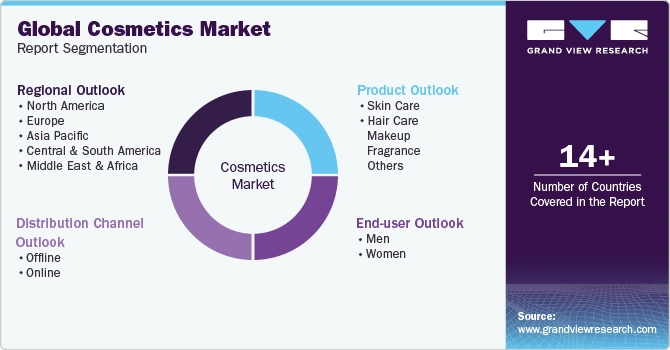

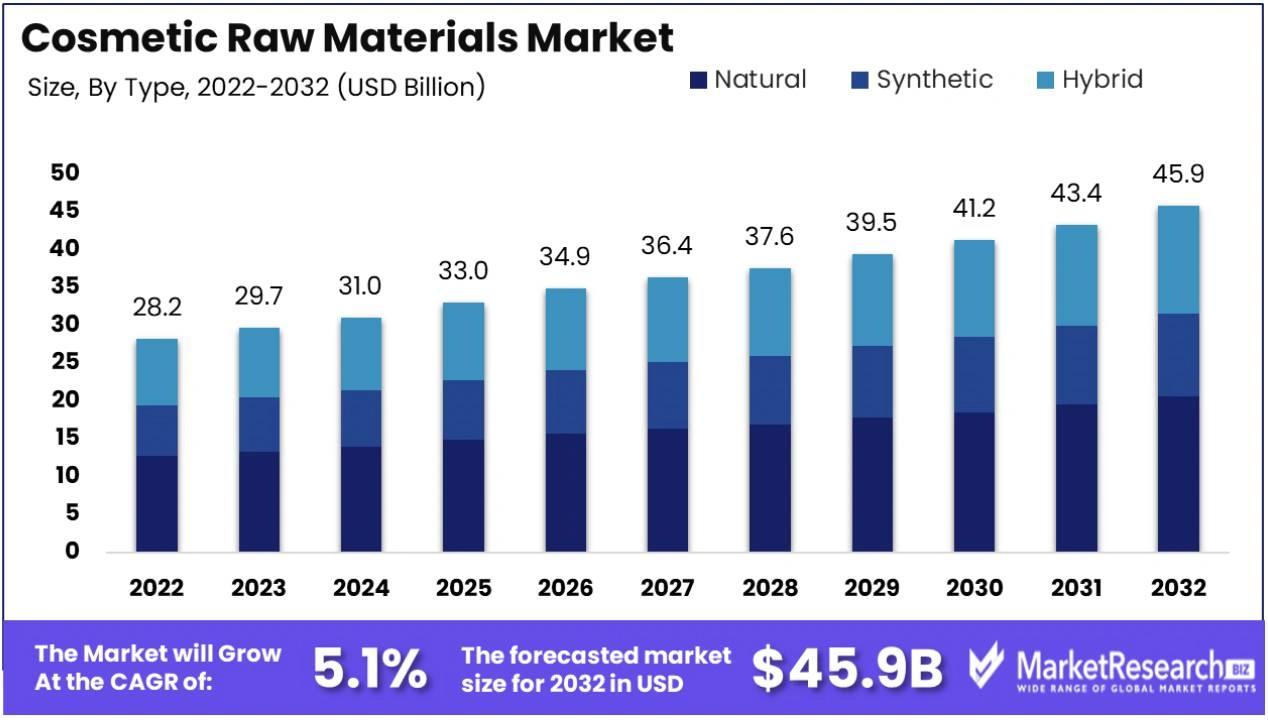

The global beauty product industry faces an unprecedented convergence of economic pressures, supply chain disruptions, and evolving consumer demands that are fundamentally reshaping how cosmetic companies approach cost management. With proposed U.S. tariffs ranging from 10% to 60% on beauty product imports and prices jumping 40-60% per unit due to new tariff enforcement, beauty product manufacturers of different sizes must implement distinct strategies to maintain competitiveness while preserving product quality and brand integrity.

The beauty product cost structure has become increasingly complex, with over 70% of consumer goods companies experiencing supply chain disruptions. Understanding how these challenges impact beauty product companies differently based on their size and operational scale has become essential for sustainable business operations, particularly as the global cosmetic industry is projected to reach $756 billion by 2029.

1. The Current Economic Landscape Affecting Beauty Product Manufacturing Costs

The beauty product industry confronts multiple simultaneous cost pressures that vary in impact depending on company size and operational structure. Geopolitical instability and ongoing trade conflicts have introduced significant complexities in managing costs of raw materials and logistics across the beauty product supply chain. These challenges are compounded by inflationary pressures that are expected to create steady price increases rather than temporary supply chain shocks.

Beauty Product Tariff Impacts and Trade Disruption Costs

The threat of substantial tariffs on beauty product imports, particularly those from China, represents a significant cost factor affecting cosmetic companies differently based on their supply chain complexity and sourcing strategies. Beauty product brands are moving production out of China to avoid a 60% U.S. tariff, with companies like Estée Lauder now sourcing synthetic talc from the U.S. and packaging from Mexico, while Revlon is shifting to synthetic mica and Brazilian inputs. High-impact beauty product items include mica, talc, and plastic packaging—primarily imported from China—with tariffs increasing unit costs by $0.05 to $0.10, representing a margin hit of up to 3% for a $30 lipstick.

Cross-border shipments involving sensitive or restricted cosmetic ingredients are subject to varying international regulations, with the potential for disruption to cross-border logistics increasing substantially. Beauty product companies are responding by establishing cross-functional command centers that include representatives from supply chain, finance, and marketing functions to ensure decisions are made quickly and transparently when tariff changes occur.

Beauty Product Raw Material and Ingredient Cost Pressures

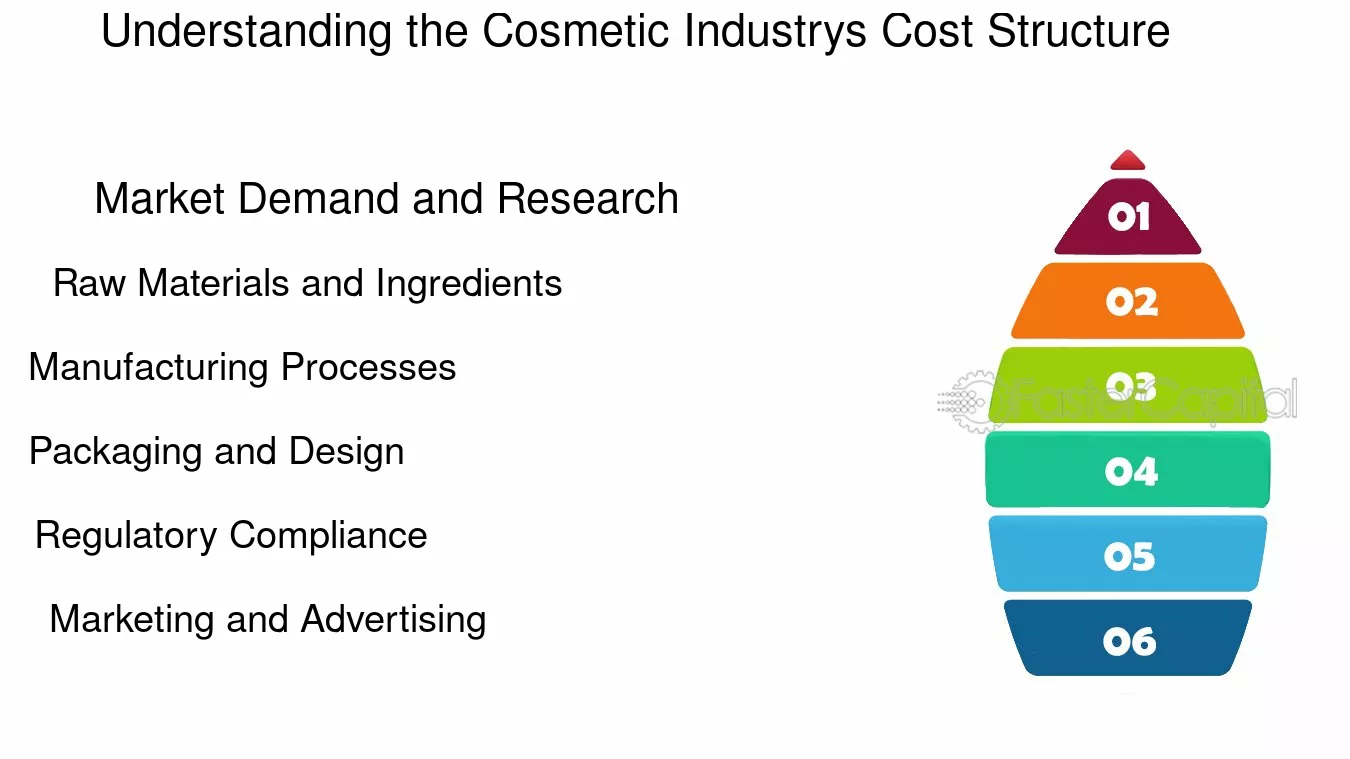

Raw materials and packaging typically account for 40-50% of overall production budgets for beauty product manufacturing, making these areas critical for cost control regardless of company size. The procurement of high-quality raw materials for cosmetic products, including essential oils, alcohols, citric acid, glycerin, colors, and fragrances, represents one of the most significant expenditures in beauty product production. Beauty product companies are implementing strategies to source economical raw materials while maintaining quality standards, including negotiating better rates with existing suppliers, consolidating orders, and exploring new sources for cosmetic ingredients.

2. Large Beauty Product Company Cost Management: Leveraging Scale and Resources

Large cosmetic companies possess distinct advantages in beauty product cost management through their ability to leverage economies of scale, sophisticated technology investments, and comprehensive supply chain management capabilities. These multinational beauty product corporations benefit from substantial bargaining power that enables them to negotiate better prices for raw materials, marketing expenses, and distribution costs, while their larger asset base provides superior access to financing for cost-saving opportunities.

Strategic Beauty Product Procurement and Supply Chain Advantages

Large beauty product corporations implement multi-year contract negotiations with suppliers, providing cost stability and protection against supply market volatility. These agreements help beauty product brands anticipate that tariffs or global supply-demand imbalances will drive volatility, offering a measure of cost stability for business planning. Many large beauty product brands have pared down their assortments to focus on hero products, ensuring these remain in stock while meeting quality and consumer expectations rather than launching variety niche flanker SKUs.

This strategic focus reduces the need to carry lesser-performing beauty products and associated raw and pack items in inventory, lowering complexity across the beauty product supply chain. Large cosmetic companies can leverage bulk purchasing to achieve significant cost savings, with purchasing raw materials and packaging in bulk often resulting in substantial cost reductions. Their scale enables them to negotiate volume-based pricing that smaller beauty product companies cannot access, with procurement teams using tools like SAP Ariba configured with tariff-sensitive SKUs and AI forecasting to manage tariff risk.

Beauty Product Technology and Automation Investments

Large beauty product companies can afford substantial investments in automation and advanced manufacturing equipment, with automated systems in production lines shown to lower expenses by as much as 20% without compromising quality. These cosmetic companies utilize machine learning systems and advanced algorithms to optimize production processes, reduce waste, and improve efficiency across multiple beauty product lines simultaneously.

Technology investments consume approximately 20-25% of beauty product manufacturing budgets in large companies, contributing significantly to personalized product innovations and production efficiency. The integration of AI in beauty product manufacturing continues gaining momentum, with AI taking a larger role in early stages of formulation by generating prototypes through analyzing ingredient combinations, consumer preferences, and scientific data, reducing reliance on cosmetic chemists and significantly speeding up the beauty product development process.

Advanced Beauty Product Supply Chain Management

Large cosmetic companies implement sophisticated supply chain strategies that include diversifying suppliers and negotiating shared costs to reduce exposure to tariffs. They prioritize vendors in lower-tariff regions to minimize cost increases while maintaining flexibility in beauty product supply chains. Mexico is emerging as a packaging hub for beauty products, offering tariff-free access under USMCA, while India and Brazil are becoming key alternatives for ethical mica and talc sourcing for cosmetic products.

These beauty product companies can establish decentralized distribution models by leveraging multiple warehouses and fulfillment centers to reduce delivery times and provide alternatives in case of localized disruptions. Their resources enable the implementation of IoT-based environmental monitoring systems that utilize cutting-edge sensors to monitor temperature and humidity throughout the shipping process, ensuring product integrity for temperature-sensitive beauty product ingredients.

Cost Structure Analysis for Large Beauty Product Companies

Large cosmetic companies typically allocate their operational budgets as follows: raw materials and packaging (30-40%), technology investments (20-25%), labor costs (15-20%), and distribution/logistics (10-15%). Their ability to spread fixed costs across larger beauty product production volumes creates significant economies of scale, with research showing that bigger firms have lower costs of goods sold and operating expenses on average.

3. Medium-Sized Beauty Product Company Strategies: Balancing Efficiency and Growth

Medium-sized cosmetic companies face unique challenges in achieving cost efficiencies without the full benefits of large-scale operations while competing against both larger corporations and nimble smaller beauty product brands. These companies must be particularly strategic in their cost allocation techniques to optimize resources effectively while maintaining growth trajectories, typically operating with annual costs ranging from $100,000 to over $500,000 depending on beauty product production scale.

Strategic Beauty Product Portfolio Management

Medium-sized beauty product companies often focus on product portfolio optimization by concentrating on essential SKUs and reducing lesser-performing cosmetic products to lower inventory complexity. This approach requires careful analysis of beauty product performance metrics and consumer demand patterns to identify which products deliver the highest return on investment. Unlike large companies that can afford to maintain extensive beauty product lines, medium-sized companies must make more selective decisions about their cosmetic offerings.

These beauty product companies implement selective automation in critical production areas to improve efficiency without requiring massive capital investments that might strain financial resources. They focus on identifying high-impact automation opportunities that provide measurable returns on investment within reasonable timeframes, utilizing a phased approach for technology development that aligns with key business milestones, ensuring that technology costs scale with beauty product business growth.

Collaborative Beauty Product Cost Management Approaches

Medium-sized cosmetic companies benefit from consolidated purchasing strategies where they group orders across multiple beauty product lines to achieve better pricing from suppliers. While they cannot match the purchasing power of large corporations, they can still negotiate favorable terms by demonstrating consistent volume and long-term partnership potential with beauty product suppliers.

These beauty product companies often form strategic partnerships with other medium-sized firms to share resources and costs, whether in research and development, marketing, or distribution networks. Such collaborations enable them to access capabilities and economies of scale that would be difficult to achieve independently, with some beauty product manufacturers offering smaller batch sizes of 500-1,000 units, perfect for testing without large financial commitments.

Beauty Product Supply Chain Diversification and Risk Management

Medium-sized cosmetic companies are increasingly diversifying their beauty product supply chains, sourcing materials from multiple regions and exploring near-shoring options to reduce dependency on single markets. These strategies not only mitigate risks but also enhance supply chain resilience, particularly important given current geopolitical uncertainties affecting beauty product imports.

They implement lean inventory management practices using just-in-time production principles to minimize storage costs and waste. Their smaller scale compared to large corporations makes it easier to implement flexible production schedules that respond directly to demand patterns, reducing risks of overproduction and excess beauty product inventory. Medium companies typically allocate 35-45% of their budget to raw materials, 15-20% to technology, 20-25% to labor costs, and 15-20% to distribution.

Activity-Based Costing Implementation for Beauty Products

Medium-sized beauty product companies often implement Activity-Based Costing (ABC) systems that assign costs to products based on the activities required to produce them, improving accuracy in cost assignment and reflecting real resource consumption. This granular approach helps allocate overhead costs like machinery maintenance and utility expenses based on actual usage by different beauty product lines, providing better insights into true product profitability.

4. Small Beauty Product Company Innovation: Agility and Creative Solutions

Small cosmetic companies must be particularly innovative in their beauty product cost control strategies, operating with limited resources but possessing greater flexibility to adapt quickly to market changes. These companies often turn constraints into competitive advantages through creative approaches to cost management and operational efficiency, typically starting with focused beauty product lines of 1-3 hero products to reduce development, manufacturing, and inventory costs.

Beauty Product Order Consolidation and Bulk Strategies

Small beauty product companies implement order consolidation strategies by encouraging customers to consolidate orders into larger, less frequent shipments and opting for bulk containers instead of smaller-sized packaging. This approach not only reduces transportation costs but also aligns with sustainability commitments by minimizing packaging waste and lowering carbon footprints associated with beauty product shipping.

These cosmetic companies excel at leveraging bulk purchasing for raw materials and packaging when possible, though their smaller volumes limit the extent of savings compared to larger beauty product companies. They often coordinate with other small companies or work through buying cooperatives to achieve better pricing on shared materials, with sourcing ingredients from local suppliers potentially reducing shipping costs by up to 30%.

Beauty Product Simplification and Lean Operations

Small cosmetic companies implement product simplification strategies through streamlined formulations and packaging designs to reduce beauty product manufacturing costs. They focus on minimalist and standardized designs that simplify packaging processes and reduce material and labor costs, which can also appeal to consumers seeking clean, uncomplicated beauty products.

The trend toward simpler formulations with fewer ingredients helps small beauty product companies manage costs more effectively. By reducing the number of ingredients required for each cosmetic product, these companies can simplify their supply chains, reduce inventory complexity, and lower procurement costs. Small companies typically allocate 40-50% of their budget to raw materials, 10-15% to technology, 25-30% to labor costs, and 15-25% to distribution.

Beauty Product Outsourcing and Strategic Partnerships

Outsourcing non-core functions like marketing, logistics, or even specialized R&D to third-party providers leads to significant cost savings for small beauty product companies. This approach allows brands to focus on their core competencies, such as product development and customer experience, while accessing specialized expertise without the overhead of maintaining these capabilities in-house.

Small cosmetic companies often embrace contract manufacturing partnerships as they avoid capital investments in production facilities. Working with established beauty product manufacturers who offer private label services can slash product development costs by 70-80%, as these partners already have tested formulas and compliance documentation in place. Minimum order quantities typically range from 1,000-5,000 units per SKU, with production setup fees of $500-$2,000 and quality control inspection costs of $500-$1,500.

Digital Marketing and Direct-to-Consumer Beauty Product Strategies

Small beauty product companies leverage digital marketing strategies that offer measurable return on investment compared to traditional advertising methods, with digital ads potentially lowering marketing expenses by up to 30% compared to traditional media. Social commerce has emerged as a major sales channel with high engagement and conversion rates, offering cost-effective alternatives to traditional retail models for beauty products.

These cosmetic companies can build direct relationships with consumers through social media platforms, reducing dependence on traditional retail channels and their associated costs. Monthly costs for digital marketing typically include social media management ($1,000-$5,000), email marketing ($300-$1,000), and digital advertising ($1,000-$15,000) for beauty product promotion.

Pre-Order and Beauty Product Inventory Management Models

To reduce inventory risk, small beauty product companies often adopt pre-order models where customers purchase cosmetic products before production runs. This approach generates capital for manufacturing, validates product-market fit, and minimizes unsold beauty product inventory. Combined with lean inventory management using just-in-time production principles, this strategy helps minimize storage costs and waste while maintaining operational flexibility.

5. Technology Integration Across Beauty Product Company Sizes

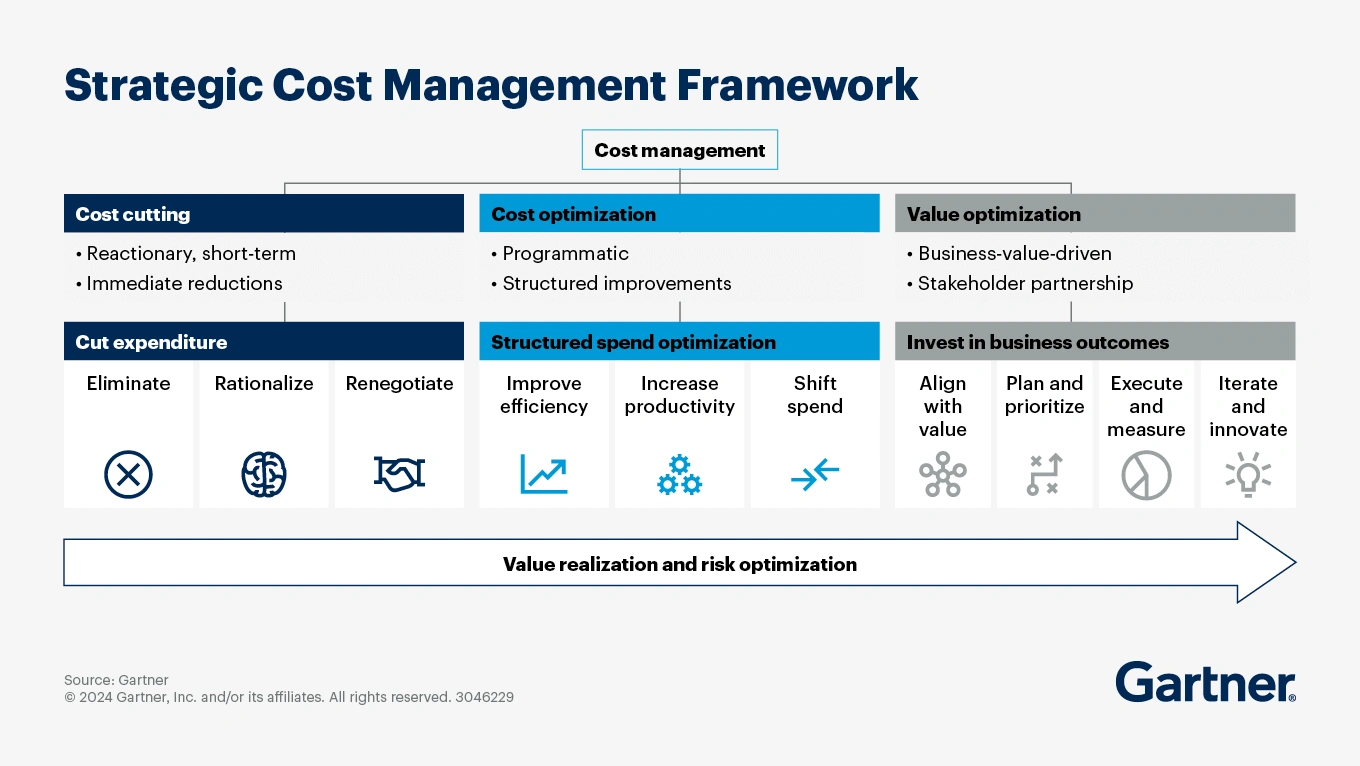

Technology integration serves as a critical cost control strategy across beauty product companies of all sizes, though implementation approaches and capabilities vary significantly based on available resources and technical expertise. Modern software offers the means for cosmetic companies to analyze their cost structures in real-time, with beauty product manufacturers able to simulate various tariff scenarios to understand financial implications.

AI and Predictive Analytics for Beauty Products

AI integration in beauty product manufacturing continues gaining momentum, with 77% of beauty professionals believing conversational AI agents offer unmatched potential for creating tailored interactions. Large cosmetic companies can implement comprehensive AI systems that analyze ingredient combinations, consumer preferences, and scientific data to optimize formulations and reduce development costs, with generative AI potentially adding $9 billion to $10 billion to the global economy based on its impact on the beauty product industry alone.

Medium-sized beauty product companies often focus on specific AI applications that provide clear returns on investment, such as demand forecasting and inventory optimization. Small cosmetic companies can access AI capabilities through cloud-based platforms and software-as-a-service models that don’t require substantial upfront technology investments.

Beauty Product Supply Chain Technology Solutions

Beauty product companies across all sizes benefit from integrating key systems such as Transportation Management Systems (TMS), Enterprise Resource Planning (ERP), and Real-Time Transportation Visibility Platforms (RTTVP) to create information-rich environments that enhance visibility, agility, and collaboration. However, the complexity and scope of these implementations vary based on company size and resources.

Predictive analytics focuses on forecasting future trends and potential disruptions in beauty product logistics operations by analyzing historical data, while prescriptive analytics provides actionable recommendations on specific actions to optimize operations based on those forecasts. Large cosmetic companies can implement comprehensive analytics platforms, while smaller beauty product companies often rely on more focused solutions that address their most critical operational needs.

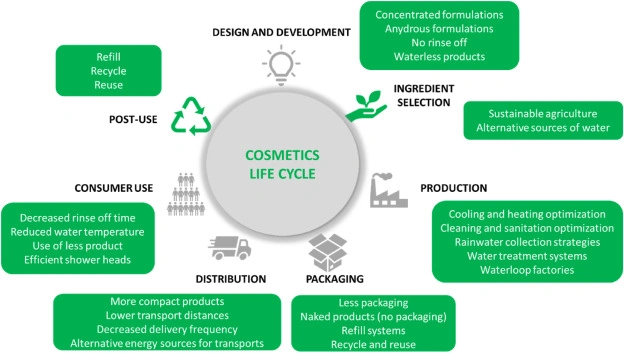

6. Sustainability as Beauty Product Cost Management Strategy

Sustainability has evolved from a niche concern to a core expectation, with consumers increasingly holding beauty product companies accountable for environmental impact. However, implementing sustainable practices can also serve as effective cost control measures across cosmetic companies of all sizes, with beauty product brands able to save significant costs by innovating in packaging design, including reducing packaging size, using eco-friendly materials, or switching to refillable packaging options.

Beauty Product Packaging Innovation and Cost Reduction

Cosmetic companies are implementing packaging innovations that reduce costs while appealing to environmentally conscious consumers. Using recycled packaging materials or sourcing ingredients locally can reduce transportation costs while meeting consumer demand for sustainable beauty products. The demand for refillable beauty products is decreasing in favor of compostable packaging, offering a more convenient and eco-friendly solution.

Investing in sustainable and efficient packaging solutions can reduce costs by up to 15% while appealing to eco-conscious consumers. These changes lower costs while appealing to environmentally conscious consumers, creating dual benefits for cost management and brand positioning in the beauty product market.

Sustainable Sourcing and Beauty Product Production

Implementing sustainable sourcing and production practices helps lower costs in the long run for beauty product companies. Cosmetic companies are investing in biodegradable and reusable packaging materials that lower environmental impact and disposal costs. While developing these solutions requires significant R&D investments initially, they often result in long-term cost savings and improved brand positioning in the beauty product industry.

The shift toward bio-based ingredients sourced from renewable plants or biotechnology appeals to eco-conscious consumers with innovative, more sustainable formulations. These ingredients are often less tied to specific geographic areas, which may create opportunities to establish manufacturing and supply in less volatile areas with smaller footprints or shorter supply chains for beauty products.

7. Industry-Wide Challenges and Universal Beauty Product Solutions

Regardless of size, all beauty product companies face challenges from geopolitical instability, trade conflicts, and inflation that require strategic responses tailored to their operational capabilities and resource constraints. The current geopolitical climate and ongoing trade conflicts have introduced complexities in managing costs of raw materials and logistics across the beauty product industry.

Beauty Product Supply Chain Resilience Building

Beauty product companies across all sizes are implementing strategies to build supply chain resilience through diversification and risk management. Diversifying supplier sources and collaborating with multiple suppliers across different regions helps mitigate risks. Enhanced supplier collaboration fosters strong relationships to ensure priority during shortages, while improved inventory management systems monitor stock levels and forecast demand for beauty products.

Supply chain automation utilizes automated systems to track purchase orders and streamline procurement processes, while agile manufacturing processes implement flexible systems to adapt to changing demand quickly. The complexity and scope of these implementations vary based on company size, with larger cosmetic companies able to implement more comprehensive systems.

Beauty Product Regulatory Compliance and Quality Management

Increasing regulatory requirements, particularly around sustainability and ingredient safety, create new cost categories that beauty product companies must manage effectively. The FDA is introducing new rules to ensure talc-based cosmetics are free from asbestos, requiring beauty product companies to adopt advanced testing technologies and adapt manufacturing processes.

Cosmetic companies must balance regulatory compliance costs with operational efficiency, conducting regular quality control audits to ensure consistency while sourcing sustainable yet cost-effective raw materials. Investing in technology to automate quality checks during production helps maintain standards while controlling labor costs for beauty product manufacturing.

8. Future Outlook and Emerging Beauty Product Cost Considerations

The beauty product industry’s cost control landscape continues evolving, driven by technological advancement, regulatory changes, and shifting consumer preferences that create both challenges and opportunities for cosmetic companies of all sizes. Beauty product brands face a range of headwinds: intense competition, rising costs, shrinking margins, and rapidly changing consumer preferences.

Market Trends Affecting Beauty Product Cost Structures

The rise of TikTok and its shopping features brought a surge of micro-trends in beauty products, though consumers are beginning to see value in investing in timeless products that work well for them on a daily basis. This shift toward quality over trends may benefit beauty product companies that focus on developing durable, effective cosmetic products rather than chasing short-term market movements.

Beauty product companies can expect higher MSRPs in the market to account for rising costs, along with shrinkflation within beauty to avoid price hikes and customer backlash. There may also be a reduction in the number of new beauty product launches as existing brands attempt to stay afloat while new ones become more mindful of their market entrance strategies.

Beauty Product Pricing Strategy Adaptations

To address rising costs while maintaining competitiveness, beauty product brands are adapting pricing strategies with greater transparency, communicating price changes alongside their commitment to quality and sustainability. Cost engineering and value delivery remain pivotal, with cosmetic companies implementing development strategies to execute the highest quality beauty products that are commercially viable.

Rather than relying solely on cost-cutting—which can alienate today’s discerning consumers who are quick to recognize compromises in formulation, packaging, or supply chain integrity—the key to long-term success lies in smarter, strategic pricing for beauty products. By leveraging various options, beauty product brands can protect their market share and profit margins while delivering value to consumers and trade partners.

The beauty product industry’s cost control demands will continue varying by company size, but successful businesses across all scales will be those that balance immediate cost pressures with long-term strategic investments in technology, sustainability, and consumer engagement. Understanding these size-specific demands and implementing appropriate strategies remains crucial for maintaining competitiveness in an increasingly complex and challenging beauty product market environment.

Cosmetic companies that successfully integrate cost management with innovation, sustainability, and consumer value creation will emerge as leaders in this dynamic and rapidly evolving beauty product landscape, regardless of their size or operational scale.