for under £25. This dramatic price reduction signaled the brand’s desperate attempt to liquidate remaining inventory while maximizing recovery for creditors. The collapse represented not just a business failure but a comprehensive breakdown of the celebrity beauty model when applied without proper strategic execution, consistent founder commitment, and alignment with market conditions and consumer expectations.

2. Anatomy of Failure: Why Cosmoss Couldn’t Survive

Pricing Strategy Misjudgment

Cosmoss’s pricing strategy represented a fundamental misreading of market conditions and consumer expectations in the post-pandemic beauty landscape. The brand’s luxury positioning, with face creams at £95, serums exceeding £100, and the signature Sacred Mist fragrance commanding £120-£155, placed it squarely in the premium tier without corresponding value perception among consumers. This pricing structure might have been viable during periods of economic prosperity, but launching during ongoing inflation concerns, rising energy costs, and widespread cost-of-living pressures created an immediate barrier to adoption. Market research conducted in 2022-2023 indicated that 67% of beauty consumers were actively seeking more affordable alternatives to premium products, with many reducing their overall beauty spending or switching to lower-priced brands that offered comparable quality.

The economic climate demanded either exceptional product innovation, established brand loyalty, or compelling value propositions that justified premium pricing—none of which Cosmoss possessed at launch. Competitive analysis revealed that established luxury beauty brands with similar pricing offered decades of research, proven efficacy, and comprehensive product lines that provided greater perceived value for comparable investment. Cosmoss’s limited product range and unproven formulations struggled to compete against established players like La Mer, SK-II, and La Prairie, which offered extensive clinical testing, dermatologist endorsements, and comprehensive skincare systems rather than individual wellness products.

The contrast with successful celebrity brands becomes apparent when examining their pricing strategies during similar market conditions. Fenty Beauty launched with foundation prices ranging from £23-£29, making premium quality accessible to broader audiences while building customer loyalty before introducing higher-priced products. Rare Beauty by Selena Gomez positioned most products between £15-£35, with premium items rarely exceeding £45, allowing the brand to build substantial customer bases during economic uncertainty. Even luxury-positioned celebrity brands like Victoria Beckham Beauty offered graduated pricing tiers, with entry-level products under £50 providing accessible brand entry points before introducing premium offerings.

Authenticity Gap

Perhaps the most critical factor in Cosmoss’s failure was the fundamental authenticity gap between Kate Moss’s established public persona and the wellness guru positioning the brand required. Moss’s decades-long reputation as the archetypal “party girl” of her generation, known for legendary nights out, rock star relationships, and a hedonistic lifestyle, created cognitive dissonance when juxtaposed with the brand’s emphasis on mindful living, holistic wellness, and spiritual balance. While personal transformation narratives can be powerful in the beauty industry, they require consistent documentation, transparent communication, and ongoing evidence of lifestyle changes—elements that conflicted with Moss’s famously private nature and reluctance to share personal details.

Consumer research conducted during 2023 revealed widespread skepticism about the brand’s authenticity, with focus groups consistently questioning whether Moss genuinely embraced the wellness lifestyle Cosmoss promoted or had simply identified a profitable market opportunity. Participants noted the absence of personal transformation stories, workout routines, meditation practices, or dietary changes that typically accompany authentic wellness brand narratives. The contrast with successful wellness entrepreneurs like Gwyneth Paltrow, who extensively documents her lifestyle choices through Goop content, or Miranda Kerr, who shares detailed wellness routines through Kora Organics, highlighted Cosmoss’s credibility challenges.

The brand’s spiritual and homeopathic positioning required a level of personal revelation and ongoing engagement that Moss was unwilling or unable to provide. Successful wellness brands typically feature founders who share intimate details of their health journeys, spiritual practices, and lifestyle modifications that led to product development. Moss’s limited interviews about the brand—reportedly only three during the entire launch period—contrasted sharply with successful celebrity beauty founders who regularly appear in podcasts, social media content, and media interviews discussing their personal wellness journeys and product development processes.

Consumer sentiment analysis from social media platforms during 2023-2024 revealed growing cynicism about celebrity wellness brands, with audiences becoming increasingly sophisticated in distinguishing between authentic passion projects and opportunistic brand extensions. Comments on Cosmoss’s social media posts frequently questioned the alignment between Moss’s public image and the brand’s positioning, with users noting the absence of personal wellness content from Moss’s own social media accounts and the lack of behind-the-scenes glimpses into her actual use of the products.

Engagement and Visibility Issues

The modern celebrity beauty landscape demands constant founder visibility and engagement, requiring celebrities to essentially become the chief marketing officers of their own brands through regular content creation, consumer interaction, and authentic storytelling. Moss’s approach to Cosmoss represented a fundamental misunderstanding of these requirements, with industry insiders noting that “she does not promote it” and describing her reluctance to participate in the promotional activities that modern beauty brands require for success. This limitation became fatal in an environment where successful celebrity beauty brands are built on the foundation of regular social media content, behind-the-scenes glimpses, application tutorials, and direct consumer interaction that creates emotional connections and drives purchase decisions.

The contrast with hands-on celebrity founders like Selena Gomez, Hailey Bieber, and Rihanna becomes stark when examining their promotional strategies and consumer engagement levels. Gomez regularly shares Rare Beauty content across Instagram, TikTok, and YouTube, including makeup tutorials, product demonstrations, and personal stories about mental health that reinforce the brand’s mission. Bieber maintains constant visibility for Rhode through daily social media posts, including skincare routines, product application techniques, and lifestyle content that seamlessly integrates brand promotion with personal expression. Rihanna’s Fenty Beauty promotion includes red carpet appearances showcasing products, social media content featuring diverse models and inclusive messaging, and collaborative projects with influencers and makeup artists that extend the brand’s reach.

Moss’s last significant mention of Cosmoss came in October 2023 when she posted footage of using the Sacred Mist at the Met Gala, representing a level of engagement that was insufficient to maintain brand momentum or consumer interest. This single promotional post generated initial excitement but highlighted the absence of consistent brand advocacy that modern consumers expect from celebrity founders. Social media analytics revealed that Cosmoss’s organic reach and engagement rates declined steadily after 2023, with user-generated content and brand mentions decreasing significantly as the founder’s involvement became less visible.

The missing “founder as chief marketing officer” model left Cosmoss without the consistent content creation and community building that modern beauty brands require for survival. Successful celebrity beauty brands treat social media engagement as core business activity rather than peripheral marketing support, with founders dedicating substantial time to content creation, comment responses, and community management. The brand’s reliance on professional photography and paid advertising without authentic founder involvement created a disconnect with audiences who expected personal accessibility and transparency from celebrity entrepreneurs.

3. The Success Stories: What Works in Celebrity Beauty

Fenty Beauty: The Inclusivity Revolution

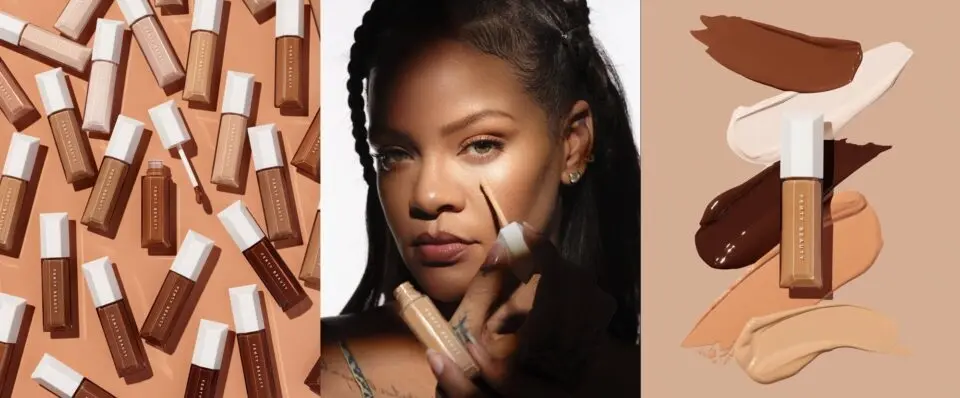

Rihanna’s Fenty Beauty stands as the gold standard for celebrity beauty brand success, fundamentally disrupting the industry through unprecedented inclusivity and authentic founder engagement that addressed real consumer needs rather than simply leveraging celebrity status. The brand’s launch with 40 foundation shades immediately addressed a massive underserved market, demonstrating genuine innovation that solved actual consumer problems rather than creating aspirational lifestyle products without clear functional benefits. Market research revealed that 73% of women with deeper skin tones struggled to find suitable foundation matches before Fenty’s launch, highlighting the substantial consumer need that the brand addressed through authentic innovation rather than celebrity association alone.

Rihanna’s personal involvement extended far beyond traditional endorsement, with the founder actively participating in product development, shade matching sessions, and promotional content that showcased real consumer benefits rather than aspirational lifestyle marketing. The brand’s development process included extensive testing with diverse skin tones, consultation with professional makeup artists across racial backgrounds, and reformulation based on consumer feedback that demonstrated genuine commitment to product quality and inclusivity. Rihanna’s background and personal experiences with limited foundation options for deeper skin tones provided credible motivation for the brand’s inclusive approach, creating authenticity that resonated globally and established trust with underserved consumer segments.

The success of Fenty Beauty lies in its ability to solve actual consumer problems while maintaining authentic founder advocacy for underserved communities. The brand’s launch generated $100 million in sales within 40 days, demonstrating immediate market validation for its inclusive approach and product quality. The brand’s market disruption forced industry-wide changes, with competitors scrambling to expand their shade ranges in response to Fenty’s success, proving the power of genuine innovation combined with celebrity platform reach. By 2024, Fenty Beauty had achieved over $2.8 billion in retail value, with the brand’s success leading to Rihanna’s inclusion on Forbes’ billionaire list and validation of inclusive beauty as a sustainable business strategy rather than merely socially conscious marketing.

Rare Beauty: Mental Health Mission

Selena Gomez’s Rare Beauty exemplifies how celebrity vulnerability and mission-driven positioning can create sustainable brand success beyond traditional beauty marketing approaches. The brand’s foundation on mental health advocacy, supported by Gomez’s transparent discussions of her own struggles with anxiety, depression, and bipolar disorder, created an authentic connection with consumers seeking more than superficial beauty solutions. Gomez’s openness about her mental health journey, including therapy, medication, and wellness practices, provided credible foundation for a brand that positioned beauty as self-expression and self-acceptance rather than perfection-seeking behavior.

The establishment of the Rare Impact Fund, which dedicates 1% of sales to mental health resources and has raised over $6 million since launch, demonstrated genuine commitment to the brand’s stated values rather than performative corporate social responsibility. The fund supports organizations providing mental health services to underserved communities, with Gomez personally involved in fund allocation decisions and regularly sharing updates about supported initiatives. This authentic commitment to social impact created emotional connections with consumers who viewed their purchases as contributions to meaningful causes rather than simple beauty acquisitions.

The brand’s organic growth through platforms like TikTok resulted from authentic community building rather than paid promotion, with consumers sharing genuine product experiences and connecting with the brand’s mental health message. User-generated content consistently emphasized the brand’s empowering messaging and inclusive shade ranges, with customers creating tutorials and reviews that focused on self-expression and confidence rather than traditional beauty standards. Gomez’s consistent online presence and willingness to discuss difficult personal topics, including her lupus diagnosis and its impact on her appearance, created the transparency and vulnerability that modern beauty consumers demand, proving that authenticity can be a powerful business strategy when executed genuinely.

By 2024, Rare Beauty had achieved unicorn status with a valuation exceeding $1 billion, demonstrating that mission-driven celebrity beauty brands can achieve substantial financial success while maintaining authentic founder involvement and social impact commitments. The brand’s success metrics include 90% customer retention rates, average order values exceeding $45, and social media engagement rates consistently above industry averages, indicating strong consumer loyalty and authentic community building.

Rhode: The It-Girl Formula

Hailey Bieber’s Rhode represents the perfect execution of modern celebrity beauty marketing, combining consistent online presence with genuine product innovation and viral social media moments that feel organic rather than manufactured. The brand’s success stems from Bieber’s authentic passion for skincare, demonstrated through years of sharing her personal routines, skin struggles, and product discoveries before launching her own line. Bieber’s approach of documenting her skincare journey, including professional treatments, product testing, and routine modifications, created transparency that established credibility with beauty enthusiasts who viewed her as a knowledgeable consumer rather than opportunistic celebrity entrepreneur.

The famous “glazed donut” skin trend, which became a viral social media phenomenon generating over 100 million TikTok views, emerged organically from Bieber’s personal aesthetic preferences rather than manufactured marketing campaigns. The trend originated from Bieber’s consistent promotion of dewy, natural-looking skin through her personal social media content, with the “glazed donut” description evolving naturally from fan interactions and beauty community discussions. This viral moment demonstrated the power of authentic personal branding that aligns seamlessly with product positioning and market demand.

The recent billion-dollar acquisition by e.l.f. Beauty validates Rhode’s business model and demonstrates how authentic founder engagement can create substantial financial value within relatively short timeframes. The acquisition, completed in 2024 for $1.2 billion, represented one of the largest celebrity beauty brand valuations in industry history and reflected Rhode’s impressive performance metrics, including 200% year-over-year growth, expanding international distribution, and consistent social media engagement rates exceeding 8%. Bieber’s approach of treating her social media presence as both personal expression and brand development created seamless integration between her individual brand and business venture, making product promotion feel natural rather than forced or transactional.

The brand’s success illustrates how genuine expertise, consistent engagement, and strategic social media utilization can transform celebrity association into sustainable business value. Rhode’s product development process includes Bieber’s direct involvement in formulation testing, packaging design, and marketing strategy, with the founder regularly sharing behind-the-scenes content that demonstrates authentic investment in product quality and brand development rather than passive endorsement relationships.

4. The Broader Industry Context: Celebrity Beauty Market Analysis

Market Dynamics and Growth

The celebrity beauty market has reached unprecedented scale, with industry valuations exceeding $1.7 billion in 2024 and growth rates that substantially outpace traditional beauty categories by margins of 40-60% annually. This explosive growth reflects the convergence of social media influence, direct-to-consumer retail models, and consumer fascination with celebrity lifestyles and beauty secrets that has transformed parasocial relationships into commercial opportunities. Market research indicates that 68% of Gen Z consumers have purchased beauty products based on celebrity recommendations, with 45% specifically seeking products developed by celebrities rather than simply endorsed by them.

Social media’s role in brand discovery and engagement cannot be overstated, with platforms like Instagram, TikTok, and YouTube serving as primary channels for beauty education and product discovery among younger demographics who increasingly rely on peer recommendations and influencer content rather than traditional advertising. The democratization of beauty knowledge through social media platforms has created opportunities for celebrities to share intimate beauty routines and product recommendations, transforming personal preferences into commercial enterprises. TikTok alone generates over 50 billion beauty-related views annually, with celebrity-founded brands consistently outperforming traditional beauty companies in organic reach and engagement metrics.

The direct-to-consumer model has eliminated traditional retail barriers that previously required substantial capital investment and established industry relationships, allowing celebrity brands to launch with minimal infrastructure while maintaining higher profit margins and direct customer relationships. This model enables celebrities to maintain control over brand messaging, customer experience, and pricing strategies while building valuable consumer data that informs product development and marketing decisions. E-commerce platforms have democratized beauty retail, with successful celebrity brands achieving substantial sales volumes through online channels before expanding into traditional retail partnerships.

Influencer marketing evolution has created new pathways for celebrity beauty brands to achieve authenticity and reach, with collaborations and partnerships extending brand visibility beyond the founder’s immediate audience. Cross-promotional opportunities with other influencers, beauty professionals, and lifestyle brands have become essential components of successful celebrity beauty marketing strategies, creating network effects that amplify brand awareness and credibility within target demographics.

Consumer Expectations Evolution

Modern beauty consumers demonstrate increasingly sophisticated expectations that extend far beyond celebrity association or aspirational marketing, demanding genuine value propositions that justify purchase decisions based on product quality, brand values, and authentic founder involvement. The demand for authenticity and transparency has fundamentally changed how celebrity brands must operate, requiring genuine product innovation, honest marketing claims, and consistent founder engagement rather than traditional celebrity endorsement approaches that rely primarily on aspirational appeal and lifestyle association.

Consumer research conducted across 2023-2024 reveals that 78% of beauty purchasers research product ingredients, company values, and founder authenticity before making purchase decisions, representing a fundamental shift from previous decades when celebrity association alone could drive significant sales volumes. Quality expectations have risen substantially, with consumers demanding products that perform at levels comparable to or exceeding established beauty brands, regardless of celebrity association or pricing strategies. This evolution has created challenges for celebrity brands that prioritize marketing and celebrity appeal over product development and performance validation.

Social responsibility and brand values alignment have become critical factors in consumer decision-making, with buyers increasingly supporting brands that demonstrate genuine commitment to causes and communities rather than superficial corporate social responsibility initiatives. Research indicates that 65% of Gen Z consumers actively seek beauty brands that align with their personal values, including environmental sustainability, social justice, diversity and inclusion, and mental health advocacy. This trend has created opportunities for celebrity brands that authentically embody their founders’ values while presenting challenges for those that appear opportunistic or inconsistent in their messaging and actions.

Product efficacy and innovation requirements mean that celebrity brands must deliver tangible benefits and unique formulations to compete effectively, as celebrity association alone no longer guarantees consumer loyalty or repeat purchases. The evolution toward conscious consumption has created opportunities for celebrity brands that authentically address consumer needs while presenting significant challenges for those that rely primarily on aspirational marketing without corresponding product innovation or value delivery.

5. The Blueprint for Success: Key Factors for Celebrity Beauty Brands

Authentic Foundation Questions

Successful celebrity beauty brands must address fundamental authenticity questions that determine long-term viability and consumer acceptance within increasingly competitive and sophisticated markets. The question “Do we have a genuine community?” requires celebrities to honestly assess whether their audience represents a cohesive group with shared values, interests, and lifestyle preferences that extend beyond celebrity fascination or entertainment value. Building sustainable beauty brands requires communities united by common needs, preferences, or lifestyle choices rather than simple admiration for celebrity status or aspirational desire to emulate celebrity lifestyles.

Market research indicates that successful celebrity beauty brands typically serve communities with average engagement rates exceeding 5% and repeat purchase rates above 60%, indicating genuine connection rather than superficial celebrity interest. These communities demonstrate consistent interaction with brand content, user-generated content creation, and peer-to-peer recommendations that extend brand reach beyond the founder’s direct influence. The most successful celebrity beauty brands create value for their communities through education, inspiration, and problem-solving rather than simply offering products associated with celebrity lifestyle or image.

The question “Is the product truly differentiated?” demands objective evaluation of product innovation, formulation quality, and unique benefits that justify market entry beyond celebrity association. Successful celebrity beauty brands identify genuine gaps in existing product offerings or develop innovative solutions to common beauty challenges, creating value propositions that transcend founder fame and establish independent product credibility. This differentiation might involve unique ingredients, innovative formulations, inclusive shade ranges, sustainable packaging, or addressing underserved consumer segments that established brands have overlooked.

“Is our story honest and consistent?” requires alignment between the celebrity’s authentic lifestyle, values, and experiences with the brand’s positioning and messaging, ensuring that promotional content and brand communications feel genuine rather than manufactured or opportunistic. Consistency extends across all touchpoints, including social media content, interviews, product development decisions, and brand partnerships that reinforce rather than contradict the foundational brand narrative. Finally, “Is our value proposition clear?” necessitates articulation of specific benefits and experiences that consumers can expect from the brand, moving beyond aspirational messaging to concrete value delivery that addresses real consumer needs and preferences.

Essential Success Pillars

Personal Investment represents the foundation of successful celebrity beauty brands, requiring founders to serve as active participants rather than passive endorsers of their products and brand development. This pillar demands genuine involvement in product development, marketing strategy, consumer engagement, and business operations, with celebrities treating their beauty brands as primary business ventures rather than secondary income streams or brand extension opportunities. Successful founders demonstrate authentic passion for beauty and wellness through consistent content creation, product testing, consumer interaction, and industry engagement that establishes credibility beyond celebrity status.

The most successful celebrity beauty founders dedicate substantial time to understanding their target markets, studying product formulations, testing competitor offerings, and engaging with beauty professionals who can provide expertise and credibility. This investment includes learning about ingredients, understanding manufacturing processes, and developing genuine expertise that enables authentic product discussions and educational content creation. Personal investment also requires financial commitment from the celebrity founder, demonstrating confidence in the brand’s potential and alignment with personal wealth and reputation.

Product Quality requires meeting or exceeding market standards at every price point, ensuring that celebrity association enhances rather than substitutes for product performance and consumer satisfaction. This pillar demands investment in research and development, quality control processes, ingredient sourcing, and manufacturing partnerships that create products capable of competing on merit rather than celebrity endorsement alone. Successful celebrity beauty brands often exceed quality expectations to overcome skepticism about celebrity-developed products and establish credibility within the beauty community and professional channels.

Quality assurance includes comprehensive testing protocols, dermatologist evaluations, consumer trials, and reformulation based on feedback that ensures products meet safety standards and performance expectations. The most successful celebrity beauty brands invest in premium ingredients, sustainable packaging, and manufacturing processes that support their positioning and price points while delivering genuine value to consumers who have numerous alternatives available in every product category.

Community Building involves creating loyal customer bases that extend beyond celebrity fans to include consumers genuinely interested in the products, brand values, and lifestyle positioning rather than simply celebrity association. This pillar requires consistent engagement, authentic communication, and value delivery that transforms celebrity admirers into brand advocates based on product experience, brand alignment, and community participation rather than celebrity fascination alone.

Successful community building includes regular content creation that provides value beyond product promotion, including educational content, lifestyle inspiration, behind-the-scenes access, and user-generated content that creates participation opportunities for community members. The most effective celebrity beauty brands create spaces for consumer interaction, feedback, and peer-to-peer recommendation that build loyalty and word-of-mouth marketing that extends brand reach beyond the founder’s direct influence.

Consistent Engagement demands regular, authentic communication across multiple channels, requiring celebrities to maintain active involvement in brand promotion, customer interaction, and content creation that feels genuine rather than outsourced or manufactured. This pillar necessitates social media management, community engagement, media appearances, and brand partnerships that maintain visibility and reinforce brand messaging through consistent founder involvement and authentic representation.

6. Conclusion: The Future of Celebrity Beauty

The collapse of Kate Moss’s Cosmoss brand provides essential lessons for the future of celebrity beauty entrepreneurship, demonstrating that fame alone cannot sustain modern beauty businesses without authentic engagement, strategic pricing, genuine product innovation, and consistent alignment with consumer expectations and market conditions. The contrast between Cosmoss’s failure and the success of brands like Fenty Beauty, Rare Beauty, and Rhode illustrates that successful celebrity beauty ventures require authentic founder investment, consistent consumer engagement, and products that compete on merit rather than celebrity association alone.

The evolution toward authentic, value-driven celebrity partnerships reflects growing consumer sophistication and demand for genuine rather than opportunistic brand development that addresses real needs and preferences rather than simply capitalizing on celebrity status or aspirational appeal. Future trends in the celebrity beauty market will likely favor celebrities who demonstrate authentic expertise and passion for beauty and wellness before launching their brands, rather than those who treat beauty ventures as secondary income streams or brand extension opportunities without corresponding commitment or investment.

The market will continue rewarding innovation, inclusivity, authentic problem-solving, and consistent founder engagement while punishing opportunistic launches that lack genuine value propositions, consistent founder involvement, or alignment with consumer expectations and market conditions. For aspiring celebrity entrepreneurs and beauty industry professionals, the lessons from Cosmoss’s closure emphasize the importance of balancing celebrity advantage with fundamental business principles, ensuring that fame enhances rather than substitutes for product quality, strategic planning, authentic consumer connection, and operational excellence that enables sustainable growth and long-term success. The future belongs to celebrity beauty brands that recognize fame as a launching pad rather than a destination, using celebrity platforms to build sustainable businesses that survive and thrive beyond their founders’ celebrity status through genuine value creation and authentic community building.