1. Redefining Masculinity Through Skin

For decades, the world of skincare and beauty was framed as a realm for women—a coded language of softness, indulgence, and vanity. Men, conversely, were defined by ruggedness and restraint, taught to associate minimalism with masculinity and to view self-care as weakness. Yet here we are in the mid-2020s, witnessing one of the beauty industry’s most fascinating transformations: men actively investing in their skin, embracing cosmetics, and redefining the concept of confidence itself.

What began as a niche movement among early adopters has become a mainstream global market exceeding $100 billion in annual revenue. From Seoul to São Paulo, men are not merely tolerating the idea of skincare—they’re demanding advanced solutions, personalized regimens, and even makeup that helps them look rested, younger, or camera-ready. The stigma that once confined male grooming to the basics—soap, razor, and aftershave—has eroded. Replacing it is an era of conscious care, where protecting one’s skin barrier is as vital as protecting one’s reputation.

This transformation is not purely aesthetic. It mirrors deeper social evolution: the convergence of mental health awareness, gender inclusion, and technology-driven personalization. In this new landscape, skincare and beauty have become pillars of performance, self-expression, and empowerment. Masculinity is being rewritten not in opposition to care but through it.

2. Market Overview and Key Data

The global men’s skincare and beauty market has transcended its niche beginnings to become one of the defining growth pillars of the modern beauty industry. Once dismissed as novelty, men’s grooming now occupies a central role in the broader narrative of wellness, gender inclusivity, and self-expression.

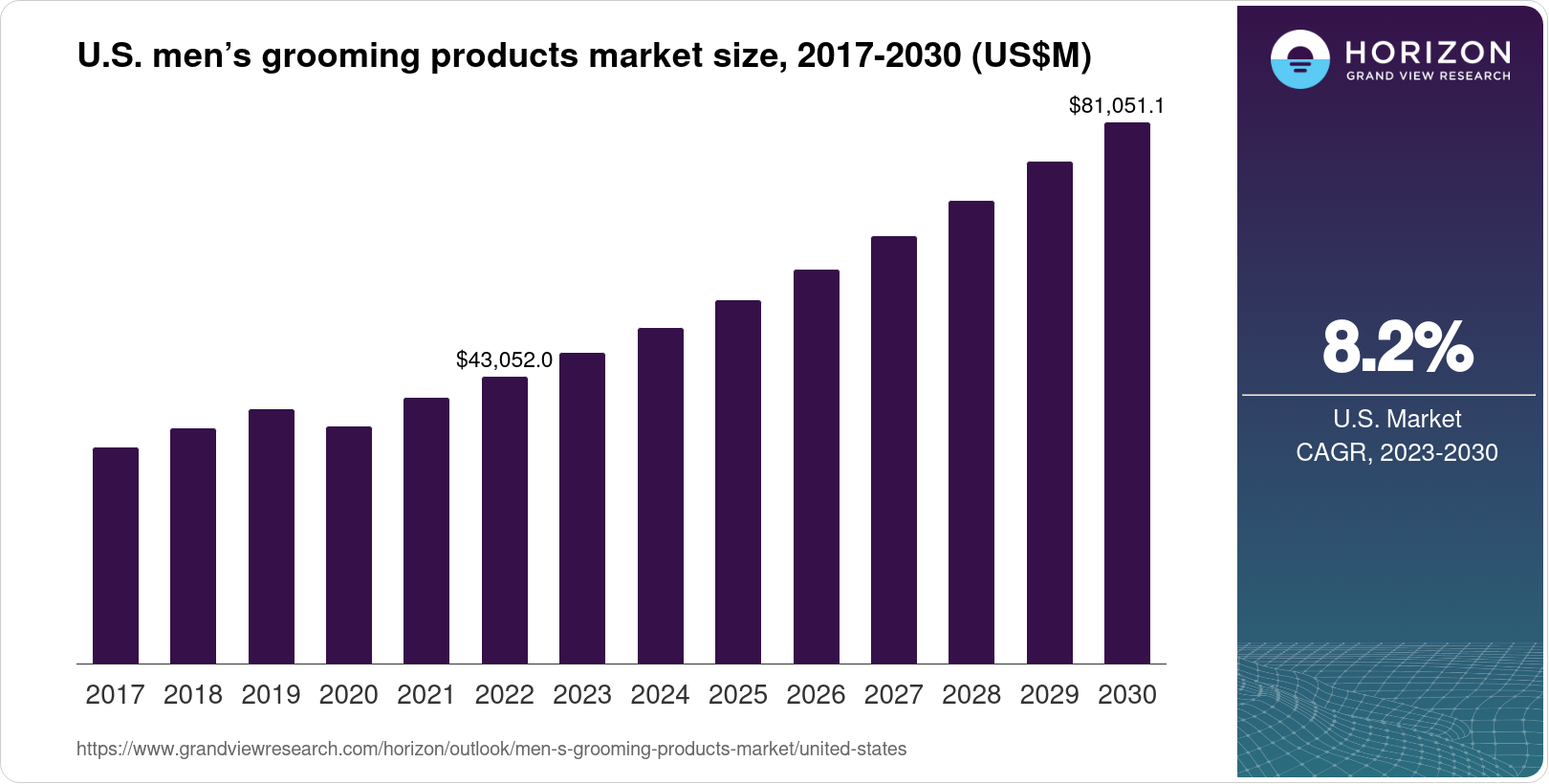

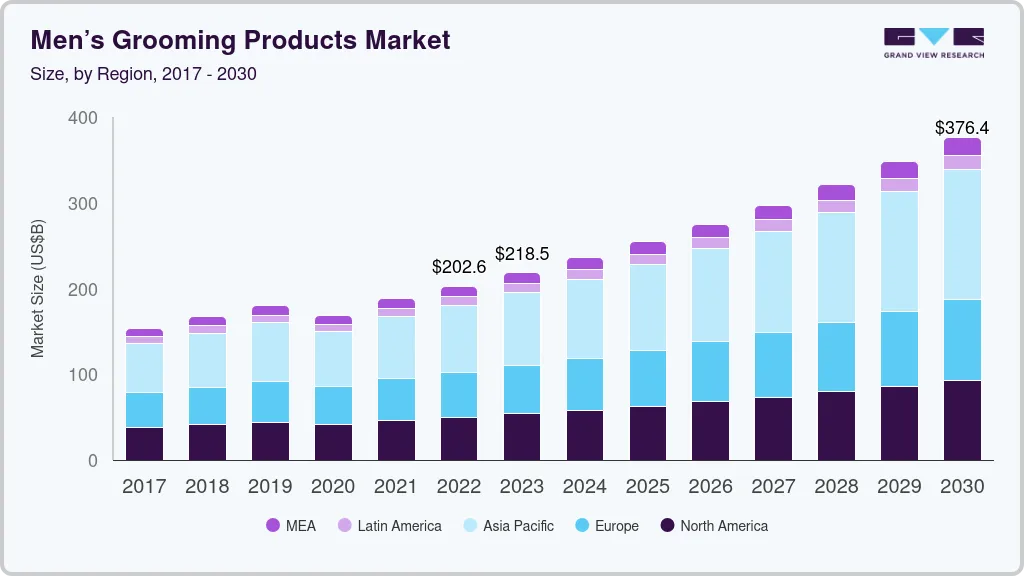

According to industry analysts, the global men’s skincare and beauty category was valued at approximately $85 billion in 2023 and is forecast to reach over $120 billion by 2030, expanding at a compound annual growth rate (CAGR) of 6–8 percent. Within the total beauty and personal care market, men’s categories represent nearly 10 percent of total global value, yet their growth pace outstrips that of female-oriented segments by a notable margin.

This acceleration is not driven by short-lived fads but by deep, interconnected structural dynamics—social evolution, generational mindset shifts, digitalization, and the merging of clinical science with brand storytelling.

Regional Dynamics

- North America: The DTC and Hybrid Model Boom

North America’s men’s skincare market exemplifies rapid innovation and bold shifts in consumer behavior, powered by direct-to-consumer (DTC) strategies and hybrid retail evolution. Homegrown digital-native brands—Geologie, Disco, and Huron—have carved out leadership through personalized offerings, harnessing AI-driven skin diagnostics to match products to each user’s skin type, routines, and preferences. These platforms enable men to build tailored regimens through online quizzes, chatbots, and algorithmic recommendations, making skincare accessible and stigma-free.

Major retailers—including Sephora, Ulta Beauty, Nordstrom, and Target—have responded by significantly expanding men’s skincare and grooming sections. Shelves now integrate prestige and niche brands within inclusive, gender-neutral formats, removing traditional barriers and sparking openness to variety. This reflects broader consumer trust and willingness to experiment, as men embrace self-care not just for function, but also as a lifestyle signal.

Year-on-year growth in the U.S. men’s skincare segment reached 10.2% in 2022, far outpacing the wider beauty category. Success is rooted in smart digital marketing—especially the rise of influencer dermatologists like Dr. Shah and Dr. Charles, whose TikTok and Instagram tutorials break down routines, ingredients, and efficacy for hesitant buyers. Social media has fully democratized skincare knowledge, allowing men to learn discreetly and gain confidence in their choices.

- Europe: The Era of Refined Masculinity

Europe’s men’s skincare market is defined by an enduring blend of craftsmanship, scientific innovation, and a refined sense of masculinity rooted in both heritage and modernity. Leading conglomerates such as L’Oréal, LVMH, and Beiersdorf have significantly invested in expanding male-targeted lines, with ClarinsMen, Biotherm Homme, and Chanel Boy serving as flagships of this sophisticated expansion.

European consumers, especially in France, Italy, and Germany, exhibit strong loyalty to products that deliver eco-certifications, reduced fragrance, clean formulations, and functional, minimalist packaging. For many, luxury is synonymous with principle—skincare is not just about efficacy but also responsible sourcing, transparent ingredient lists, and reduced environmental impact. The retail experience often merges luxury presentation with sustainability, such as refillable containers, glass bottles, and paper packaging, reflecting the regulatory and cultural priorities of the region.

The UK market, in particular, is driving innovation in hybrid care products. Adaptive moisturizers, multi-purpose balms, and SPF-infused creams are gaining traction, often marketed with straightforward instructions and stripped-back designs that support a pragmatic “less-is-more” approach favored by busy male consumers. Hybrid products meet men’s demands for convenience, effectiveness, and simplicity, without excess ritual.

- Asia-Pacific: The Cultural Engine and Global Trendsetter

Asia-Pacific leads the men’s grooming evolution both in market scale and cultural normalization. In South Korea and Japan, skincare routines for men are considered as routine as brushing one’s teeth, spanning multiple steps—cleansing, moisturizing, and sun protection.

The region’s men’s skincare market accounted for over 40% of global category revenues in 2023, with South Korea alone generating nearly $1.5 billion annually in men’s beauty product sales.

In China, where grooming attitudes evolve rapidly, male consumers particularly between ages 18–35 are flocking to premium skincare brands. Male KOLs (Key Opinion Leaders) and livestream hosts have made skincare education mainstream—turning what was once taboo into aspirational behavior.

Cultural integration is key: formulations emphasize hydration and protection against pollution, reflecting environmental realities of Asia’s urban megacities. Moreover, Japan’s J-beauty philosophies—precision, purity, and natural minimalism—continue to influence international product design, especially in premium men’s moisturizers and serums.

- Middle East and Africa: Experiential Luxury and Modern Rituals

In the Middle East and Africa, men’s beauty is experiencing a nuanced renaissance driven by luxury experiences and cultural integration. Urban centers like Dubai, Riyadh, and Cape Town are cultivating sophisticated male grooming precincts where skincare intersects with fragrance and barbering services.

Men’s skincare here often borrows from traditional care rituals—attar oils, oud, botanical infusions, and clay treatments—reinterpreted through the lens of modern cosmetology and biotech formulation.

The market’s high disposable income base, combined with deep brand curiosity, has made premium and ultra-luxury segments expand at twice the global average. A growing emphasis on halal-certified and fragrance-layered products provides distinctive competitive differentiation.

In Africa, indigenous brands are rising, particularly those centered on melanin-friendly skincare, addressing concerns like hyperpigmentation and uneven tone through ethically sourced ingredients like shea butter, baobab, and rooibos extract.

- Latin America: Fitness, Wellness, and Emerging Demand

Latin America stands out for its dynamic cultural intersection between self-care, sport, and social expression. In Brazil, already among the world’s top five male grooming markets, skincare adoption has evolved well beyond aftershaves. Men are embracing anti-shine moisturizers, clay masks, and hydro-cooling gels—practical for humid climates and post-workout refreshment.

Mexico follows closely, where e-commerce is the breakthrough channel. Subscription services, influencer routines, and digital skincare testing tools have brought skincare literacy to younger demographics. The average Latin American male consumer now spends over $250 annually on grooming and skincare—a notable increase from just $150 in 2018.

Social and cultural acceptance grows fastest where skincare is framed around performance and professional presentation rather than vanity. Aesthetic grooming is now fused with confidence, signaling modern manhood.

Product Segmentation

The men’s skincare and beauty market is highly stratified but unified by a gradual broadening of-category participation.

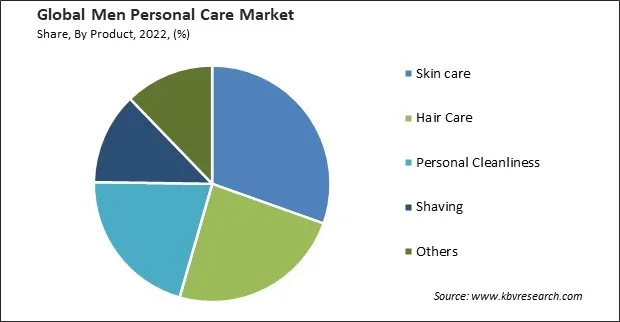

- Core Skincare – Cleansers, toners, moisturizers, and sunscreens remain the category bedrock, making up more than 50–55% of global male grooming sales. Innovations here center on pH-balanced formulas, oil-control emulsions, and advanced SPF integration.

- Hair and Beard Care – With the resurgence of barbershops and the continued popularity of facial hair, the segment has maintained double-digit growth across urban markets. Beard oils, exfoliating shampoos, and conditioning balms have transitioned from luxury offerings to staples.

- Men’s Makeup – While still a single-digit portion of the market, men’s cosmetics are projected to triple in revenue by 2030, driven by Western consumer destigmatization and K-pop influence. Concealers, tinted moisturizers, and hybrid complexion balms are leading categories.

- Fragrance Hybrids – The fusion of skincare and perfumery has produced one of the fastest-growing cross-category niches. Hydrating mists, aromatherapeutic balms, and scented moisturizers appeal to sensory-driven male consumers seeking identity through scent and skincare efficacy combined.

Key Growth Drivers

- Celebrity and Influencer Endorsement:

Global icons are legitimizing men’s participation in skincare. BTS normalizes clear-skin ideals in Asia, Brad Pitt connects beauty with age inclusivity and sustainability through Le Domaine, while Pharrell Williams frames minimal skincare as mindfulness via Humanrace. These narratives bridge aesthetics and psychology. - Social Media Education:

Platforms like TikTok and YouTube have democratized dermatological literacy. Skincare influencers simplify regimens and explain barrier science, fostering community trust. The algorithmic rise of “men’s skincare routines” has become one of the fastest-growing social content categories globally. - Post-Pandemic Shifts:

COVID-19 redefined self-care priorities. Remote work lifestyles and heightened camera exposure during video meetings made appearance awareness everyday necessity. Simultaneously, increased mental health conversations encouraged men to view skincare as part of overall wellbeing—a gesture of daily self-investment. - Clean and Clinical Formulations:

Rising sensitivity and environmentally conscious consumption have normalized “dermatologist-approved” and “fragrance-free” claims. Men increasingly prioritize efficacy over fragrance or status imagery. - Technology Integration:

AI-powered applications that analyze skin tone, hydration, and sebum levels have embedded personalization in men’s beauty retail. Smart mirrors, diagnostic scanners, and AR try-ons enhance engagement and convenience.

Market Takeaway

Men’s skincare has reached a cultural and commercial inflection point. It embodies how men today navigate identity and autonomy—not defined by absence of care but by intentional maintenance. This market’s ascent is not a passing fashion; it’s an empirical expression of a generational mindset: appearance equals agency.

As global category momentum grows, men’s skincare is positioned not as an accessory to masculinity but as one of its new foundations—data-backed, inclusive, and enduring.

3. Cultural Shifts and the Psychology of Male Grooming

For generations, men approached grooming with caution, often guided by cultural scripts that equated skincare with vanity and fragility. Advertising, societal norms, and even parental influence shaped male attitudes: soap, basic aftershave, and the rare face lotion were considered sufficient, with anything further crossing into “feminine” territory. The psychology of male grooming was therefore founded in denial—a quiet refusal to engage with self-care for fear of undermining one’s masculinity.

However, the world of the 2020s bears little resemblance to that landscape. Social, cultural, and technological forces are rewriting expectations about what it means to be a man, and nowhere is this more evident than in the explosion of the male grooming market. At the heart of this transformation is not a product or a marketing campaign but a cultural conversation: What is masculinity in an era defined by openness, vulnerability, and self-expression?

Generational Psychology: Gen X to Gen Z

- Gen X Men: Born between 1965 and 1980, Gen X men inherited a world with a strict binary between male and female self-care. Their formative years were shaped by utilitarian ads, a lack of product choice, and the prevailing wisdom that real men “don’t fuss over their appearance.” For most, grooming was about hygiene and practicality—shaving, soap, perhaps some aftershave.

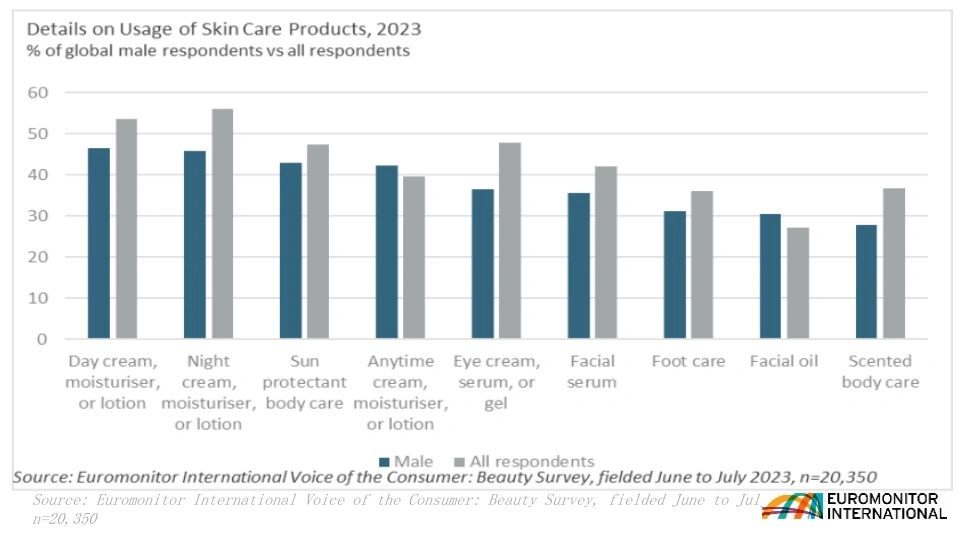

- Millennials: Entering young adulthood in a more globalized and media-rich environment, millennials (born 1981–1996) brought openness and experimentation to grooming. They traveled more, accessed new influence via social media, and began prioritizing experience and self-expression over mere image. The rise of men’s skincare products reflected millennial willingness to move beyond the basics—testing facial serums, eye creams, and specialized moisturizers. For them, skincare became synonymous with self-care and confidence.

- Gen Z: The youngest adult demographic, Gen Z (born after 1997) has fully obliterated old boundaries. To Gen Z, gendered marketing is increasingly irrelevant, and the core question is not “Is skincare for men?” but “How does skincare help me present my best self?” Concealers, serums, and even subtle makeup do not threaten their sense of masculinity; instead, these products enhance their confidence, routine, and identity. Skincare is understood as wellness—a tool for self-improvement rather than a sign of vanity.

The Language of Grooming: From Functionality to Empowerment

The evolution in marketing language alongside these generational shifts is notable. In the early 2000s, men’s grooming was framed around function and problem-solving: “razor relief,” “anti-aging cream,” “oil control,” and “cooling gel.” Brands and ads focused on fixing issues, not celebrating the act of care itself. The experience was transactional, not emotional.

By the 2020s, the conversation changed dramatically. New campaigns use words such as “energize,” “restore,” “confidence,” and “focus.” This shift resonates with men who view self-care as a strategic choice that complements ambition, physical health, and mental wellbeing. The act of caring for skin is now intertwined with personal development. Product ads often reference “unlocking potential,” “living well,” or “showing your strength”—casting grooming as empowerment, not mere maintenance.

Fashion and Social Trends: Quiet Luxury, Broadcast Grooming

Fashion culture also underpins this evolution. The rise of “quiet luxury”—labels and styles that imply subtlety, discipline, and self-assurance—demands a healthy, well-kept appearance. The modern male wardrobe favors clean lines, muted colors, and refined tailoring, all of which are best complemented by balanced, cared-for skin.

Grooming habits have thus become signals of discipline—akin to maintaining fitness, mindfulness routines, or balanced nutrition. It is no longer uncommon for men to openly discuss their skincare routines, exchange product tips at the gym, or embrace self-care as part of relationships and professional life. On social media, men’s skincare routines have become viral, sometimes attracting millions of views on TikTok and Instagram. The stigma surrounding products like sheet masks, eye creams, or moisturizers has diminished considerably.

4. Regional Spotlights

North America

The U.S. men’s beauty segment has exploded through digital microbrands and DTC ecosystems. Companies such as Huron, Disco, and Geologie attract tech-savvy consumers through algorithmic personalization and sleek visual design. Subscription services deliver tailored regimens monthly, reinforcing consistency—a key behavioral shift.

Retailers like Sephora, Ulta, and Target have expanded unisex grooming aisles, integrating men’s skincare next to traditional beauty lines. On social media, dermatologists have become influencers in their own right, simplifying education for men previously alienated by jargon or stigma.

Another defining U.S. trait is brand transparency—ingredient lists, cruelty-free positioning, and sustainable packaging are now baseline expectations. North American consumers are drawn to products that merge performance with principle.

Europe

Europe blends heritage and innovation. Legacy skincare houses like Clarins, Biotherm Homme, and Chanel Boy leverage luxury heritage to legitimize male skincare sophistication. Meanwhile, minimalist brands emphasize sustainability and subtlety—eco-certified ingredients, glass bottles, and refillable aluminum tubes are central to appeal.

European men tend to embrace meticulous grooming as an extension of lifestyle—not vanity. Mediterranean and Nordic consumers value protection from environmental stress, UV exposure, and pollution, while U.K. and French markets push male grooming toward artistry.

Asia-Pacific

Asia-Pacific leads not just in size but in normalization. In Korea and Japan, skincare is a standard part of daily hygiene, woven into masculine identity. Male idols, actors, and athletes openly collaborate on cosmetics campaigns—normalizing BB creams, moisturizers, and lip care without controversy.

K-beauty culture radiates outward: lightweight formulas, clean lines, fragrance minimalism, and “glass skin” ideals influence global manufacturing. China’s market growth is striking—urban male consumers increasingly invest in prestige skincare as symbols of professionalism.

Asia also seeds innovation in men’s makeup—subtle tinted balms or toners—where “natural enhancement” aligns with cultural values of refinement and discipline.

Middle East and Africa

The region blends deep grooming rituals with luxury sensibility. In cities like Dubai and Riyadh, male grooming lounges now offer facial treatments and curated skincare experiences. Oils, attars, and traditional cleansers merge seamlessly with modern formulations.

The Middle East’s luxury men’s market is pushing boundaries in olfactory skincare—using scent and texture to express identity while maintaining cultural modesty. Similarly, African innovators are creating melanin-conscious men’s skincare products addressing hyperpigmentation and hydration in humid climates.

Latin America

Latin America represents immense untapped growth. Brazilian men, already leading globally in personal care consumption, now seek specialized post-gym toners and anti-shine formulations. Mexican urban professionals gravitate toward simplified morning kits, often purchased online through subscription boxes.

E-commerce breakthroughs and influencer education are accelerating a grooming renaissance in the region, aligning with global awareness but infused with local energy and warmth.

5. The Rise of Men’s Makeup and “Concealance”

Men’s makeup, once considered fringe, has surged into mainstream lifestyles and public consciousness—a phenomenon epitomized by the rise of “concealance”: subtle, utilitarian use of cosmetic products for men that blend the boundaries between skincare and makeup. Concealers, tinted moisturizers, brow gels, and skin-perfecting tints have become everyday staples for men seeking a natural, healthy appearance without dramatic transformation.

Gen Z and the Post-Gender Beauty Boom

Gen Z is driving a profound shift in beauty standards. Unlike previous generations, these consumers view makeup less as a tool for artistry or gender definition, and more as a device for confidence and self-optimization. Surveys indicate that up to 70% of Gen Z men follow beauty or grooming influencers, amplifying the normalization of cosmetic tools for men. The function isn’t “look like someone else”—it’s “look like the best version of yourself,” whether that means erasing dark circles or achieving an even skin tone for a selfie or a video meeting.

Gen Z’s post-gender attitude means a concealer or skin tint isn’t about challenging masculinity; it’s about efficacy and self-presentation. In digital culture, male models and creators routinely share beauty routines with millions of followers, and male makeup tutorials have seen upward spikes in traffic—TikTok’s men’s makeup searches rose nearly 80% during recent lockdown periods.

Brand Innovation and Product Design

The new wave of men’s makeup brands—like Stryx, War Paint for Men, Shakeup Cosmetics, Fenty Skin, and Age of Super—are reshaping product design and marketing. Packaging relies on masculine cues: muted colors, monochrome finishes, ergonomic sticks and pens. Naming skews toward “toolkits” and “solutions” rather than the overt “makeup,” lowering intimidation and stigma for entry-level users.

- Stryx: Known for concealed, click-pen applicators and natural pigment blends, their ethos is discreet coverage that travels well and blends invisibly.

- War Paint for Men: Offers Skin Tint and Concealer Pen, emphasizing durability and hard-working images. Their instructional content is geared toward male users who want practicality without excess.

- Shakeup Cosmetics: Focuses on user-friendly hybrid cosmetics for men, featuring multi-use sticks and easy-to-match shades.

- Fenty Skin: Promotes inclusivity and routine integration, positioning its tinted products as part of universal skincare, not gendered rituals.

Societal Normalization: Utilitarian, Not Identity Crisis

As makeup for men seamlessly enters daily routines, societal attitudes have evolved. Corporate professionals openly endorse concealers to look “less tired,” esports commentators apply skin tints for livestreams, and tutorial platforms incorporate male models. In competitive and social contexts where digital presence is constant, these products become efficient solutions—not statements of identity or rebellion.

The mainstreaming of men’s makeup marks broader personal freedom: men claiming the right to look rested, feel confident, and express themselves without apology. Market projections support the momentum—male color cosmetics are expanding with a CAGR of over 9% to 2030, outpacing traditional male skincare.

6. Branding and Communication Evolution

The branding of men’s skincare has undergone one of the most profound transformations in the consumer industry. The early 2000s spoke the language of macho minimalism—black bottles, slogans about toughness, imagery evoking steel and muscle. The 2020s, however, ushered in balance.

Modern branding frames skincare as a lifestyle ritual grounded in wellness, calm, and clarity. Mission statements shifted from “conquer the day” to “take care of yourself.” Visual palettes moved from aggression to composure: textured neutrals, foil accents, serene gradients.

Celebrity-driven brands show this arc clearly. David Beckham’s House 99 offered early enthusiasm but struggled with authenticity; consumers sensed commercial detachment. Pharrell’s Humanrace, in contrast, succeeded by connecting skincare to mindfulness and routine discipline. Brad Pitt’s Le Domaine leaned into sustainable luxury and restraint rather than glamour—appealing to men seeking craftsmanship.

Communication strategy embraces realness over perfection. Consumers expect transparency—imperfections in skin, diverse ages, and multi-ethnic representation. Ads celebrate fatherhood, community, and success as facets of care.

In short, the future of men’s skincare branding isn’t about heroism—it’s about humanity.

7. Market Forecast to 2030

The men’s skincare and beauty industry is set for significant expansion through 2030, emerging as one of the fastest-growing segments within the global beauty economy. Recent forecasts estimate the men’s personal care market (which includes skincare) will nearly double to more than $67 billion globally by 2030, with skin-focused products driving about half of that value. Let’s break down key trends, product leadership, and the technological innovations shaping this future:

Product Segment Growth

- Serums & Eye Creams: These categories are leading the charge due to rising interest in anti-fatigue and anti-aging solutions. Modern serums leverage active ingredients (like niacinamide, peptides, hyaluronic acid) for hydration and repair, while eye creams target puffiness and dark circles—concerns frequently cited by male consumers working longer hours and spending more time on screens.

- SPF Solutions & Hybrid Sunscreens: Men’s awareness of sun damage, skin cancer, and aging has fueled surging demand for SPF-infused products. Innovations in tinted sunscreens and spray-on sun care offer both protection and cosmetic enhancement, integrating sun defense into everyday wear in user-friendly formats.

- Hybrid Cleansers: Product innovation increasingly centers on multi-functional solutions (exfoliating and brightening cleansers, detoxifying masks). Men seek simplicity, so brands design formulas tackling multiple concerns in one step, improving routine adherence and engagement.

Market Forces and Technology

- AI, Augmented Reality (AR), and Virtual Try-On: Smart technologies are revolutionizing skincare discovery for men. AI-powered skin analysis apps enable instant assessment of skin type and concerns, recommending tailored regimens in seconds. AR tools allow virtual product trials—men can preview sunscreen tints, see cleansing effects, and match shades privately on personal devices. These advances address men’s desire for privacy, efficiency, and personalization, reducing hesitation and product returns.

- Proactive vs. Reactive Care: While historically men purchased skincare reactively to address specific issues (dryness, acne), a major shift is underway toward proactive regimes emphasizing prevention (anti-pollution, anti-stress, and longevity strategies). Skincare is evolving from a problem-solver to a daily discipline and identity marker, as normalized as shaving or brushing teeth.

- Luxury vs. Premium: The luxury sector may plateau, as mid-tier premium brands capture mass audience trust by combining high-efficacy, clean formulations, and reasonable price points. This movement expands accessibility and sophistication to a broader male market, especially among Gen Z and millennials looking for value and efficacy over status.

8. Case Studies of Lumin: Digital Personalization, Skin Science & Brand Buzz

Brand Story:

Lumin entered the market to fill the gap for male-specific, science-driven skincare, emphasizing straightforward routines that address hydration, oil control, sensitivity, and aging. The brand was built around understanding men’s unique skin physiology and life habits, deploying clinical-grade ingredients including hyaluronic acid for moisture retention, charcoal for oil control, and niacinamide for balancing sebum.

Solutions and Impact:

Lumin’s focus on digital personalization made it easy for men to self-select regimens via interactive online guides and quizzes. Their direct-to-consumer strategy paired product delivery with educational content and social engagement, making routine building as frictionless as possible. The “Brilliant Men’s Skincare Solutions”campaign generated exceptional buzz and helped Lumin expand its range and audience. The brand’s inclusion of high-tech gadgets (like the Luminator LED Eye Mask) and clean, minimalist packaging positioned it as trustworthy and easy to use, boosting loyalty and routine consistency.

Market Results:

Lumin’s multi-channel approach has resulted in global recognition, repeat purchase rates above category averages, and successful product line extensions that address the full spectrum of men’s skincare and lifestyle needs.

9. Conclusion

Men’s skincare and beauty transcend pure consumer evolution; they chronicle a true transformation in culture, health priorities, and self-perception. What was once defined by stigma and fear is now characterized by curiosity, education, and a drive for embodiment—where grooming is an integrated element of holistic identity, merging health, appearance, and self-confidence.

Today’s modern man approaches skincare not as mere indulgence but as a statement of responsibility. Scientific formulas, ethical sourcing, and mindfulness unite to create a balanced, inclusive vision of masculinity—one that values self-care for its physical, emotional, and social benefits.

As we move through the 2020s and beyond, men’s beauty will remain a reflection not of perfection, but of identity. The boundaries between technology, self-expression, and wellbeing will continue to dissolve, and it will soon be clear that the most profound frontier of beauty is not gendered—it’s fundamentally human.