1. Introduction: Why Clean Beauty Matters Now

Clean beauty has moved from glossy niche to global growth engine, reshaping how the beauty industry formulates products, designs packaging, and talks to consumers. At its core, clean beauty is less about a single legal definition and more about a cluster of expectations: safer and simpler ingredient lists, greater transparency, and reduced environmental and ethical harm across the value chain.

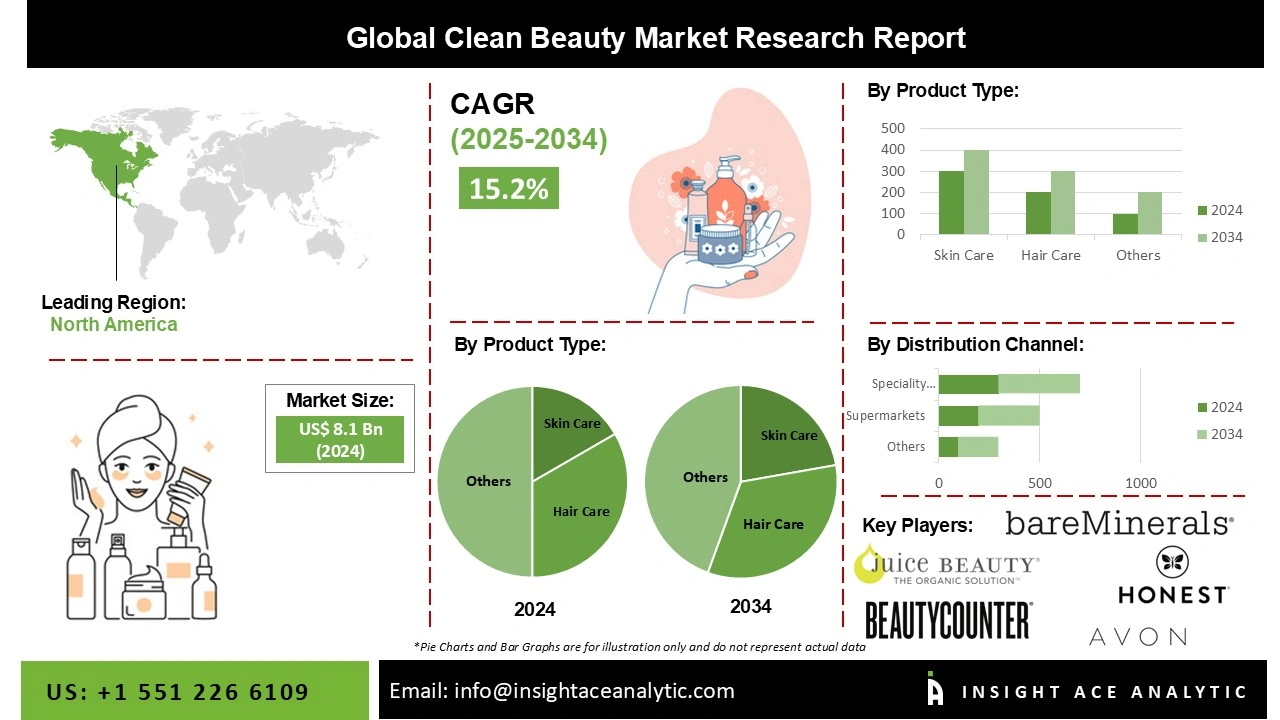

Over the past decade, the category has grown rapidly as shoppers question long ingredient lists, worry about “forever chemicals,” and demand more sustainable consumption. Market analysts now value the global clean beauty segment at around 8–9 billion USD in the early 2020s, with forecasts projecting it could more than quadruple by 2033 on mid-teens compound annual growth. This momentum sits inside an even larger wave: sustainable beauty and skincare overall, worth nearly 200 billion USD in 2024 and expected to more than double by the early 2030s.

What makes clean beauty strategically important is not just its current size but its role as a “future template” for mainstream beauty. Ingredient restrictions in the European Union, evolving U.S. state-level rules, and growing pressure on chemical safety mean that what counts as “clean” today often looks like where the entire market is heading tomorrow. At the same time, consumers—especially Millennials and Gen Z—are blending beauty, wellness, ethics, and climate anxiety into a new kind of expectation: products must work, feel good, and align with personal values.

This article analyzes clean beauty as a market and a movement: its size and growth, the values driving consumer demand, the regulatory and scientific forces reshaping formulations, and the strategic choices brands must make as “clean” evolves from buzzword to baseline.

2. Market Size, Growth, and Segmentation

Global market size and forecast

There is no single agreed number for the size of the clean beauty market, partly because definitions vary, but most recent forecasts point in the same direction: rapid, sustained expansion. One global report estimates that the clean beauty market grew from about 7.15 billion USD in 2024 to roughly 8.0 billion USD in 2025, at a CAGR of just over 12 %, and is on track to reach 12.8 billion USD by 2029. Another analysis suggests an even faster trajectory, projecting growth from 8.7 billion USD in 2023 to 39 billion USD by 2033, implying annual growth north of 16 %.

Even conservative estimates show clean beauty outpacing the global beauty industry as a whole, which leading consultancies see growing at mid-single-digit rates in the mid-2020s. When clean is viewed as part of the wider sustainable beauty and skincare segment—including natural, organic, and eco-positioned products—the numbers become much larger: sustainable beauty alone is valued at around 190–200 billion USD in 2024, with projections above 430 billion USD by 2032. In other words, clean beauty is both a distinct niche and a visible tip of a much bigger structural shift.

Regional breakdown

Regionally, North America currently leads the clean beauty market, with some estimates putting its share at nearly 40 % of global revenue thanks to high disposable incomes, strong indie-brand ecosystems, and retailer-driven “clean” standards. Europe follows closely, underpinned by long-standing regulatory restrictions and a consumer base highly attuned to ingredient safety and organic labels. The EU’s stringent cosmetics and chemical rules effectively make it a de facto global regulator; many brands formulate to EU standards even when selling primarily elsewhere, which indirectly boosts clean-aligned innovation worldwide.

Asia-Pacific is the fastest-growing region, driven by rising middle classes, intense social-media beauty culture, and domestic brands in markets like South Korea, Japan, and China adopting “mild,” and natural narratives that overlap heavily with clean positioning. In Southeast Asia and parts of the Middle East, overlapping demands for halal, vegan, and cruelty-free cosmetics create a unique fusion of religious, ethical, and clean criteria. Latin America and Africa remain smaller in absolute size but represent important future growth, especially for affordable, locally sourced, and climate-resilient formulations.

Category segmentation

Skincare sits at the heart of the clean beauty boom, consistently capturing the largest share of sales as consumers apply safety and sustainability criteria most strongly to products that stay on the skin for long periods. Facial serums, moisturizers, and sunscreens are particularly dynamic categories, with many launches highlighting short ingredient lists, sensitive-skin suitability, and reef-safe or mineral filters. Haircare is another high-potential area, especially for sulfate-free shampoos, silicone-light conditioners, scalp-care treatments, and curly-hair products aligned with textured-hair needs.

Color cosmetics, once seen as difficult to clean-up without sacrificing performance, have seen strong innovation in hybrid formats—tinted serums, skin-care-infused foundations, and multi-use sticks that promise both glow and gentler ingredients. Bodycare, baby care, and men’s grooming represent growing but still under-penetrated segments where concerns about sensitive skin, endocrine disruptors, and microplastics are starting to drive substitution toward cleaner options. Emerging sub-segments—microbiome-friendly products, biotech-based actives, waterless and solid formats, and “edible beauty” that blurs topical and ingestible lines—point to where the next wave of clean concepts may come from.

Source: https://www.insightaceanalytic.com/report/global-clean-beauty-market/1238

3. Consumer Demand: Values, Behavior, and Willingness to Pay

The conscious consumer shift

The rise of clean beauty is inseparable from a broader cultural turn toward conscious consumerism, where health, ethics, and environmental impact factor into everyday purchase decisions. Surveys across multiple markets consistently find that sizable majorities of consumers pay attention to ingredients in personal care products and worry about potential long-term health effects of certain chemicals. This is amplified by social media, where dermatologists, cosmetic chemists, and influencers deconstruct labels and explain obscure acronyms to millions of followers.

Younger consumers, particularly Millennials and Gen Z, are central to this shift. Studies show they often define “clean” through overlapping dimensions: safety (no perceived harmful ingredients), ethicality (cruelty-free, fair sourcing), and environmental responsibility (recyclable packaging, lower carbon footprint). These cohorts are also more likely to say they would switch brands if they discovered ingredients or practices that conflict with their values, making cleanness not just a nice-to-have but a condition for long-term loyalty.

Trust, transparency, and brand loyalty

Trust is the real currency of the clean beauty era. Consumers who cannot easily judge the toxicology of every ingredient instead look for external signals: certifications, retailer “clean” badges, detailed INCI explanations, and brand narratives about sourcing and testing. Research on beauty and wellness centers shows that positive brand experience—spanning results, atmosphere, and perceived integrity—translates into higher satisfaction, trust, and loyalty over time. Clean beauty brands that consistently over-communicate their standards, testing protocols, and limitations tend to enjoy a reputational moat that is difficult for copycat products to erode.

Transparency is a central mechanism here. Brands that provide full ingredient lists, rationales for each component, and clear educational content help demystify formulation and position themselves as partners rather than gatekeepers. Conversely, vague “chemical-free” promises or fear-based messaging can backfire, especially among more informed consumers who recognize that everything—including water—is a chemical and expect nuance rather than alarmism.

Willingness to pay and price sensitivity

A perennial question is whether consumers will truly pay more for clean and sustainable beauty or whether stated preferences evaporate at the checkout. Recent data suggests that a meaningful portion will accept a premium, up to a point. A global survey found that around 47 % of consumers would pay more for cosmetics in sustainable packaging, with some willing to pay roughly 10–12 % extra on average, although enthusiasm drops sharply at higher premiums. Other research indicates that roughly three-quarters of consumers consider organic or naturally derived ingredients important, and nearly half are prepared to pay extra for certified organic personal care products.

Generational differences are pronounced. In some markets, more than half of Gen Z consumers report willingness to pay more for eco-conscious beauty, and when combined with Millennials, that figure can reach over 70 %. However, the cost-of-living crisis has made price-sensitive shoppers more cautious, and around a third of people say they are not willing to pay any premium for sustainable packaging. For brands, this means that clean positioning can support moderate price premiums and improved loyalty, but it cannot fully override basic price–value equations or compensate for underwhelming performance.

Source: https://sublimelife.in/blogs/sublime-stories/making-the-switch-why-clean-beauty-matters

4. Regulatory and Standards Landscape

Lack of a universal definition

One of the defining paradoxes of clean beauty is that while the term dominates marketing and consumer conversation, it is rarely defined in law. In most jurisdictions, “clean” is not a regulated category; instead, brands, certifiers, and retailers construct their own standards—lists of banned ingredients, sustainability commitments, or testing requirements—that may share a family resemblance but differ in specifics. This patchwork opens the door both to meaningful differentiation and to greenwashing, as some players adopt a “clean by association” stance without robust underlying criteria.

To fill the gap, a range of certifications (for example, natural and organic labels) and retailer frameworks have emerged, each with its own ingredient blacklists, proportional thresholds for natural or organic content, and process rules. While these can help signal rigor, the sheer number of seals and standards risks overwhelming shoppers who lack time or expertise to decode them, underscoring the need for clearer, harmonized definitions over time.

EU as de facto global benchmark

The European Union does not formally regulate “clean beauty” as a separate category, but its overall approach to chemicals and cosmetics effectively pushes the entire market toward cleaner formulations. The EU Cosmetics Regulation already bans or restricts over 1,600 substances, far more than many other regions, and enforces a blanket ban on animal testing for finished products and most ingredients. New developments under the EU’s Chemical Strategy for Sustainability and amendments to the CLP Regulation introduce additional hazard classes and tighter scrutiny of endocrine disruptors, persistent pollutants, and certain fragrance allergens.

Recent and upcoming bans on ingredients like alpha-arbutin, specific UV filters, and certain preservatives are forcing both conventional and clean brands to reformulate. At the same time, EU discussions around digital product passports, allergen labelling, and harmonized packaging rules are setting expectations for transparency and circularity that will likely ripple globally. Many multinational brands now formulate to the strictest common denominator to simplify compliance, effectively making EU standards a global baseline.

US and other major markets

In contrast, the United States has historically maintained a more permissive federal framework, with relatively few outright bans and heavy reliance on post-market enforcement. However, momentum is shifting: recent state-level laws, especially in California, are targeting specific controversial substances, PFAS “forever chemicals,” and certain fragrance ingredients, and there is ongoing discussion about modernizing federal cosmetics oversight. Retailers and civil-society groups have stepped into the vacuum, using their own clean standards to push reformulation.

In Asia, regulatory landscapes are diverse and evolving. China has moved to relax mandatory animal testing requirements for many imported cosmetics under certain conditions, opening the door for more cruelty-free positioning, while also tightening rules on new ingredients and safety assessment. Markets like South Korea and Japan, already influential in beauty innovation, are increasingly focusing on functional claims, mildness, and microbiome-friendly products, intersecting with clean narratives even when not labelled as such.

Implications for clean beauty positioning

Regulation simultaneously supports and complicates clean positioning. On one hand, bans on high-profile substances and stricter safety assessments raise the overall floor, making mainstream cosmetics safer and pushing laggards to catch up. On the other, as the baseline improves, some “free-from” claims become less meaningful or even misleading—promising absence of ingredients that are already prohibited—or conflict with scientific consensus on relative risk.

A further complication is that some natural complex substances, including certain essential oils and plant extracts, are themselves under scrutiny for allergenicity or environmental persistence, challenging simplistic “natural equals safe and clean” narratives. Over time, this will likely push the market away from binary “toxic vs non-toxic” rhetoric and toward more nuanced, evidence-based discussions of exposure, dose, and lifecycle impact.

Source: https://private-label-skin-care.com/clean-beauty/

5. Science and Technology: From Naturals to Biotech

Natural and bio-based ingredients

The earliest wave of clean beauty leaned heavily on botanicals: plant oils, butters, extracts, hydrosols, and clays positioned as gentler alternatives to synthetic or petroleum-derived ingredients. Consumer enthusiasm for these materials remains strong, especially when linked to traditional pharmacopoeias and ethnobotanical knowledge. However, scaling natural ingredients brings its own sustainability challenges: land-use pressure, biodiversity risks from overharvesting, variable quality across harvests, and complex, often opaque supply chains.

As a result, the conversation has shifted from “natural at any cost” to “bio-based and responsibly sourced.” Brands and suppliers increasingly scrutinize the provenance of botanicals, look for fair-trade or regenerative agriculture certifications, and invest in traceability systems that can document origin down to the farm or cooperative. In parallel, advances in extraction technologies, green solvents, and stabilization allow for more efficient use of plant material and more consistent performance, reducing waste while improving efficacy.

Biocosmetics and biotech innovation

A second, more technologically sophisticated wave is biocosmetics—beauty products that use bio-engineered actives, fermentation-derived compounds, and microbially produced materials to deliver high performance with potentially lower environmental impact. Microorganisms can produce molecules like hyaluronic acid, certain ceramides, and peptides in controlled, scalable fermentation systems, reducing reliance on animal or petrochemical sources and easing ecological pressure on wild or cultivated plants.

Bacterial nanocellulose is one example of a biotech material gaining attention: it can be used in sheet masks, wound-healing scaffolds, and novel delivery systems, offering high purity and tunable mechanical properties. Other innovations include lab-grown or nature-identical fragrance molecules that avoid overharvesting endangered botanicals, and precision-fermented oils that mimic the composition of scarce or controversial lipids. For clean beauty brands, these technologies enable formulations that are both more “science-backed” and more aligned with environmental goals, although they sometimes challenge consumer expectations that “natural” must mean plant-derived rather than microbially produced.

Formulation challenges and performance expectations

Building truly clean formulations is technically demanding. Removing certain classes of preservatives, UV filters, or texturizing agents can jeopardize product stability, shelf life, sensorial enjoyment, or microbial safety if not replaced with well-researched alternatives. Natural extracts are often chemically complex and variable, complicating reproducibility and regulatory documentation, while minimalistic formulas must still withstand real-world conditions such as humidity, heat, and repeated opening.

At the same time, consumer expectations have risen sharply. Clean beauty customers now expect the same (or better) performance as conventional benchmarks—fast results, pleasant textures, and inclusive shade ranges—alongside ethical and environmental benefits. This pushes brands to invest more heavily in R&D, clinical testing, and partnerships with ingredient suppliers to co-develop tailored solutions rather than relying on off-the-shelf bases. Over time, the most competitive clean brands will likely be those that marry rigorous science, biotech innovation, and credible storytelling, rather than those that rely solely on “free-from” lists or aesthetic minimalism.

6. Sustainability Beyond Ingredients: Packaging, Logistics, and Circularity

Sustainable packaging as a differentiator

As consumers become more familiar with ingredient issues, attention has expanded to the packaging that beauty products come in and the waste they generate. Surveys show that around half of consumers are willing to pay more for products in sustainable packaging, although the precise premium they accept varies by region and income. In response, brands are experimenting with a range of strategies: lightweighting, refillable systems, mono-material components, and clearer on-pack recycling guidance.

In the clean beauty segment, sustainable packaging is often framed as a logical extension of clean ingredients—a way to “detox the whole product,” not just what touches the skin. Glass and aluminum are popular for their recyclability and perceived premium feel, while recycled plastics (PCR) help keep material in circulation, despite constraints related to food-grade regulations and supply variability. Some brands spotlight their packaging choices as prominently as their hero actives, turning bottle and box design into visible proof points of environmental commitment.

Material and format innovation

Beyond material swaps, clean beauty is also driving experimentation with formats that inherently reduce packaging needs. Solid shampoos, cleansing bars, concentrated serums, and powder-to-foam cleansers use less water and often require smaller, simpler containers, shrinking both material usage and shipping emissions. Refillable systems—whether through in-store bulk stations, cartridge-based at-home refills, or mail-back pouches—are gaining traction despite operational complexity.

Novel materials are emerging as well. Bio-based plastics derived from sugarcane or other renewable feedstocks, compostable films, and even edible or fully biodegradable pack formats are being piloted, though their real-world impact depends heavily on local infrastructure and consumer behavior. Regulators and industry groups increasingly stress the importance of design for actual recyclability or compostability in existing systems, rather than theoretical claims that cannot be realized in most municipalities.

Sustainability in clean beauty also extends to how products are made and moved. Concentrated and waterless formats shrink transportation weight and volume, reducing associated emissions. Some brands localize production closer to key markets to cut shipping distances and better align with regional regulatory and cultural expectations. Others invest in renewable energy at manufacturing sites or partner with logistics providers that offer lower-carbon options.

Carbon accounting and lifecycle assessments are increasingly used to quantify these efforts. A growing number of brands publish carbon footprints or lifecycle comparisons for products and actively market carbon-conscious choices as part of their clean value proposition. For clean beauty, the next competitive frontier is likely to be verifiable, product-level environmental performance rather than generic sustainability claims.

7. Competitive Landscape and Business Models

Indie disruptors vs legacy giants

The early growth of clean beauty was driven by indie brands that challenged incumbents with stricter internal standards, agile storytelling, and direct-to-consumer models. These companies often built communities around specific pain points—sensitive skin, pregnancy, hormonal acne—or around strong ethical stances like zero animal testing or plastic-negative operations. Their authenticity and responsiveness won them passionate followings and attracted acquisition interest from major beauty groups.

Legacy players have responded on multiple fronts: acquiring standout clean brands, launching clean sub-lines under existing banners, and quietly reformulating core products to remove controversial ingredients. Many large portfolios now include at least one “anchor” brand explicitly marketed as clean, vegan, or sustainably sourced, which can serve as an innovation test bed for techniques later applied across the group. The result is an increasingly crowded field where differentiation hinges on depth of standards, scientific credibility, aesthetics, and cultural resonance rather than on the mere presence of the word “clean” on packaging.

Retailers and marketplaces as gatekeepers

Retailers have become powerful arbiters of what counts as clean beauty. Major brick-and-mortar and online players use their own ingredient blacklists, certification partnerships, and educational content to curate “clean” assortments and label eligible products with badges or dedicated site sections. These frameworks often include bans on parabens, phthalates, certain sulfates, and formaldehyde-releasing preservatives, as well as requirements for cruelty-free status or restricted fragrance use.

For brands, meeting retailer clean criteria can be both a hurdle and a marketing boon. Compliance may require reformulation and documentation, but once achieved, the associated visibility—shelf placement, search filters, and editorial inclusion—can significantly boost discovery and trust. Over time, retailer standards may act as a quasi-regulatory force, particularly in markets where formal rules lag behind consumer expectations.

DTC, subscriptions, and personalization

Digital commerce has been integral to clean beauty’s rise. Direct-to-consumer websites, social platforms, and marketplaces allow niche brands to tell nuanced stories about sourcing, science, and values without relying on traditional advertising channels. DTC also gives brands access to granular customer data—skin concerns, ingredient preferences, sensitivity history—that can inform R&D and more targeted communication.

Subscription models and personalized routines are natural fits for clean positioning. Quiz-based onboarding and AI-driven recommendation engines can match customers with products that minimize known triggers, align with dietary or ethical preferences, and evolve as skin or lifestyle changes. When combined with refillable packaging or concentrated formats, these models can reduce waste and returns while deepening loyalty—turning clean beauty from a one-off purchase into a long-term service relationship.

8. Challenges, Critiques, and Risks

Greenwashing and definition fatigue

As clean beauty has become fashionable, accusations of greenwashing have multiplied. Vague “non-toxic” claims, unsubstantiated “chemical-free” rhetoric, and misleading imagery of leaves and water can give the impression of sustainability without meaningful substance. Consumers, regulators, and watchdog organizations are increasingly critical of such practices, and lawsuits over deceptive environmental claims are becoming more common in multiple jurisdictions.

Definition fatigue is another risk. With dozens of overlapping labels—clean, natural, organic, vegan, reef-safe, microbiome-friendly—shoppers may struggle to distinguish meaningful differences, potentially disengaging or defaulting to price and performance alone. Brands that cannot clearly articulate what their version of “clean” means, how it is verified, and why it matters may find it harder to justify price premiums or stand out in a crowded market.

Accessibility, inclusivity, and price

A persistent critique of clean beauty is that it often skews toward affluent, urban consumers who can afford to prioritize values over price. Premium pricing reflects real costs—high-quality ingredients, certifications, smaller production runs—but risks creating a two-tier system where only certain groups can access perceived safer or more ethical products. At the same time, some mass brands are proving that entry-level price points and cleaner formulations are not mutually exclusive, gradually democratizing access.

Inclusivity is another dimension. Historically, many clean brands have launched with limited shade ranges, hair-type representation, or cultural references, sometimes alienating consumers of color or those with textured and coily hair. Recent years have seen improvement as brands expand shade offerings, design products for diverse hair types, and incorporate more inclusive imagery and founder stories, but gaps remain and will be closely watched by socially conscious Gen Z.

Innovation constraints and supply risk

Rising regulatory pressure, ingredient delistings, and hazard reclassifications can strain both clean and conventional supply chains. As certain UV filters, preservatives, and fragrance components become harder or impossible to use, brands must scramble to secure alternatives, often from a limited pool of suppliers. This can drive up costs, slow innovation, and create shortages, particularly for smaller indie players without strong procurement leverage.

Natural and biotech supply chains are not immune to risk. Climate change threatens crop yields for key botanical species, while surges in demand can prompt overharvesting or land-use conflicts if not managed responsibly. Biotech routes, though promising, require capital-intensive facilities and regulatory clarity, and can face consumer skepticism if not communicated well. Managing these trade-offs is central to the long-term credibility and resilience of clean beauty.

Source: https://rixincosmetics.com/blog/clean-beauty-trends/

9. Future Outlook: Where Clean Beauty Goes Next

From “clean” to “proven and responsible”

As the market matures, there are signs that the conversation is shifting from simple “free-from” lists toward a more demanding standard: products that are demonstrably safe, clinically proven, and environmentally responsible across their lifecycle. Consumers increasingly expect evidence—clinical trials, ingredient-specific studies, third-party certifications—rather than broad promises. Regulators and industry groups, for their part, are working on clearer rules for environmental, health, and performance claims, which will raise the bar for marketing.

In this context, clean beauty may evolve into a baseline expectation—akin to “no animal testing” in some markets—while the competitive frontier shifts toward measurable impact, data-rich transparency, and integrated wellness benefits. Brands that rely solely on fear-based messaging or aesthetic minimalism, without robust scientific and ethical underpinnings, may struggle to maintain relevance.

Integration with wellness, nutrition, and tech

The boundaries between beauty, wellness, and nutrition continue to blur. Consumers increasingly think in terms of holistic routines, combining topical products with supplements, stress management, sleep hygiene, and gut health interventions. Clean beauty brands are well-positioned to play in this space by emphasizing gentle, barrier-supportive formulations, ingestible complements, and rituals that address both appearance and well-being.

Technology will deepen this convergence. Smart packaging, QR-linked product passports, and ingredient traceability apps can give shoppers real-time access to sourcing, safety, and sustainability information, turning bottles and jars into entry points for ongoing digital relationships. AI-powered diagnostics and recommendation engines may move beyond basic skin typing to incorporate lifestyle data, environmental conditions, and ethical preferences, making “clean and tailored for you” a mainstream expectation.

Strategic implications for brands and investors

For brands, the strategic implications are clear. Surviving in a more regulated, more transparent, and more value-driven era will require stronger R&D capabilities, closer partnerships with ingredient and packaging innovators, and investment in data systems that can track and communicate impact credibly. It will also demand internal alignment: marketing, product development, regulatory, and sustainability teams must collaborate to ensure that clean promises are realistic, compliant, and backed by genuine improvements rather than surface-level tweaks.

For investors, clean beauty represents both opportunity and risk. Rapid growth, high consumer engagement, and alignment with ESG criteria make the segment attractive, but rising regulatory complexity, reputational exposure, and the need for continuous innovation mean that not all players will thrive. The most resilient brands will likely be those that treat clean not as a static label but as an evolving practice—rooted in science, responsive to regulation, and integrated across ingredients, packaging, operations, and storytelling.

FAQs

What is “clean beauty” and how is it different from natural or organic beauty?

Clean beauty generally refers to products formulated without certain controversial ingredients and with greater transparency around safety and sourcing, rather than strictly using only naturally derived materials. Natural beauty focuses on ingredients sourced from nature, while organic beauty requires certified organic farming and processing standards, so a product can be clean without being fully natural or organic, and vice versa.

Why are consumers so interested in clean beauty now?

Rising awareness of ingredient safety, climate change, and ethical issues such as animal testing has made many shoppers more cautious and values‑driven in their beauty purchases. Younger generations, especially Millennials and Gen Z, tend to research ingredients online, follow expert and influencer content, and seek products that feel aligned with both their health and environmental concerns.

Are clean beauty products actually safer or better for my skin?

Clean beauty aims to reduce exposure to ingredients with contested safety profiles, but “clean” is not a formal safety guarantee and many conventional products are also rigorously tested. What truly matters is the specific formula, quality of testing, and how well a product suits your skin type and sensitivities, rather than the marketing label alone.

How can I tell if a product is genuinely clean and not just greenwashing?

Look for clear ingredient lists, transparent explanations of what standards the brand follows, and any reputable third‑party certifications that back up claims. Be cautious of vague phrases like “chemical‑free” or “non‑toxic” without details, and check whether “free‑from” claims refer to ingredients that are actually relevant to that product type.

What role do regulations play in the clean beauty trend?

Strict cosmetic and chemical rules in regions like the European Union have effectively pushed the whole industry toward cleaner formulations by banning or restricting hundreds of substances. In markets with looser rules, retailer standards and consumer pressure often fill the gap, creating demand for brands to go beyond minimum legal requirements.

Which categories dominate the clean beauty market today?

Facial skincare remains the largest and fastest‑growing category in clean beauty, followed by haircare, color cosmetics, and bodycare. Baby care and men’s grooming are smaller but emerging segments as safety and simplicity become bigger purchase drivers for those groups.