The beauty industry has always thrived on partnerships. From department store counters in the 20th century to today’s digital-first retail ecosystems, the relationship between beauty brands and platforms has been central to growth, visibility, and longevity. Yet in today’s hyper-competitive environment, where direct-to-consumer (DTC) brands, marketplace giants, and omnichannel strategies collide, the nature of this relationship has evolved. Beauty brands no longer simply sell through retailers; they collaborate with them. Meanwhile, retail platforms—from Sephora to Ulta to Amazon—rely heavily on brands to attract and retain consumers.

This blog explores how beauty brands and retail platforms achieve mutual benefits: the shared value created when product innovation meets retail ecosystem strength. Covering marketing, supply chain efficiency, consumer engagement, loyalty programs, sustainability partnerships, data exchange, and technology enablement, we’ll discover why the most successful players in beauty thrive when they view each other not as competitors for consumer attention but as partners in delivering value.

1. The Traditional Beauty Brand–Retailer Relationship

The traditional beauty industry was built around hierarchical partnerships, with luxury brands such as Estée Lauder, Lancôme, and Elizabeth Arden leading the way by offering prestige products, while department stores and specialty retailers provided prime physical space and customer access. These relationships were underpinned by exclusivity agreements, product launches tailored to retailer demands, and in-store experiences like beauty counters, personal consultations, and sampling events that established consumer trust and loyalty.

Prestige and Retailer Control

Retailers had significant control over which products gained visibility, often dictating assortment and placement on store shelves. This meant brands invested heavily in cultivating relationships, negotiating for promotional support, and even supplying their own trained staff to department store counters. Such partnerships elevated retailers’ status, positioning them as trusted authorities in beauty and luxury, while brands benefited from the built-in traffic and consumer loyalty of established stores.

Consumer Experience and Brand Curation

For consumers, this traditional model provided a curated shopping journey—they could explore various brands, benefit from personal recommendations by expert staff, and sample products in a luxurious setting. The experiential retail concept, born in the early 1900s with innovators like Elizabeth Arden, helped forge lifelong loyalty among shoppers who developed trust in brands and stores alike.

Shift to Digital and Direct-to-Consumer (DTC) Models

While the in-store experience remained powerful for decades, the rise of e-commerce and social media disrupted this dynamic. Direct-to-consumer strategies emerged, allowing brands to bypass traditional retail and reach shoppers globally through digital storefronts and social engagement. Consumers now expect seamless online purchases, community-driven reviews, and virtual try-ons—diminishing, but not replacing, the impact of in-store experiences.

Retailers responded by curating expanded product selections, integrating experiential retail features into digital channels (like live chat and AR tools), and doubling down on loyalty programs that bridge physical and digital shopping. The underlying shift is from a rigid, hierarchical model to a flexible, collaborative partnership where brands and retailers jointly adapt to rapidly changing consumer behaviors.

This evolution has redefined how prestige and emerging brands achieve success, blending the authority and traffic of retail platforms with the agility, storytelling, and direct feedback loops enabled by digital channels.

2. The New Dynamics of Beauty and Retail

Today’s beauty brand–retail relationships are driven by collaboration, not hierarchy. Modern retailers such as Sephora, Ulta, and Cult Beauty partner deeply with brands to co-create marketing campaigns, digital experiences, sustainability initiatives, and data-enriched loyalty ecosystems. Whether a disruptive indie label or a heritage giant, brands rely on these retail platforms for scaling operations, broadening their marketing reach, and securing consumer trust at every touchpoint.

Key Forces Driving the Shift

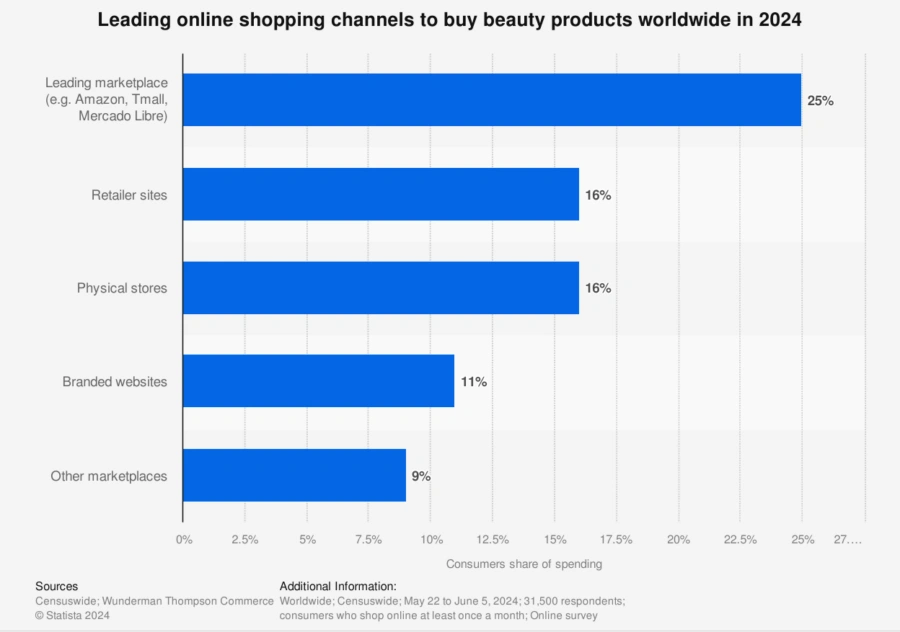

E-commerce Growth

Online shopping has transformed the beauty market, making seamless digital–physical integration essential. Retailers now host interactive livestreams, offer in-app shopping, and support buy-online-pickup-in-store (BOPIS), all powered by joint investments between brands and platforms.

Consumer Choice Overload

With thousands of beauty products launching every year, collaboration helps both sides rise above the noise. Retailers curate selections based on trends, while brands gain valuable shelf visibility, making it easier for overwhelmed consumers to find relevant and high-performing products.

Brand Differentiation Pressures

Retail platforms provide storytelling spaces—through influencer collaborations, educational campaigns, and community engagement—so brands can showcase their values, innovation, and mission directly to audiences. These efforts are amplified on social media, driving authenticity and social proof.

Data-Driven Marketing

Collaboration extends into real-time data exchange: retailers share insights on consumer behavior, purchasing trends, and campaign performance. Brands use these analytics to refine product launches, target audiences, and adjust loyalty programs, leading to smarter joint strategies.

Sustainability Imperatives

Modern beauty shoppers expect eco-friendly packaging and ethical sourcing, prompting brands and retailers to partner on refill programs, certification campaigns, and transparent supply chains. Platforms launch “clean beauty” and “planet-positive” initiatives, with brands participating to enhance trust and competitive advantage.

The Impact

A truly collaborative beauty brand–retail partnership delivers broad advantages across the market. Brands immediately access new audiences and earn consumer trust by associating with established retailers; this often translates to increased sales, improved reputation, and opportunities for creative launches or campaigns. Retailers, meanwhile, remain relevant and innovative by continually refreshing their product assortments, offering exclusive goods, and responding quickly to beauty trends—drawing in loyal customers while attracting new ones.

On the consumer side, these collaborations create a more rewarding shopping journey. Shoppers enjoy a greater variety of products, from emerging indie labels to prestige collections, and benefit from industry-leading digital tools like virtual try-on, AI-driven personalization, and integrated loyalty programs that span both online and brick-and-mortar experiences. Transparent ingredient lists, ethical sourcing, and sustainability-focused initiatives like refillable packaging or green sections further enhance trust, showing that both brands and retailers are committed to meeting evolving values and priorities.

Ultimately, this environment generates a virtuous cycle: as brands and retailers co-innovate and respond to shopper feedback, the entire beauty marketplace grows more dynamic, inclusive, and consumer-centric. The constant exchange of ideas, data, and resources helps each party thrive, ensuring they are able to adapt, scale, and inspire loyalty amidst rapid industry transformation.

3. Shared Benefits Between Brands and Retail Platforms

Beauty brands and retail platforms form a powerful ecosystem with multiple shared benefits that drive growth, loyalty, and innovation across the industry.

Expanded Audience Reach

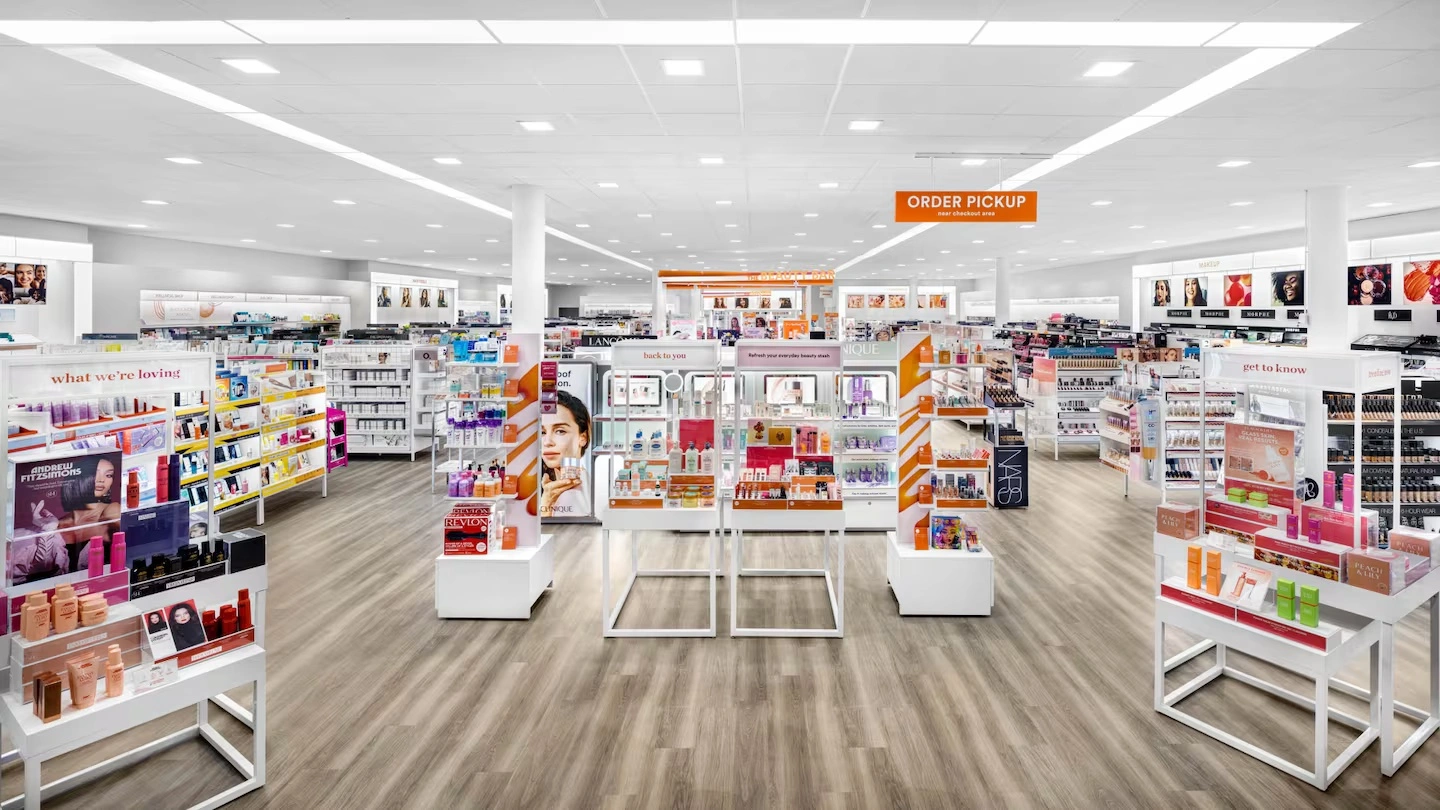

Brands gain access to millions of retailer-loyal customers simply by partnering with platforms like Sephora, Ulta, or Amazon. For example, being included in Sephora’s curated assortment automatically delivers global reach and instant credibility, while Amazon’s vast marketplace exposes even niche offerings—like vegan skincare or refillable makeup systems—to a broader consumer base. Retailers, in turn, boost their relevance by offering trending and specialized categories, attracting new demographics and increasing overall sales.

Shared Consumer Trust

Retailers lend third-party credibility and validation to brands, particularly emerging labels. When a skincare startup is featured at Ulta, it benefits from the retailer’s high standards of quality control and curation. Meanwhile, retailers benefit from featuring highly reviewed cult-favorites, which drive repeat store visits and enhance customer loyalty to the platform itself.

Storytelling and Content Synergy

Brands bring unique identities—such as “clean beauty,” “luxury fragrance,” or “K-beauty essentials”—and retailers amplify these stories with editorial features, influencer campaigns, and community platforms. Sephora’s Beauty Insider Community, for instance, showcases brand stories and consumer reviews, while Glossier’s pop-up events enable immersive brand experiences. This content alignment helps build emotional connections with consumers and keeps storytelling fresh and collaborative.

Loyalty Ecosystem Integration

Beauty retail is particularly driven by robust loyalty programs. Retailers like Ulta and Sephora offer tiered rewards and personalized incentives, but brands participating in these programs leapfrog their own retention efforts by piggybacking off retailer engagement infrastructure. For Ulta, this led to nearly all transactions flowing through their loyalty program, dramatically increasing repurchase rates and overall consumer lifetime value. Retailers depend on fresh, exciting brands to keep their loyalty ecosystem attractive for ongoing member spending.

Data and Insights Sharing

Retail platforms amass behavioral and transactional data across geographies, demographics, and purchase habits. By collaborating, brands gain insights into consumer trends, product affinities, lifetime value, and cross-category dynamics, guiding both strategic launches and targeted promotions. Retailers rely on brands to interpret these signals and fuel innovation, whether through new product formats, shade extensions, or limited editions.

Co-Created Exclusives

Retail exclusives have become industry standards, driving traffic and distinction. From Ulta-exclusive Morphe palettes to Sephora-only skincare launches, brands enjoy guaranteed shelf visibility and promotional support, while retailers differentiate themselves with unique offerings not found elsewhere.

Sustainability and Values Alignment

Consumer demand for sustainability drives joint initiatives like eco-friendly packaging, refill systems, and carbon-neutral campaigns. Sephora’s “Clean + Planet Positive” seal, for example, requires brands to meet rigorous sustainability standards in ingredients, packaging, and transparency in order to be featured—and has spurred wide adoption of sustainable practices across the industry. Retailers educate and engage shoppers at the point of sale to encourage materials recycling, transparent sourcing, and circularity, strengthening both brand images and retailer leadership in responsible business.

These shared benefits create a vibrant, mutually reinforcing partnership model where brands and retail platforms together drive industry advancement, consumer satisfaction, and meaningful business results.

4. Marketing Partnerships

Marketing partnerships between beauty brands and retail platforms are central to achieving visibility, engagement, and growth across channels. Both sides collaborate to leverage highly visual, influencer-driven campaigns that connect with consumers online and offline.

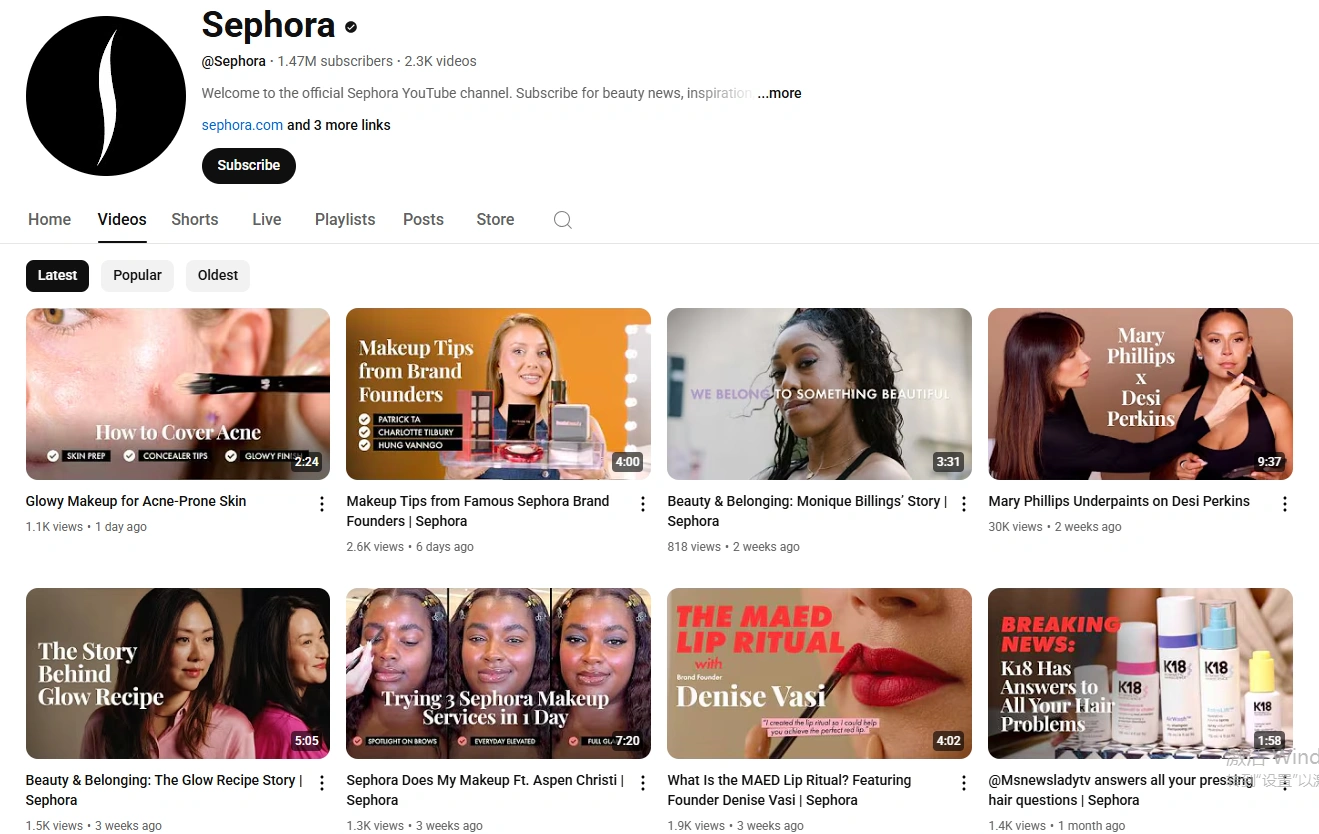

Social Media Amplification

Joint digital campaigns launch on both brand and retailer feeds, boosting reach and credibility. A skincare launch at Sephora, for example, is promoted through teasers, tutorials, and influencer integrations on Instagram, TikTok, and YouTube—driving discovery and instant buzz. Influencer marketing—especially with authentic storytellers or micro-influencers—amplifies results and builds long-term trust with consumers.

In-Store Experiences

Retailers provide immersive brand opportunities, such as pop-up shops, masterclasses, and sampling events, that individual brands often can’t scale alone. These experiential activations generate positive impressions, drive foot traffic, and create “Instagrammable” moments for viral sharing. Indie and new brands, as well as DTC players, frequently use pop-ups in major retail spaces to introduce themselves and personalize the shopper journey.

Cross-Category Promotions

Holiday gift sets and bundled offers feature curated selections from multiple brands—like “Best-Selling Hydration Set” or “Glow Essentials”—encouraging cross-product discovery and boosting sales for all brands involved. These promotions leverage the retailer’s assortment strengths and data-driven product recommendations.

Events

Major beauty conventions—such as Sephoria—act as shared stages for sponsorships, exclusive launches, community networking, and live education. Events blend tactile product experiences, panels, influencer meetups, and interactive demos that can’t be replicated online. They also power real-time digital content, hashtags, livestreams, and haul videos, extending momentum far beyond the convention floor.

Synergy and Amplification

Retail platforms ensure campaigns get maximum reach through established audiences and loyalty ecosystems, while brands inject freshness, innovation, and excitement. The result is a synergistic effect: brand messages reach more people, shoppers have memorable experiences, and both retailers and brands build lasting authority and engagement across all channels.Marketing partnerships are essential for both beauty brands and retail platforms, forming a multi-channel backbone for visibility and customer engagement. The beauty industry thrives on influencer-driven and highly visual campaigns, making collaborative marketing particularly impactful.

Social Media Amplification

Brands and retailers co-launch campaigns on their respective social channels—Instagram, TikTok, and YouTube—featuring teaser videos, tutorials, and influencer partnerships that maximize reach and credibility. The effectiveness of influencer marketing lies not just in celebrity endorsements but in authentic collaborations with micro-influencers whose loyal followers trust their guidance. Platforms like Sephora often use this tactical approach, combining brand content with high-profile and emerging creators.

In-Store Experiences & Retail Activations

Retailers provide spaces and resources for immersive events that brands alone would struggle to organize. These include sampling stations, pop-up shops, and masterclasses where customers can try products, receive expert advice, and interact directly with brand representatives. Such events help build brand awareness and emotional connection, driving both immediate purchases and future loyalty.

Cross-Category Promotions & Bundled Offers

Retailers leverage their diverse assortments by creating cross-category bundles, such as holiday gift sets featuring multiple skincare or makeup brands. These promotions boost product discovery and sales for all participating brands by allowing customers to explore new favorites within trusted sets. It’s a win-win that leverages retailer reach and brand uniqueness.

Events & Industry Conventions

Events like Sephoria create a vibrant stage for brand sponsorships, new product releases, influencer collaborations, and customer networking. These conventions foster real-time buzz, encourage social sharing, and provide educational experiences that deepen consumer connection to both retailers and brands.

Retail platforms bring built-in amplification, driving traffic and engagement, while brands contribute fresh innovation and excitement, ensuring mutually beneficial marketing strategies that extend beyond point-of-sale into lasting customer loyalty.

5. Technology as a Connector

Technological advances are transforming how beauty brands and retail platforms collaborate, integrating digital innovation into every facet of the consumer experience. These solutions—ranging from AR-powered try-ons to omnichannel logistics—make product discovery, personalization, and sustainability newly achievable and scalable across the industry.

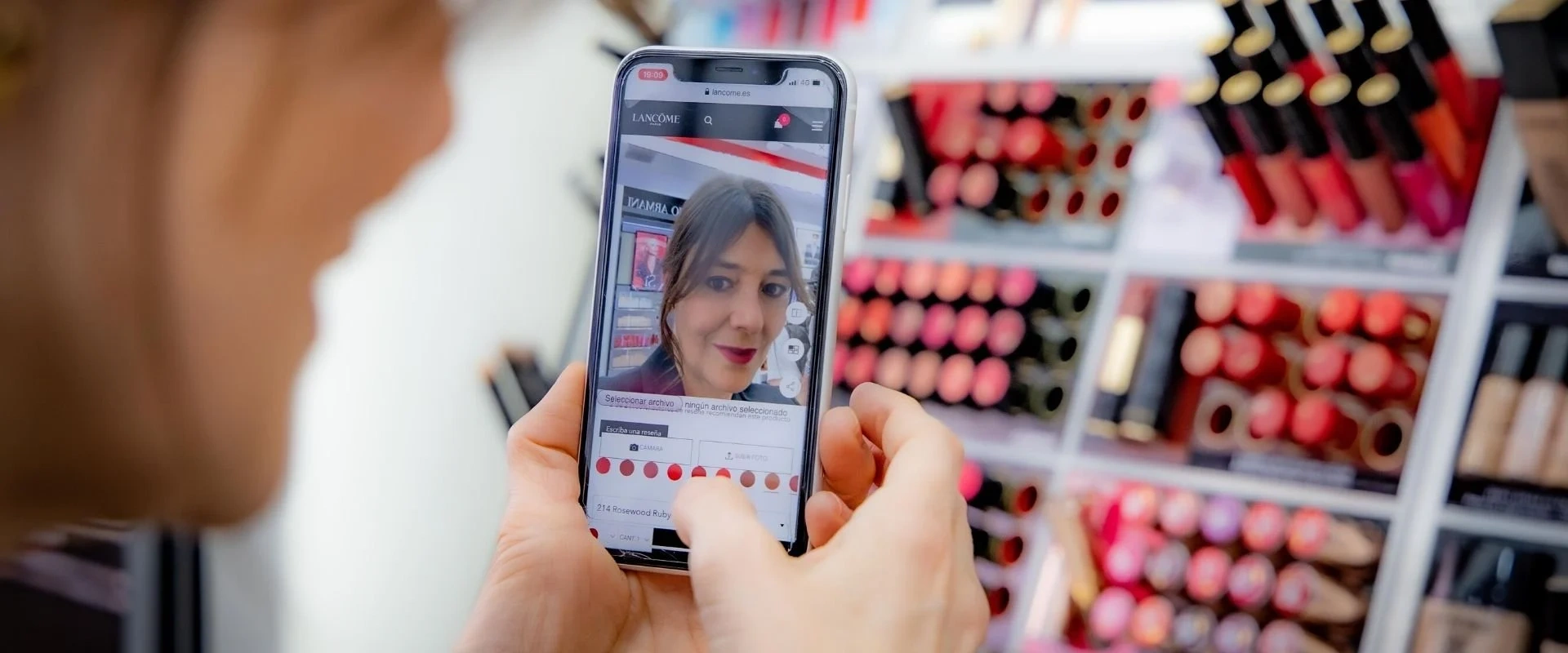

Augmented Reality (AR) Try-ons

Brands like MAC and L’Oréal now provide AR virtual try-on experiences, allowing shoppers to experiment with makeup in real time before purchasing. Retailers incorporate these tools into e-commerce sites, apps, and even flagship stores. For example, browser-based AR lets users test lipstick, eyeshadow, or foundation using their device’s camera, while in-store AR mirrors guide consumers through a seamless, immersive experience. This boosts shopper confidence, increases conversion rates, and reduces product returns.

AI-Powered Personalization

Advanced AI algorithms segment shopper behavior and analyze skin profiles, preferences, and purchase history, driving highly tailored product recommendations. Retailers leverage these machine learning insights to spotlight both hero products and emerging, smaller brands—helping each participant optimize strategies and target marketing. This data feedback loop facilitates continuous improvement in inventory, loyalty, and campaign effectiveness.

Omnichannel Logistics

Capabilities like “buy online, pick up in store” (BOPIS), curbside pickup, and ship-from-store fulfillment require deep integration between retailer infrastructure, brand inventory, and coordinated logistics partners. Seamless omnichannel flows allow consumers to move freely from website to store and back, increasing convenience and fostering brand loyalty. Retailers like Sally Beauty use these systems to unify customer journeys, eliminate shipping costs, and drive both online and in-store conversions.

Subscription and Refill Programs

Eco-conscious consumers increasingly seek refillable packaging and recurring delivery, supported by subscription systems and integrated refill stations. Retailers collaborate with brands to offer “refill club” discounts, auto-restock programs for essentials, and visible sustainability commitments, linking these features across digital and in-store experiences.

Technology thus transforms the competitive tension between brands and retailers into collaborative efficiency—personalizing shopping journeys, reducing waste, and delivering creative, accessible experiences at scale. The future is built on partnerships powered by smart devices, analytics, and immersive digital innovation.

6. Case Studies of Mutual Benefit

Sephora and Fenty Beauty

Fenty Beauty’s exclusive launch at Sephora in 2017 set a new industry benchmark for inclusivity with 40 foundation shades, revolutionizing expectations for diversity in cosmetic offerings. Sephora’s global reach and high-end positioning amplified Fenty’s momentum, helping it achieve $100 million in sales in its first month while making “the Fenty Effect” a catalyst for industry-wide change. Fenty gained overnight global recognition, and Sephora reinforced its leadership as a retailer championing representation and innovation, drawing in new shoppers and solidifying brand loyalty.

Ulta and Target Partnership

Ulta’s “shop within a shop” rollout in Target stores connected Ulta’s prestige beauty brands and loyalty program to Target’s massive demographic. Target gained access to Ulta’s beauty enthusiasts, sparking increased foot traffic and shopper excitement, while Ulta extended its distribution and brand awareness via Target’s consumer reach. The integration of loyalty programs provided both with valuable shopper data, enhancing continued engagement and cross-shopping. This collaboration elevated both retailers’ profiles in prestige and mass beauty and created new habits for U.S. shoppers seeking convenience and assortment.

Amazon and Indie Beauty Brands

Amazon’s infrastructure and programs—such as the Premium and Indie Beauty accelerators—allow emerging and indie brands to quickly scale nationally and globally with reduced operational overhead. Indie brands leverage Amazon’s Prime eligibility, enhanced digital storefronts, and marketing features like virtual try-on or influencer placements, while Amazon grows its authority and selection in premium beauty, attracting more discerning shoppers and holding its own against specialty beauty retailers. This symbiosis provides smaller brands exposure to millions and provides Amazon with differentiation in a crowded e-commerce space.

Lush and Ethical Retail Alignment

Lush’s partnerships with outlets like Whole Foods highlight true values alignment, focusing on sustainability, zero-waste packaging, and ethical sourcing. Lush’s circular economy initiatives—such as its “Green Hub” in the UK, which reused 1,700+ tonnes of waste in 2024—and commitment to fair-trade ingredients resonate with consumers and retail partners alike. These shared sustainability priorities drive sales, deepen brand loyalty, and demonstrate that environmental advocacy and commercial success can go hand-in-hand.

These case studies showcase how brand–retailer collaborations, when rooted in clear values and operational synergy, deliver breakthrough results for both parties while shaping the direction of the wider beauty industry.

7. Challenges in Partnerships

Despite the clear mutual benefits, the partnership between beauty brands and retail platforms presents significant challenges that require strategic negotiation and ongoing management.

Margin Pressure

Retailers commonly charge brands for distribution, promotional events, and premium shelf placement—fees that can sharply reduce brand profitability, especially for emerging or independent labels. The costs can include slotting fees, unfavorable payment terms, and requirements for heavily discounted introductory campaigns. Brands must carefully weigh the sales volume and exposure gained against tighter margins, often negotiating for more favorable terms or shared costs where possible.

Data Ownership Conflicts

While brands seek direct access to customer data to inform product development and marketing, retailers typically guard this information to protect their own competitive edge and consumer relationships. This tension can slow down insights sharing and hamper the effectiveness of joint campaigns. Successful partnerships often depend on agreeing upfront on the scope, use, and sharing protocols for purchase, loyalty, and behavioral data.

Exclusivity Clauses

Retailers may demand exclusivity agreements that restrict a brand’s ability to sell via other stores or its own DTC (direct-to-consumer) channels for a set period. This can hinder a brand’s growth and flexibility, tying its fortunes too closely to a single retail partner. Conversely, brands may fear that too many exclusives will fragment their own relationships and confuse loyal customers.

Brand Dilution Risks

Entering mass-market retail channels risks diluting the perceived prestige of high-end or luxury brands. High visibility with broader audiences may compromise exclusivity and alienate core customer bases, especially if quality controls or brand presentation are not rigorously maintained. Brand dilution can occur when launching outside a core expertise, inconsistent messaging, or licensing to unaligned third parties.

The Path Forward

Healthy brand–retailer relationships balance these risks through transparent and early negotiation: covering price, supply chain, data rights, marketing support, and brand positioning. Strong communication, defined KPIs, and flexibility are key. Only by aligning expectations and sharing both the benefits and burdens can both sides realize long-term mutual value.While beauty brand–retailer partnerships can be lucrative, they also face several friction points requiring careful negotiation and continuous adjustment.

Margin Pressure: Retailers typically require brands to pay listing fees, invest in promotions, and sometimes accept lower wholesale costs to secure shelf space. These added expenses strain profitability, especially for smaller brands without economies of scale.

Data Ownership Conflicts: Brands increasingly want direct access to customer data for smarter product development and marketing, but retailers are inclined to safeguard this as a key asset. The tug-of-war over actionable insights can delay or restrict mutually beneficial data-driven campaigns.

Exclusivity Clauses: Some retailers condition their partnership on exclusivity, limiting a brand’s ability to sell through other platforms or direct channels. While this can ensure prominent placement and retailer investment, it may also stifle a brand’s broader market ambitions.

Brand Dilution Risks: Expanding from prestige channels into mass retail can sometimes erode a luxury brand’s aura if not managed carefully. Lack of consistent messaging or slipping quality standards may harm reputation and alienate core consumers.

The most successful partnerships proactively address these realities through transparent negotiation—clarifying contract terms, data-sharing protocols, and brand positioning. Open communication and trust are essential for striking the right balance between reach, profitability, and long-term equity for both sides.

8. The Future of Brand–Retail Partnerships

The future of brand–retail partnerships in the beauty industry will be defined by adaptability and collaboration across both digital and physical platforms. As online sales approach half the market and social commerce rapidly expands, brands and retailers must seamlessly merge e-commerce, in-store, and social experiences to meet evolving shopper habits. Prestige, indie, and mass brands alike will compete and partner with retailers to create omnichannel journeys, blending AI-driven personalization, exclusive in-store events, and shoppable content on platforms like TikTok and Instagram to capture consumer attention at every touchpoint.

Sustainability and value alignment will become even more central to partnership strategies. Shoppers are increasingly seeking out brands with transparent sourcing, eco-friendly packaging, and ethical practices, rewarding those that back claims with independent verification. Retailers are responding by curating “clean beauty,” refillable, and private-label lines, ensuring their assortments reflect consumer priorities and differentiating themselves in an increasingly crowded marketplace. At the same time, brands must find ways to stand out through purpose-driven innovation, data-backed engagement, and community-first storytelling.

Ultimately, successful partnerships will go beyond transactional arrangements. Future-forward brands and retailers will co-create solutions that offer both value and experience—optimizing product selections, integrating technology for better personalization, and supporting customers’ wellness and lifestyle aspirations. This approach not only builds loyalty in a fast-changing landscape but firmly positions the partnership model as the engine of growth for the modern beauty industry.