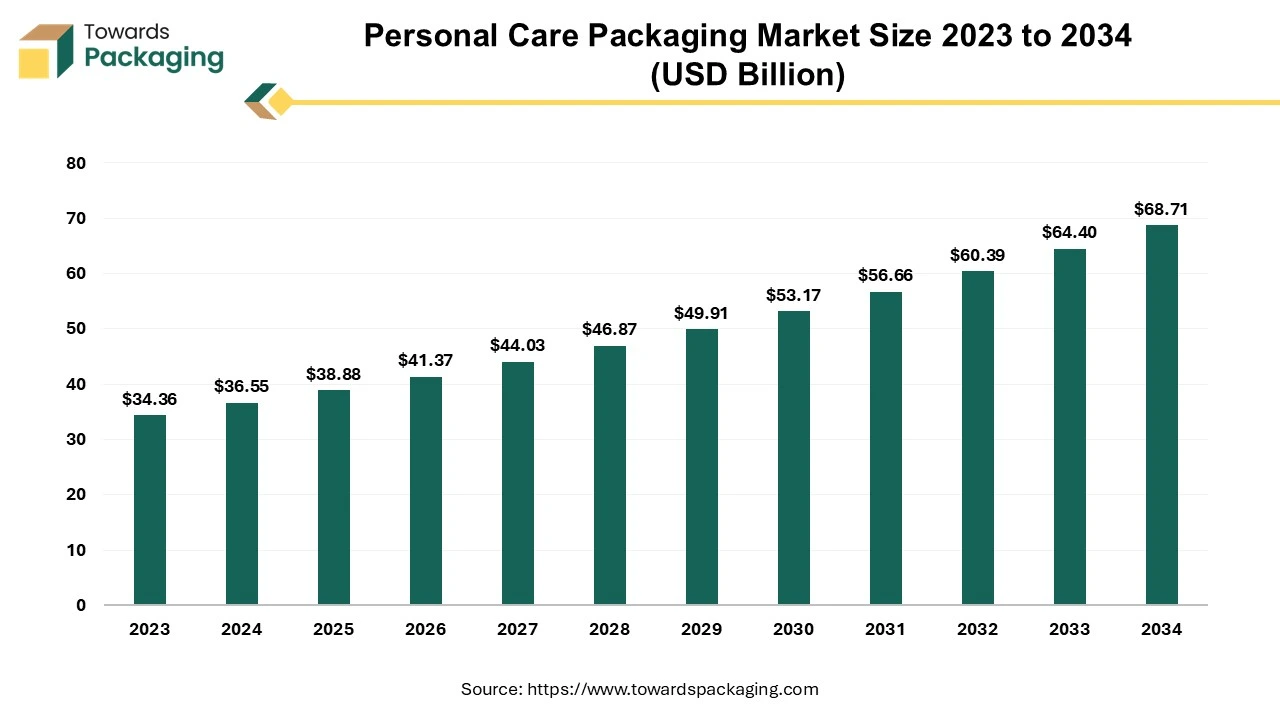

The personal care packaging industry stands at a pivotal moment in 2025, with the global market projected to reach $45.32 billion this year and expand to $83.37 billion by 2032, growing at a CAGR of 7.92%. This remarkable growth reflects the evolving landscape of consumer preferences, sustainability demands, and technological innovations that are reshaping how brands approach packaging design and functionality. The transformation has been driven by multiple factors, including heightened environmental awareness, digital commerce expansion, and shifting consumer demographics that demand more from their product packaging than ever before.

As consumers become increasingly conscious about both product quality and environmental impact, packaging has evolved from merely functional containers to powerful storytelling mediums that forge emotional connections. Today’s personal care packaging must not only protect and preserve products but also communicate brand values, enhance user experience, and meet growing sustainability expectations. In an industry where product differentiation can be challenging, packaging has emerged as a critical competitive advantage, allowing brands to stand out in crowded retail environments and digital marketplaces.

1. The Evolving Landscape of Personal Care Packaging

Market Overview and Growth Projections

The personal care packaging market has demonstrated remarkable resilience and growth, even amid global economic fluctuations. This robust growth trajectory is being driven primarily by the skincare segment, which accounts for approximately 35% of the market share, followed by haircare and body care products. The Asia Pacific region continues to lead market expansion, with China and India representing particularly high-growth markets due to rising disposable incomes and increasing adoption of premium personal care products.

Demographic shifts are significantly influencing packaging demands across the industry. The growing purchasing power of Millennials and Gen Z consumers, who prioritize sustainability, authenticity, and digital integration, has pushed brands to rethink traditional packaging approaches. Meanwhile, the aging population in developed markets has created demand for packaging with enhanced functionality, such as easy-open features and larger, more readable text. These diverse consumer needs have led to unprecedented segmentation in packaging solutions, with brands developing targeted approaches for different demographic groups.

The COVID-19 pandemic accelerated several pre-existing trends, particularly in hygiene-focused packaging and contactless dispensing systems. These changes, initially driven by necessity, have become permanent features of the market landscape as consumers maintain heightened awareness of product safety and contamination risks. The pandemic also accelerated e-commerce growth, creating new challenges and opportunities for packaging designed specifically for direct-to-consumer shipping rather than traditional retail display.

The Shifting Role of Packaging in Brand Strategy

Packaging has undergone a fundamental transformation from its traditional role as a functional container to become a critical brand storytelling medium. Modern personal care packaging serves multiple strategic functions: it protects the product, communicates brand values, creates emotional connections, and increasingly, addresses environmental concerns. This evolution reflects broader changes in consumer behavior, with packaging now recognized as a powerful influence on purchasing decisions.

Research consistently demonstrates the impact of packaging on consumer choice, with 72% of consumers reporting that packaging design directly influences their buying decisions. This influence is particularly pronounced in the personal care sector, where product differentiation can be challenging and emotional factors often drive purchasing behavior. The “unboxing experience” has emerged as a critical touchpoint in the consumer journey, particularly for premium and luxury brands. This moment of revelation, often shared on social media platforms, represents a significant opportunity for brands to create memorable impressions and foster deeper emotional connections.

As digital commerce continues to expand its share of personal care sales, packaging must now fulfill dual roles—functioning effectively in both physical retail environments and digital contexts. This has led to innovations in packaging design that optimize for both online representation and physical interaction. Brands are increasingly viewing packaging as an extension of the product experience itself, rather than merely a container, with tactile elements, scent features, and interactive components enhancing the overall consumer experience.

Key Drivers Reshaping the Industry

Several fundamental forces are reshaping the personal care packaging industry, creating both challenges and opportunities for brands and packaging suppliers. Rising consumer awareness about environmental impact has placed sustainability at the forefront of packaging innovation, with brands facing increasing pressure to reduce plastic usage, incorporate recycled materials, and design for end-of-life recyclability or biodegradability. This shift is not merely trend-driven but increasingly mandated by regulatory frameworks in major markets worldwide.

Convenience and functionality continue to drive packaging evolution, with consumers expecting intuitive design, ease of use, and features that enhance product performance. Innovations such as airless pumps that preserve product integrity, precision applicators that improve product delivery, and travel-friendly formats that accommodate mobile lifestyles are becoming standard expectations rather than premium features. These functional improvements often determine repeat purchases and brand loyalty in competitive product categories.

The explosive growth of e-commerce has fundamentally altered packaging requirements, necessitating designs that can withstand the rigors of shipping while still creating premium unboxing experiences. This has led to innovations in protective design, weight reduction to minimize shipping costs, and packaging that transforms from shipping container to attractive display item upon arrival. The digital commerce environment has also created new opportunities for personalization and customization that were previously impractical in traditional retail channels.

Regulatory changes continue to exert significant influence on packaging design and material selection. Extended Producer Responsibility (EPR) legislation, plastic packaging taxes, and restrictions on certain materials are becoming more common globally, requiring brands to adapt their packaging strategies to maintain compliance across different markets. These regulations, while challenging, are also driving positive innovation in sustainable materials and design approaches that might otherwise have developed more slowly.

2. Sustainability: The New Packaging Imperative

The Green Revolution in Personal Care Packaging

Sustainability has transformed from a niche concern to the defining imperative of personal care packaging strategy. The cosmetics and personal care industry produces approximately 120 billion packaging units annually, much of which historically has ended up in landfills or oceans. This sobering reality has driven both consumer demand and regulatory pressure for more environmentally responsible packaging solutions. Brands across all market segments, from mass market to prestige, are now prioritizing sustainability in their packaging development processes.

Consumer research consistently demonstrates willingness to pay premium prices for eco-friendly packaging, with 73% of global consumers indicating they would pay more for products with sustainable packaging. This preference is particularly pronounced among younger consumers, with 85% of Millennials and Gen Z reporting that environmental considerations influence their purchasing decisions. This shift in consumer priorities has transformed sustainability from a cost center to a competitive advantage, with brands leveraging their environmental credentials to justify premium positioning and build consumer loyalty.

The regulatory landscape is increasingly driving sustainable packaging adoption, with legislation in the European Union, California, and other major markets imposing stricter requirements for recyclability, recycled content, and producer responsibility. The EU’s Circular Economy Action Plan and Single-Use Plastics Directive have been particularly influential, establishing frameworks that are being adopted or adapted by other regions globally. These regulatory frameworks are creating both challenges and opportunities for brands to demonstrate leadership in sustainable packaging innovation.

Innovative Sustainable Materials Transforming the Industry

Material innovation stands at the forefront of sustainable packaging transformation. Post-Consumer Recycled (PCR) plastics have become increasingly mainstream, with technological advances improving their appearance, performance, and regulatory compliance for cosmetic applications. Leading brands are now achieving 100% PCR content in many packaging formats, significantly reducing virgin plastic consumption. These materials not only reduce environmental impact but also create visual distinctiveness that communicates sustainability credentials to consumers.

Biodegradable and compostable packaging solutions are gaining traction, particularly for single-use items and secondary packaging. Materials derived from polylactic acid (PLA), polyhydroxyalkanoates (PHA), and cellulose are providing alternatives to conventional plastics, though challenges remain in ensuring these materials perform adequately in protecting sensitive personal care formulations. Advances in barrier properties and moisture resistance are gradually overcoming these limitations, expanding the potential applications for these innovative materials.

Plant-based alternatives derived from renewable resources such as hemp, cotton, sugarcane bagasse, and agricultural waste are creating new possibilities for sustainable packaging. These materials often have lower carbon footprints than petroleum-based alternatives and can be designed for composting or recycling at end-of-life. Brands like Aveda and The Body Shop have pioneered the use of these materials, demonstrating their viability for mainstream personal care applications while creating distinctive packaging aesthetics that communicate their natural positioning.

Traditional materials like glass and metal are experiencing renewed interest due to their recyclability and premium positioning. Innovations in lightweight glass formulations are addressing previous concerns about shipping weight and carbon footprint, while advances in metal decoration techniques are expanding design possibilities. These materials are particularly popular for refillable systems, where durability and aesthetic longevity are essential for encouraging consumer participation in circular economy models.

Brand Case Study: Lush Cosmetics

Lush Cosmetics has established itself as a pioneer in sustainable packaging through its radical “naked” packaging strategy and commitment to compostable materials. The brand has eliminated packaging entirely for approximately 35% of its product range, including solid shampoos, conditioners, and bath products. For products requiring containers, Lush prioritizes recycled and recyclable materials, with black plastic pots that are collected in-store for closed-loop recycling. This comprehensive approach has created a distinctive brand identity centered on environmental responsibility.

The impact on brand perception has been significant, with Lush consistently ranking among the most trusted brands for environmental commitment in consumer surveys. This trust has translated into strong customer loyalty and advocacy, with the brand enjoying industry-leading repeat purchase rates and social media engagement. Lush’s packaging strategy has become inseparable from its overall brand identity, demonstrating how sustainability commitments can become powerful differentiators in a crowded marketplace.

Implementing such radical approaches has not been without challenges. Lush has had to invest significantly in consumer education about product use without traditional packaging, develop innovative solid formulations that perform effectively without containers, and create in-store infrastructure to support their packaging return programs. The brand has addressed these challenges through comprehensive staff training, detailed product information, and demonstration areas in retail locations that help consumers understand how to use and store package-free products.

The Lush case study offers valuable lessons for brands considering similar strategies. First, packaging sustainability must be integrated with product formulation rather than treated as a separate consideration. Second, consumer education is essential for successful adoption of unconventional packaging approaches. Finally, sustainability initiatives are most effective when they align authentically with overall brand values rather than appearing as isolated efforts. While few brands may adopt Lush’s package-free approach entirely, elements of their strategy can be adapted across different market segments and product categories.

3. Design Strategies for Brand Differentiation

Minimalist Design: Less is More

The trend toward minimalist packaging design continues to gain momentum across the personal care sector, reflecting broader cultural shifts toward simplicity, authenticity, and reduced consumption. Minimalist approaches typically feature clean lines, ample white space, restrained color palettes, and typography that prioritizes legibility over decoration. This aesthetic not only creates distinctive shelf presence but also communicates transparency and honesty—qualities increasingly valued by consumers skeptical of excessive marketing claims.

Brands like Glossier have built their identity around minimalist packaging that emphasizes the product rather than elaborate decoration. Their simple white and pink color scheme, straightforward typography, and uncluttered layouts have created instantly recognizable packaging that stands out precisely because of its restraint. This approach has proven particularly effective for digital-native brands, as minimalist designs typically photograph well for social media and create a sense of sophistication that elevates relatively affordable products.

The challenge in minimalist design lies in balancing simplicity with necessary product information and brand recognition. Successful minimalist packaging carefully prioritizes information, highlighting key benefits while moving secondary details to less prominent positions. Tactile elements like embossing or selective use of different finishes can create interest and recognition without visual clutter. Color psychology plays a crucial role in minimalist approaches, with carefully selected hues carrying greater significance when used sparingly.

Luxury and Prestige Packaging Approaches

In the luxury and prestige segments, packaging serves as a tangible manifestation of brand exclusivity and product quality. Materials and finishes that communicate premium positioning include heavy glass with exceptional clarity, metal components with precise engineering, soft-touch coatings that create tactile luxury, and decorative techniques like hot stamping, embossing, and silk screening. These elements create multi-sensory experiences that begin before the product is even used, establishing expectations of exceptional performance.

Structural design elements significantly enhance perceived value in luxury packaging. Custom shapes that require proprietary molds create instant brand recognition and suggest product uniqueness. Weighted components convey substance and permanence. Precision engineering in closures—the smooth action of a magnetic compact or the satisfying click of a premium lipstick cap—creates moments of micro-pleasure that reinforce luxury positioning. These structural elements often represent significant investment but create distinctive brand assets that are difficult for competitors to replicate.

Pininfarina, known primarily for automotive design, has successfully transferred its expertise to luxury cosmetic packaging with engraved bottles that tell stories of exclusivity and craftsmanship. Their approach demonstrates how techniques from other luxury categories can be adapted to create distinctive personal care packaging. The detailed engravings and precision manufacturing communicate attention to detail and design heritage, creating packaging that feels as premium as the products it contains.

The challenge for luxury brands today lies in balancing traditional prestige cues with growing expectations for sustainability. Innovative approaches include refillable systems in premium containers, incorporation of responsibly sourced materials like FSC-certified wood components, and a shift from disposable luxury to enduring quality. Brands like La Bouche Rouge have pioneered this approach with leather-cased lipsticks designed for lifetime use with recyclable refills, demonstrating that sustainability and luxury can be complementary rather than contradictory values.

Creating Emotional Connections Through Packaging Design

Visual storytelling through colors, typography, and imagery creates powerful emotional connections with consumers. Color selections can evoke specific emotional responses—cool blues suggesting purity and tranquility for sensitive skin products, vibrant hues creating energy and playfulness for younger demographics, earthy tones communicating natural origins for clean beauty brands. Typography choices similarly communicate brand personality, with serif fonts often suggesting heritage and reliability, while sans-serif options convey modernity and simplicity. These visual elements must work harmoniously to tell a cohesive story that resonates with the target audience.

Tactile elements significantly enhance consumer engagement with packaging. Textured surfaces invite touch and create memorable sensory experiences. Soft-touch coatings, embossed patterns, and material contrasts can communicate product benefits before the product is even used—a silky finish suggesting smoothing properties for a hair product, or a textured grip improving usability for in-shower items. These tactile elements are particularly important as consumers increasingly shop online, making the physical unboxing experience a critical moment for brand impression.

Creating memorable unboxing experiences has become a strategic focus for many personal care brands, particularly those with significant e-commerce presence. Thoughtful opening mechanisms, reveal sequences that build anticipation, interior printing with messages or instructions, and unexpected details all contribute to moments of delight that consumers often share on social media. These experiences transform functional packaging into brand rituals that deepen emotional connection and encourage repeat purchase.

Consistency across product lines strengthens brand recognition and builds cohesive brand identity. While individual products may have unique design elements, they should remain recognizably part of the same brand family through consistent use of key visual elements, structural similarities, or material continuity. This consistency helps consumers navigate product ranges and builds trust through familiarity, while still allowing for category-appropriate differentiation between product types.

4. Global Personal Care Market Analysis: Regional Powerhouses

The global beauty and personal care market is projected to generate revenue of US$677.19 billion in 2025, with an expected annual growth rate of 3.37% (CAGR 2025-2030). This growth is being driven by several key trends including increasing consumer focus on natural and organic ingredients, AI-powered personalization, biotech innovations, social media influence, and rising demand for men’s beauty products.

Asia-Pacific: The Dominant Growth Engine

The Asia-Pacific beauty and personal care market is expected to reach USD 233.28 billion in 2025 and grow at a CAGR of 6.74% to reach USD 323.23 billion by 2030, making it the largest and fastest-growing regional market globally. Several factors are driving this exceptional growth:

- Increasing consumer awarenessabout personal grooming and hygiene

- Rising disposable incomesacross developing economies

- Strong demand for hair care productstargeting specific issues like hair thinning and volume loss

- Growing preference for natural and organic ingredients

- Expanding e-commerce penetrationand digital adoption

The region is witnessing significant premiumization, with more consumers, especially the aging population, investing in luxurious, high-quality products that deliver results. Simultaneously, holistic wellness is becoming a major focus, as consumers seek beauty solutions that support their overall well-being. Convenience also remains a priority, with busy lifestyles pushing demand for multifunctional products that streamline routines.

In the APAC region, “skintellectual” consumers are increasingly shaping the beauty landscape, with 85% of Indian consumers believing beauty brands should provide more scientific evidence to support their claims. This trend is driving demand for science-based, AI-powered innovations that address growing consumer interest in hyper-personalization, longevity, and wellness.

North America: Mature but Innovative

The North American beauty and personal care market is expected to reach USD 129.45 billion in 2025 and grow at a CAGR of 3.95% to reach USD 157.12 billion by 2030. Despite being a mature market, North America continues to drive innovation in several key areas:

Digital transformation is revolutionizing how consumers discover, evaluate, and purchase products, with 74% of Generation Z consumers relying on influencer recommendations

Sustainable and clean beauty products are seeing significant growth, with brands incorporating eco-friendly packaging solutions and natural ingredients

Technological innovation including AI and AR is reshaping the retail landscape, with tools like virtual try-ons enhancing the shopping experience

Celebrity and influencer-led brands are transforming the competitive landscape and challenging established industry players

The personal care products segment dominates the North American market, commanding approximately 83% market share in 2024. This includes skincare, haircare, oral care, sun care products, bath and shower products, and deodorants. The color cosmetics/make-up segment is projected to grow at a CAGR of approximately 3% during 2024-2029, driven by innovative product launches and increasing adoption of premium beauty products.

Europe: Steady Growth with Sustainability Focus

Europe accounts for approximately 22% of the global beauty market and demonstrated impressive resilience with 10% growth from 2022 to 2023. Spain represents the fastest-growing market in Europe, with a projected growth rate of approximately 6% during 2024-2029, driven by increasing consumer focus on achieving natural looks and growing demand for innovative skincare solutions.

The European market benefits from:

- Strong tradition of cosmetics and skincare innovation

- High consumer education regarding ingredients and formulations

- Stringent regulatory standards driving product quality

- Growing emphasis on sustainable and ethical products

- Well-established premium and luxury segments

Emerging Markets: Middle East, Africa, and Latin America

The Middle East and Africa region demonstrated exceptional growth, reaching 18% year over year from 2022 to 2023, exceeding industry expectations. The United Arab Emirates shows the fastest growth within this region, driven by high per capita spending on cosmetics and personal care and strong demand for premium and luxury products. South Africa emerges as the largest market in the region.

Latin America demonstrated impressive growth of 17% year over year from 2022 to 2023, significantly exceeding industry projections. Brazil emerges as both the largest and fastest-growing market in South America, benefiting from sophisticated consumer preferences, strong distribution networks, and increasing demand for multifunctional products.

5. Demographic Differences in Packaging Expectations

As we move through 2025, research continues to reveal significant variations in how different demographic groups respond to personal care packaging. These insights are proving crucial for brands seeking to optimize their packaging strategies for specific consumer segments.

6. Ethnic and Cultural Considerations

A particularly significant finding from recent research is the substantial role that ethnicity plays in consumer attitudes toward natural skin care products. A 2024 study published in PMC found that “consumers’ ethnicity substantially moderated the mediation effect of personal attitude in the relationships between subjective norms, health factor, Halal certificate, packaging design, past experience factor, price factor, and purchase intention”. This research highlights how cultural backgrounds significantly influence how consumers respond to different packaging elements.

The study specifically examined how packaging design affects multicultural consumers’ intention to purchase natural skin care products, confirming that “Packaging design significantly affects multicultural consumers’ intention to purchase NSCPs [Natural Skin Care Products]”. This finding underscores the importance of considering cultural nuances when designing packaging for diverse markets.

For brands operating in multicultural markets, this research suggests that packaging strategies should be tailored to reflect cultural preferences and values. For example, the importance of Halal certification in packaging design varies significantly across different ethnic groups, with this factor having a stronger influence on purchase intention among certain cultural demographics.

Income and Education Level Differences

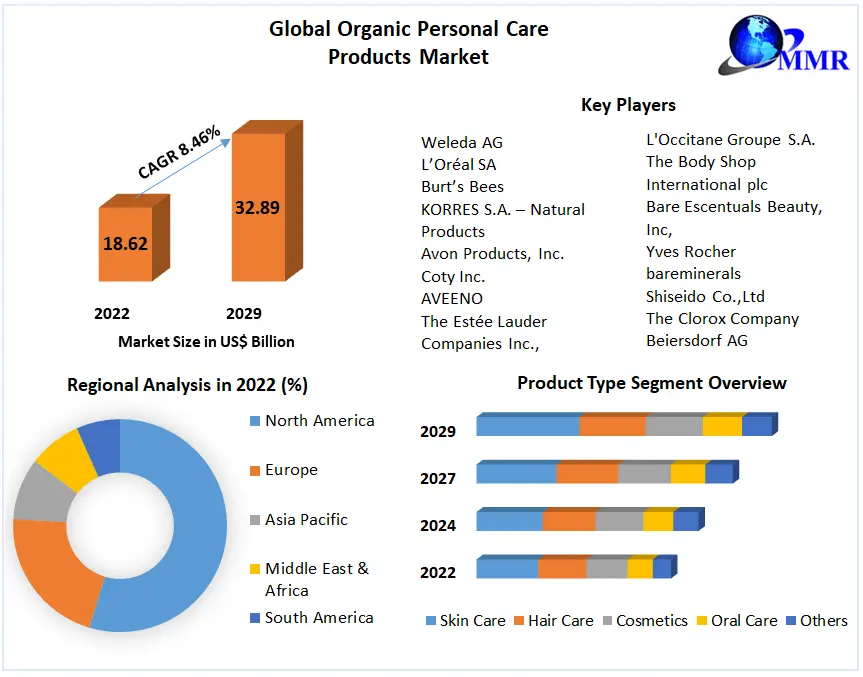

Additional research from 2021 on organic personal care products found significant differences in consumer purchase intentions based on demographic factors including “gender, age, income level and education level”. This suggests that packaging strategies should consider economic factors alongside cultural and gender considerations.

Higher-income consumers, for instance, may respond more positively to premium packaging materials and sustainable options, even at higher price points. The research indicates that different demographic segments have varying willingness to pay for sustainable packaging solutions, with education level being a particularly important factor in determining attitudes toward eco-friendly packaging options.

7. The Impact of Social Media on Packaging Design

In April 2025, social media continues to exert a transformative influence on packaging design across the personal care industry. This influence has evolved from a marketing consideration to a fundamental design principle that shapes packaging development from the earliest stages.

From Functional Container to Shareable Content

Packaging has undergone a remarkable transformation in its fundamental purpose. As Bolt Boxes notes, “Packaging is also quickly becoming a new form of content as a result of social media. Brands across the globe are packaging their products with an eye on social media and the ways their products are perceived across social platforms such as Instagram, Facebook and Twitter”. This shift means that packaging is now conceived as an extension of a brand’s content strategy rather than merely a functional container.

The implications are significant: “Since everything is shared on social media, brands have to think of the box design process as an extension of their content strategy. If their packaging is easily shared on social media, then that product is more likely to gain traction as a national brand and embed itself into the psyche of consumers. This represents a fundamental shift in how packaging is conceptualized and developed.

The Unboxing Phenomenon

Unboxing videos have emerged as one of the most influential social media trends affecting packaging design. As of April 2025, unboxing content continues to generate billions of views across platforms, with TikTok alone seeing the hashtag #unboxing garner “not merely millions but billions of views”.

The power of these videos lies in their authenticity and influence: “87% of viewers agree that YouTube creators give recommendations they can trust”. This statistic underscores why brands are increasingly designing packaging with unboxing experiences in mind—these videos represent trusted, authentic endorsements that significantly impact consumer purchasing decisions.

Brands are now carefully considering the “reveal process” in their packaging design: “If a product takes too long to unpackage, video influencers are not likely to use that product in their social media reveals and unpackaging videos”. This consideration affects everything from the type of closure systems used to the sequence in which products are revealed when a package is opened.

Strategic Design for Social Sharing

The most forward-thinking brands are now designing packaging specifically to encourage social sharing. As Your One Source reports, “Social media plays a huge role in the success of interactive packaging. When consumers share their experience with unique or fun packaging on platforms like Instagram or TikTok, it creates organic marketing and boosts brand visibility”.

8. Conclusion

The personal care packaging landscape continues to evolve rapidly in 2025, driven by sustainability imperatives, technological innovation, and changing consumer expectations. Brands that view packaging as a strategic asset rather than merely a functional necessity are finding significant opportunities for differentiation, consumer engagement, and market growth.

The most successful brands in 2025 are those that have embraced packaging as an integral part of their product experience and brand story, investing in innovations that resonate with consumers and address evolving market demands. From sustainable materials and smart technologies to designs that create emotional connections, the opportunities for brands to elevate their packaging strategy have never been more diverse or impactful.

As we move further into 2025 and beyond, the personal care packaging industry will continue to be shaped by these key trends, offering exciting possibilities for brands willing to invest in packaging innovation as a competitive advantage.