1. Introduction: The Beauty Capital at a Crossroads

Beautyworld Middle East (BWME) 2025 emerged as more than a trade exhibition — it captured the pulse of a region rewriting its identity through innovation, aesthetics, and entrepreneurship. Now in its 29th year, the event at the Dubai World Trade Centre (October 27–29, 2025) hosted 2,400 exhibitors, 70+ global pavilions, and approximately 70,000 visitors, representing over 150 nationalities.

This convergence of cultures, technologies, and commercial networks reflects the Gulf’s ambition to transition from consumer to creator and curator of global beauty trends. Under the patronage of Messe Frankfurt Middle East, BWME has transformed from a marketplace into a mirror of regional aspiration — a forum where traditional ritualism meets digital acceleration.

Dubai, standing between Asia, Europe, and Africa, exemplifies how cultural exchange through commerce can define the next wave of globalization. At the fair’s heart was an acknowledgment that beauty is no longer about adornment; it is an instrument of identity, self-expression, and diplomacy.

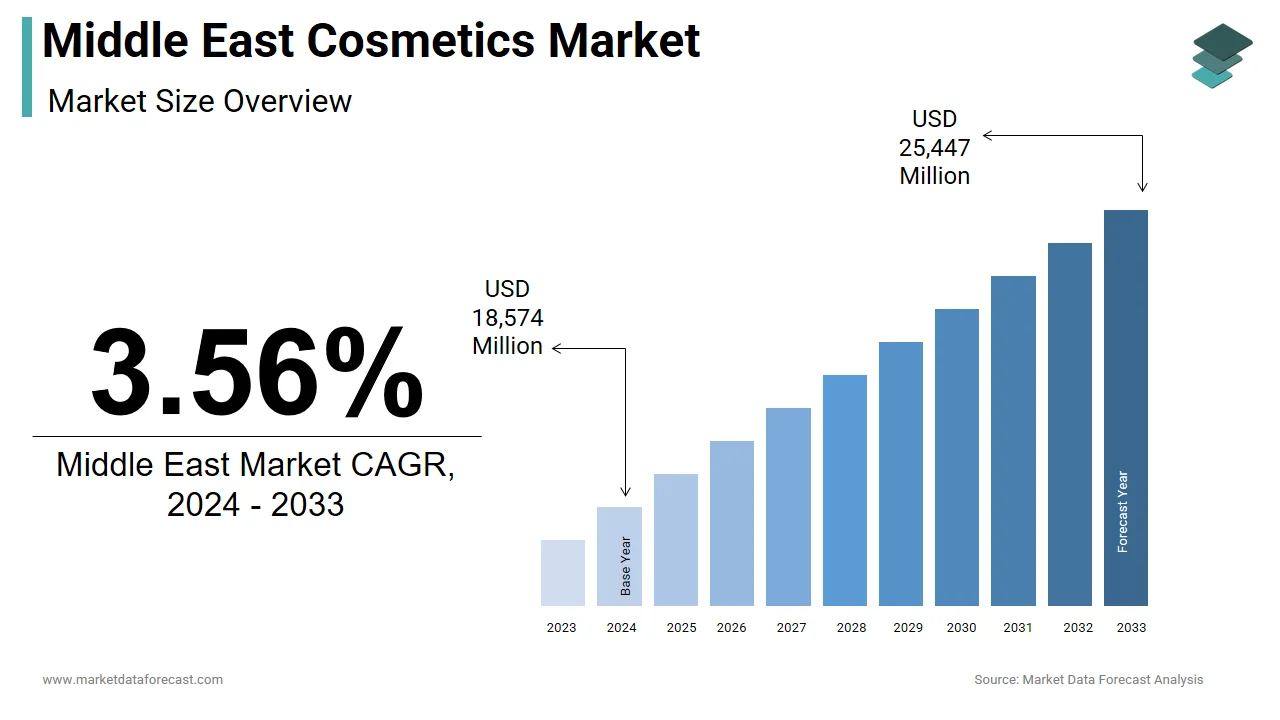

2. The Middle East’s Beauty Market in 2025

The Middle East’s beauty and personal care market continues its dynamic expansion, forecasted to reach approximately $60 billion by the end of 2025, with an annual growth rate near 6%. While fragrance remains the cornerstone—commanding over 25% market share—skincare and wellness products are accelerating fastest, reporting an annual increase of almost 30%, and now constituting about 12–14% of the market, compared to less than 10% five years ago.

The Skincare Revolution

The region is experiencing a skincare renaissance, transforming personal care from a luxury indulgence to an act of self-respect and scientific awareness. Consumers increasingly seek hybrid formats merging dermatology and tradition—anti-pollution serums safe for wudu (ritual ablution), sunscreens suitable for desert heat, microbiome-friendly cleansers, and halal-cosmeceuticals integrating botanical and ethical sourcing. With regional skincare now valued at $6 billion and climbing steadily, brands are addressing the nuanced interplay between health, faith, and innovation.

Demographics Driving Growth

With nearly 60% of GCC residents under 30, the Middle East boasts one of the youngest and most digitally engaged consumer populations in the world. This generation’s worldview blends modern aesthetics with cultural grounding — shaping preferences that prioritize clean formulations, authenticity, and storytelling. Startups established by women under 35 lead this movement; they reinterpret beauty as both cultural language and entrepreneurial opportunity, representing an ever-growing slice of innovation showcased at Beautyworld Middle East.

Economic Diversification and Beauty’s Soft Power

Beauty is now integral to the region’s economic diversification strategy. Policy frameworks such as Saudi Vision 2030 and UAE Vision 2031 position cosmetics, wellness, and personal care as core pillars of creative-economy advancement. Once seen as informal and gendered, beauty today symbolizes modernity, inclusivity, and autonomy. At Beautyworld Middle East 2025, national pavilions from Germany, Korea, France, and Japan demonstrated partnerships across cosmetic chemistry, bio-innovation, and supply chain decarbonization—evidence of regional readiness to ascend from consumer status to global co-creator in beauty science and sustainability.

3. Beautyworld Middle East – A Showcase of the Future

Beautyworld Middle East (BWME) 2025 served as a dynamic stage for innovation, business, and the reinvention of regional identity. This year, the exhibition zones were organized under four flagship banners: Next in Fragrance, Clean + Conscious, BeautyLIVE/Front Row by Nazih, and Beauty Beginnings. Each zone represented not just a market segment, but a dimension of how the Middle East is reconciling heritage, ethics, creativity, and entrepreneurship with its contemporary ambitions.

Next in Fragrance

Fragrance remains the soul of the Middle Eastern beauty economy. At BWME 2025, the Next in Fragrance conference highlighted industry-defining trends such as AI-driven scent composition, biogenic oudh cultivation, and carbon-neutral ingredient sourcing. Over 300 perfumers, brand founders, and olfactory technologists showcased how the region’s perfumery roots—centered on oudh, amber, and rose—could evolve through innovation and sustainability. This marriage of heritage and environmental commitment positioned fragrance as not only an economic driver but an ecological manifesto for the industry.

Luxury perfume maisons including Amouage, Kayali, and Ghawali debuted new collections that married traditional Arabian luxury with forward-thinking sustainability. Their innovations included the integration of vegan fixatives and recyclable, artfully designed amphorae, demonstrating that luxury and responsibility can coexist in the modern Middle East.

The Clean + Conscious Zone

In past years, sustainability was a peripheral aspect of regional beauty; in 2025, it moved center stage. The Clean + Conscious zone offered a carefully curated portfolio of vegan skincare, waterless formulation innovations, refill-bar concepts, and packaging transparency. Exhibitors here weren’t just importing global minimalist trends—they tailored sustainability around local traditions of stewardship and respect for nature, mirroring Islamic eco-ethical values.

Brand examples included ingredient resilience stories: skincare made with date seed oils, desert-grown aloe, and palm-derived squalene, each showcasing how native biodiversity empowers the region’s quest for cosmetic sovereignty. The section also highlighted ingredient transparency and traceability as new standards in both premium and mass-market products.

BeautyLIVE and Front Row by Nazih

On the event’s main stages, BeautyLIVE and Front Row by Nazih delivered high-energy demonstrations and educational sessions. The Nazih Group—long a leader in regional salon distribution—transformed its presence into a training academy for emerging Gulf talent. There, master colorists, stylists, and spa innovators provided hands-on learning for young professionals, thus narrowing gaps in technical artistry and elevating the region’s skill base to international standards.

These stages symbolized vocational progress, but also cultural affirmation: an industry built by and for regional talent, now worthy of global recognition.

Beauty Beginnings

The Beauty Beginnings zone served as an incubator for the next generation of beauty pioneers. Over 120 start-ups participated, with 60% of them women-led and one-third focused on halal or clean-minded innovations. Local ventures like Kskin Arabia, Desert Dew, and Jameela Botanics translated traditional beauty wisdom into data-driven, scalable concepts—offering products that balanced efficacy, cultural resonance, and ethical standards.

This zone illustrated the region’s wider economic evolution: Gulf entrepreneurs, increasingly young and female, are driving the translation of heritage into high-growth, export-ready businesses.

4. Cultural Identity and Consumer Psychology

Beauty in the Middle East transcends superficial standards—it is fundamentally intertwined with cultural identity, spirituality, and social values, forming what experts now call a “moral beauty economy”. The region’s approach to cosmetics and personal care is as much about dignity, faith, and communal bonds as it is about aesthetics, making Middle Eastern beauty both a coded system of values and a visible marker of identity and aspiration.

The Spiritual Aesthetic

In Islamic philosophy, beauty (jamal) is seen as reflecting divine balance and harmonious living. Grooming—through skincare, scent, and adornment—is understood as stewardship of self rather than vanity. Daily beauty rituals are often aligned with spiritual preparation and mindfulness; for instance, products compatible with ablution (wudu) and free from alcohol dominate consumer preferences. This is evident in the rise of halal-certified formulations and skincare intended to reinforce both efficacy and ritual purity. In many households, beauty routines serve not only to enhance appearance but also to express gratitude, discipline, and reverence—highlighting how ethical considerations permeate the market from product choice to usage.

The Semiotics of Modern Beauty

Beautyworld Middle East 2025 dramatized how regional consumers defy static archetypes, instead blending tradition and modernity through three core personas:

- The Thematic Heritage Minimalist: Focuses on ancestral continuity through organic oils, traditional perfumes, and ritual skincare rooted in the hammam culture. Their routines evoke family, heritage, and natural simplicity, often welcoming ingredient stories tied to local plants and historical remedies.

- The Futurist Cosmopolitan: Adopts AI-powered beauty regimes, medspa technologies, and derm-focused product innovation but grounds their style in Arab authenticity. These consumers are typically younger, urban, and tech-savvy, driving trends in personalized skincare and wellness while maintaining links to heritage through aesthetic choices.

- The Hybrid Modernist: Blends abaya-friendly modest fashion with experimental, gender-inclusive beauty, crossing boundaries between tradition and innovation. This group represents the fluidity of contemporary GCC culture, refusing to treat modesty and expressiveness as mutually exclusive and seeking beauty solutions that accommodate both.

The power of GCC consumers lies in their ability to embody all three archetypes, demonstrating that cultural hybridization is an asset, not a contradiction—with products and marketing messages evolving to capture both local and global nuances.

The Social Media Spectrum

In 2025, social media has evolved into the new marketplace for identity and influence, powerfully shaping the regional beauty narrative. Influencers like Mona and Huda Kattan, Lojain Omran, and Yara Alnamlah use bilingual storytelling, tutorials, lifestyle content, and cultural commentary to mobilize millions across Instagram, TikTok, and YouTube.

Their impact is measurable: according to Chalhoub Group, influencer-led affiliate models now represent 18% of digital beauty sales in the MENA region. The digital dominance of regional beauty stars has made the Middle Eastern aesthetic—full lips, thick brows, dewy skin—a global aspiration, not just a local standard.

While Generation Z gravitates toward interactive, short-form content that values authenticity and inclusivity, Millennials seek detailed product reviews and routine-building advice, and Generation X relies on expert guidance and premium service experiences. Across demographics, social media bridges diverse cultures in the region, propelling homegrown beauty brands and changing how international brands engage with Arabian consumers.

The result is a dynamic, joyful, and aspirational beauty discourse—not polarizing or critical, but proudly shared and community-driven. Social media amplifies cultural confidence, making the region’s values visible on the global stage and normalizing regional rituals and aesthetics that were once marginal in the international market.

Every aspect of Middle Eastern beauty—from ingredient selection to marketing, from daily ritual to social media engagement—remains deeply rooted in cultural identity, spirituality, and evolving consumer psychology. As these factors blend and transform, they continue to redefine what beauty means both regionally and globally, with the Middle East standing as a source of inspiration, innovation, and leadership in the global market.

5. Technological Transformation – From AI to Blockchain

Technological transformation is redefining the Middle East’s beauty landscape, with Beautyworld Middle East 2025 (BWME) leading the charge into a future shaped by AI, AR, and blockchain. These advances have moved the industry beyond artistry into the realm of algorithmic precision and trust-driven transparency.

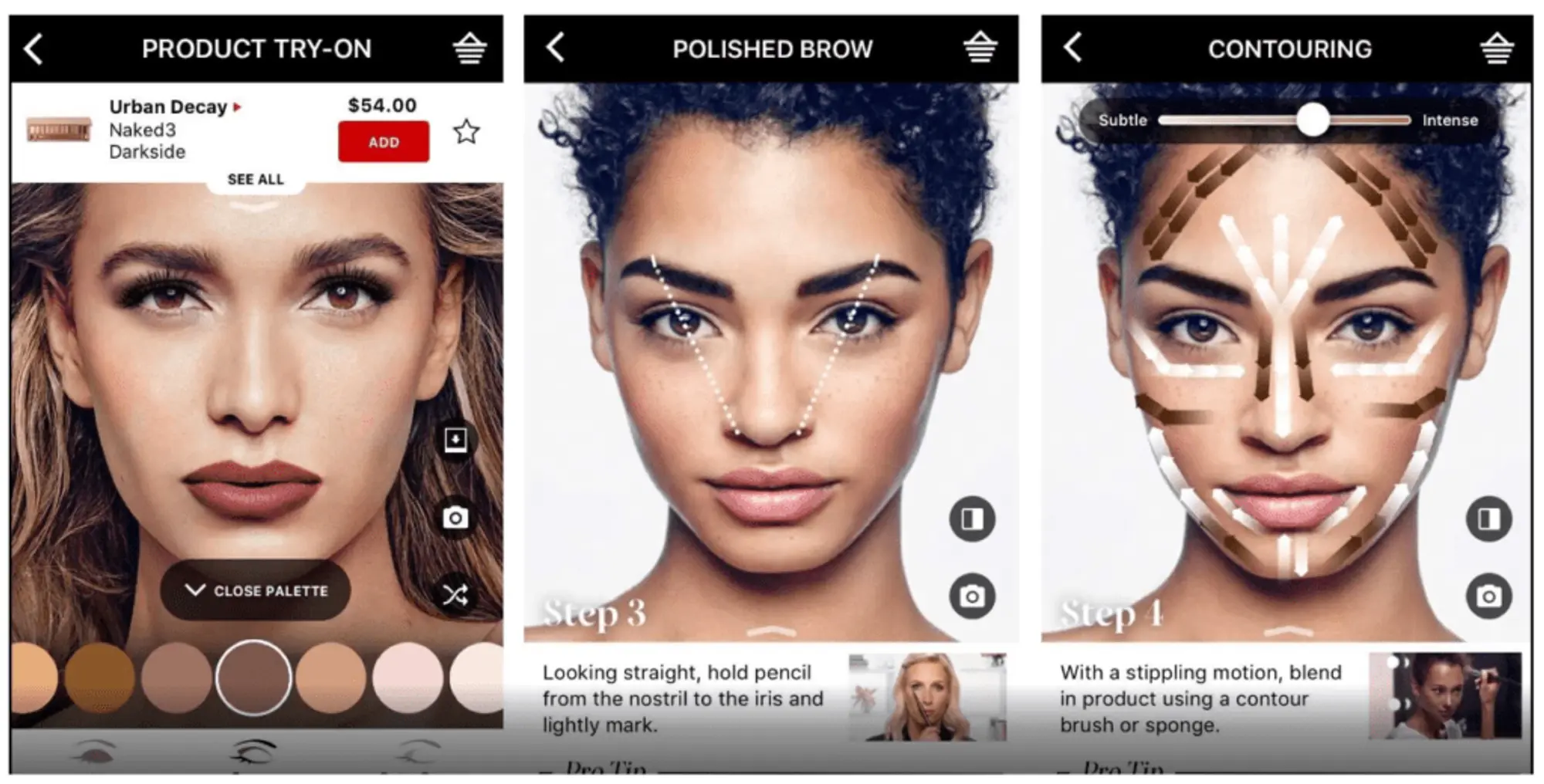

AI-Powered Beauty Diagnostics and Customization

At BWME 2025, exhibitors featured AI-powered tools for skin diagnostics, augmented-reality (AR) makeovers, and hyper-personalized product recommendations. Retailers such as Sephora Middle East and Faces introduced AI consultation pods, which use deep-learning algorithms to assess hydration, pigment, and skin health based on microclimate data and personal profiles. Shoppers receive instant custom skincare regimens, bridging clinical precision with cultural preferences for luxury and efficacy.

AI is also transforming makeup: AR try-on mirrors now let consumers visualize looks virtually, ensuring shade and formula compatibility before any purchase—a critical innovation, especially for consumers seeking modest beauty solutions or precise undertone matching.

Blockchain and Halal Compliance

Blockchain innovation is reshaping ingredient traceability and ethical trust. Saudi-based BeauChain introduced blockchain verification systems that authenticate halal certification for cosmetics, allowing real-time transparency for both consumers and regulators. Using QR-scannable packaging, shoppers can instantly trace sourcing, compliance audits, and lab testing for each product, reducing fraud and supporting the region’s robust halal standards.

Dubai’s blockchain initiatives integrate tamper-proof halal certificates and decentralized supply chain data, with smart contracts enabling real-time verification and regulatory oversight. This model is becoming a reference for regulators across the GCC, empowering small producers with streamlined compliance and fortifying the region’s export credentials.

E-Commerce and Hybrid Retail Evolution

E-commerce now comprises 35% of total beauty sales in MENA, having doubled from pre-pandemic levels. Saudi Arabia leads this transformation, supported by expanding 5G infrastructure and fast logistics. Hybrid retail models—where online, mobile, and experiential stores merge—are driven by young, digital-native consumers demanding authenticity and convenience.

Social commerce and livestreaming have turned dermatology and beauty advice into entertainment. Influencer integration on platforms like TikTok and Instagram enables consumers to watch product demos, access routine-building education in Arabic, and purchase directly through embedded links. This “knowledge-commerce convergence” represents a new digital era, where emotional storytelling is amplified by real-time algorithmic affinity and interactive shopping.

Luxury retailers use proprietary generative AI engines (e.g., Layla AI by Chalhoub Group’s Faces) to provide personalized coaching, driving higher conversions and longer engagement. Layla AI, for instance, engages customers in Arabic dialects, helping each shopper feel supported across channels from physical stores to app experiences.

6. Industry Infrastructure and Manufacturing Shifts

Beautyworld Middle East 2025 showcased the region’s growing industrial maturity, where a focus on open innovation, sustainable practices, and educational investments is quickly transforming the local beauty economy from a packaging hub into a center for formulation excellence and R&D leadership.

Modular Manufacturing

The new wave of local beauty manufacturing in the Middle East centers on modular “plug-and-play” facilities. Strategic industrial sites, such as those in Jebel Ali (Dubai) and Riyadh Industrial City (Saudi Arabia), enable brands and contract manufacturers to swiftly adapt production lines to create everything from fragrance concentrates to private-label skincare or color cosmetics. This flexibility is instrumental in promoting regional production sovereignty, lowering reliance on imports, and responding quickly to shifting market trends—an approach that mirrors the advanced adaptability found in the pharmaceutical sector.

Sustainable Logistics

Dubai’s port infrastructure is setting new standards in eco-friendly trade. Through the Jebel Ali Green Ports initiative and renewable energy integration, beauty exports have reduced shipping emissions by 15% in only a few years. These advances align with global climate goals and help the region meet its net zero pledge by 2050.

In the supply chain, brands are investing in refillable packaging and bio-cellulose containers sourced from local suppliers. Such circular economy systems—for example, using palm leaf fibers or recycled plastics—are becoming an integral part of the Middle Eastern beauty carbon narrative, offering environmentally friendly alternatives without sacrificing performance. This dual focus on innovation and sustainability resonates with conscious consumers and institutional buyers.

Workforce and Education

The development of a skilled workforce is critical for local manufacturing leadership. BWME’s partnership with the Dubai Design and Fashion Council announced new vocational degrees in cosmetic sciences and formulary development, aiming to create a population of scientists, product developers, and marketers who are as comfortable navigating local cultural nuance as they are the international regulatory landscape. Regional universities and training programs now collaborate with industry stakeholders to ensure knowledge transfer, research innovation, and professional readiness.

Organizations such as the Middle Eastern Countries Society of Cosmetic Chemists (MECSCC) and research-driven partnerships (e.g., between AUC and Egyptian manufacturers) amplify this commitment by supporting cosmetic science education and certification throughout the region.

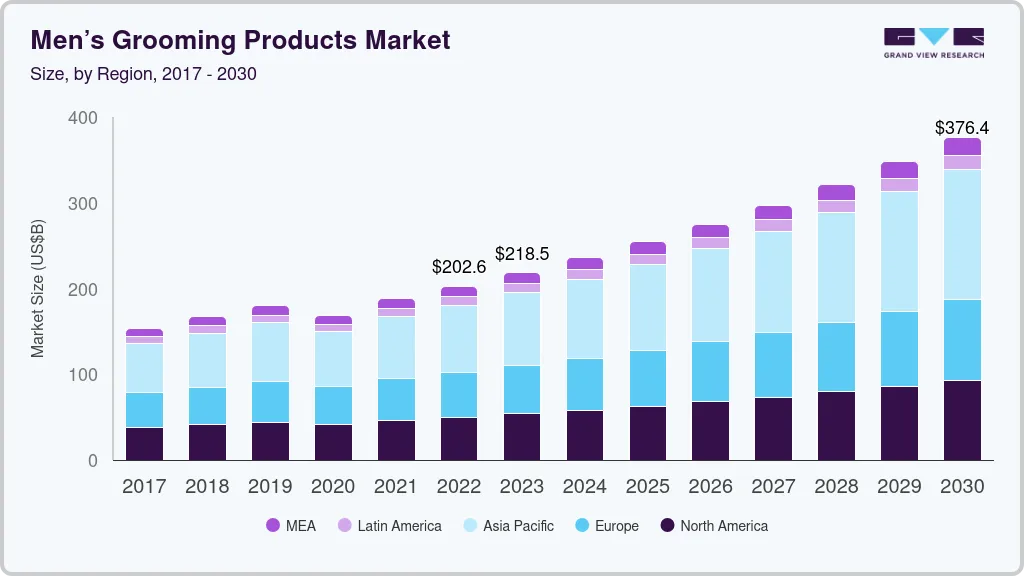

7. Male Beauty and Gender Fluid Aesthetics

Male beauty and gender fluid aesthetics have become central themes in the Middle East’s evolving beauty landscape, highlighted dramatically at BWME 2025.

Male Grooming Evolution

The 2025 edition of Beautyworld Middle East recorded a 40% increase in male grooming exhibitors—the fastest-growing sub-sector at the show. Driven by rising awareness, social media influence, and increased disposable income, men in Saudi Arabia and across the GCC now equate grooming with functional confidence and professional success, not vanity.

The traditional barbershop has morphed into men’s spa enterprises offering advanced skin health, beard artistry, and wellness services tailored to the region’s climate and cultural needs. Brands such as The Gents Lab and ManCode Arabia are targeting the aspirational youth demographic—engineers, influencers, and entrepreneurs aged 18–32—with products ranging from facial cleansers and beard oils to anti-aging serums. Saudi Arabia’s male grooming market alone is forecast to reach $1.23 billion by 2030, with skin care and hair care leading the growth.

Social acceptance of sophisticated male grooming is strongest among Millennials and Gen Z, who follow global trends and local influencers on Instagram and TikTok. These platforms provide education, normalize product experimentation, and make advanced routines feel aspirational—not excessive or taboo. Despite lingering conservativism in older or rural populations, the trajectory is clear: male grooming in the Middle East represents a new standard for self-care, aesthetics, and brand loyalty.

Gender-Inclusive Vision

Perhaps the most revolutionary shift at BWME 2025 was the industry’s embrace of gender fluidity and nonbinary aesthetics. Exhibitors presented minimalistic packaging, neutral tones, and shared grooming systems that de-emphasize traditional gender segmentation. The underlying philosophy—“beauty is personal, not gendered”—signals a new inclusivity, allowing local consumers to reinterpret modesty, identity, and self-expression without conflict.

This transition mirrors global attitudes yet preserves regional specificity. In the Gulf, gender fluidity in beauty brands is not about rebellion; it’s an organic extension of cultural modesty reframed through aesthetic fluidity. Household purchasing decisions increasingly involve shared products, while marketing campaigns highlight diverse role models and avoid rigid gender stereotypes.

Beauty brands are responding with formulas and designs that work across skin types, climate needs, and personal styles. Products are promoted as universal, with educational content that encourages both men and women—and everyone in between—to pursue personal care as a matter of dignity, health, and emotional well-being.

8. Geopolitics, Trade, and the Soft Power of Beauty

The Middle East’s rapid investment in cultural industries—especially cosmetics—marks a deliberate pivot toward economic diversification, moving away from reliance on oil and gas. Beauty and wellness occupy a strategic place in the region’s creative economy; countries use these industries to boost non-oil GDP, empower new entrepreneurial classes, and increase regional influence.

Beautyworld Middle East 2025 (BWME) exemplified this ambition, functioning as an engine of economic diplomacy. The event attracted delegations from Europe, Asia, and the Americas, resulting in new distribution and retail partnership deals exceeding $200 million, with further agreements projected for the years ahead. These deals not only strengthen the global presence of GCC-born brands but also promote knowledge transfer in formulation science, packaging innovation, and regulatory alignment.

Tourism and Cultural Convergence

Beauty tourism is now tightly integrated with Dubai’s hospitality, medical, and wellness offerings. In 2025, beauty tourism grew by 20%, bolstered by Dubai’s new “Lifestyle Visa”—a program designed to attract international visitors for extended stays, combining medical and aesthetic services with luxury shopping. Tourists participate in spa heritage tours, scent-making experiences, and workshops at cultural hubs like Alserkal Avenue, further entrenching Dubai’s reputation as a center for experiential luxury.

This convergence means BWME isn’t simply a trade fair; it’s a narrative portal where olfactory artistry, spa rituals, and ethical consumption become expressions of regional soft power. Through immersive storytelling, cross-border collaborations, and cultural events, the Gulf deepens its global footprint and advances the idea that beauty can be both a business and a vehicle for diplomacy and social connection.

9. The Beauty of Tomorrow – From Bio-Aesthetics to AI Empathy

The “beauty of tomorrow” in the Middle East is being shaped by rapid advances in biotechnology, artificial intelligence, and sustainable consumer practices, driving a forecasted market value to nearly $95 billion by 2030 across the MENA region. GCC countries, led by Saudi Arabia and the UAE, are engineering a new model—Beauty 4.0—that blends cultural heritage, eco-consciousness, and digital innovation.

Bio-synthetics and Algae-Based Actives

Regional labs and university partnerships along Red Sea coasts are pioneering marine phytochemical extraction and bio-synthetic ingredient sourcing. The industry is increasingly replacing petrochemical ingredients with algae, fermented botanicals, and plant-based peptides, not only to address local climate needs (hydration, UV protection) but also to satisfy eco-luxury demands. Biotechnology-derived components such as stem cells, enzymes, and nanotech actives are integrated into high-performance skincare, while halal certification ensures ethical and religious compliance, further fueling this trajectory.

AI Empathy Modeling

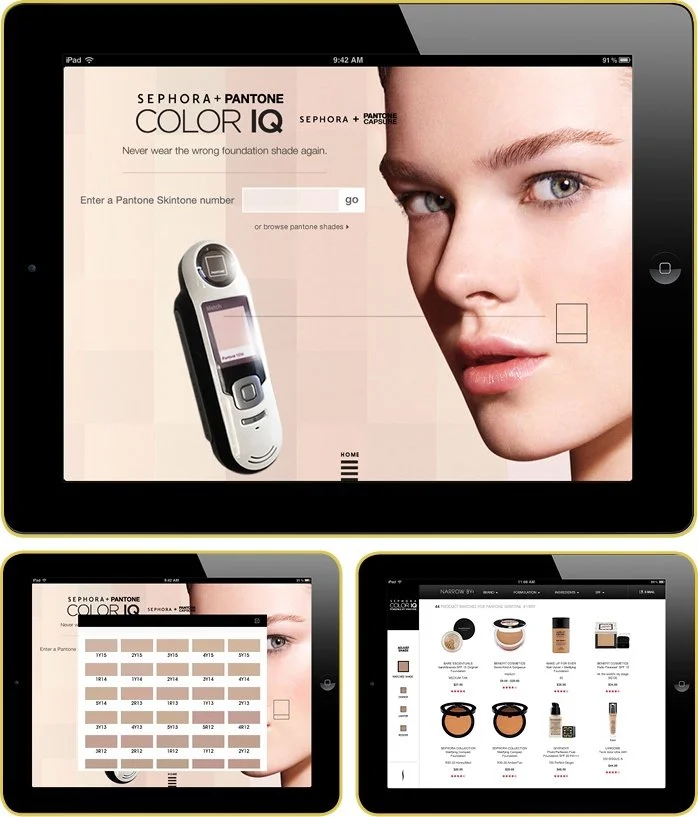

Artificial intelligence now moves beyond personalization toward “empathy modeling”—combining emotional analytics, skin diagnostics, and scent-memory profiling to create adaptive beauty rituals. Local and global players leverage AI to recommend products based not only on physical skin attributes but also on mood, cultural preference, and historical purchasing patterns. Platforms like Glamera and Sephora’s Color IQ utilize AI for foundation matching, virtual try-ons, and environment-adapted skincare solutions; the future will see AI tools analyzing emotional feedback to dynamically customize routines and scents.

Fragrance houses are also integrating AI to match perfume blends to individual scent memories and preferences, fusing high-tech data with centuries-old olfactory tradition—a development uniquely resonant in the Gulf.

Circular Consumer Marketplaces

Consumer marketplaces are moving toward fully circular ecosystems, where refillable beauty products, bio-packaging, and smart home integration reduce waste and maximize personalization. Smart dispensers can sync with personal data to replenish skincare or makeup automatically, while refill models are supported by local logistics hubs. This trend dovetails with rising environmental consciousness in the region, as consumers prioritize sustainable and traceable beauty purchases.

Governments and regulators across the GCC are easing entry for sustainable and organic products and implementing favorable policies for eco-friendly innovations. Brands that emphasize ethical sourcing, reusability, and minimal processing are gaining ground among middle- and upper-class urbanites.

Beauty 4.0: Eco-Digital Futurism

All of these innovations converge under the umbrella of Beauty 4.0: a regional syncretic system that marries deep-rooted beauty rituals (like the use of oud, rosewater, and natural oils) with digitized supply chains, emotional AI, and environmental stewardship.

- Social media and AI collaborate to forecast trends and customize shopping experiences.

- Sustainable biotech and refillable products define luxury, not just exclusivity.

- Regulatory frameworks align halal, eco, and digital standards, creating a seamless consumer journey.

In the coming five years, the Middle East is poised not only to adopt but to pioneer global advancements in beauty, offering models for “intelligent, ethical, and culturally attuned” personal care ecosystems.

10. Conclusion:

Beautyworld Middle East 2025 conclusively demonstrated the region’s transformation from a follower to a leader in the global beauty industry. By convening artisans, scientists, entrepreneurs, and policymakers under a shared vision of innovation rooted in cultural authenticity, the event illuminated the enduring power of prosperity founded on tradition and forward-thinking.

The fair showcased how the Middle East is redefining beauty as a multidimensional narrative—where the rich scent of oudh meets cutting-edge halal serums, and digital ambition intertwines with deep cultural heritage. The convergence of these elements signifies a broader societal evolution: the region, exemplified by Dubai’s exhibition halls, stands not as a passive consumer but as a teacher and trendsetter in global aesthetic identity.

Othilapak operates as a specialized division within the Jarsking Group, one of the world’s leading manufacturers of premium packaging for cosmetics, perfume, and personal care products. We will presence at Beautyworld Middle East 2025 exemplifies the exhibition’s commitment to global excellence and cutting-edge innovation. We will unveil an impressive portfolio of the latest, highest-quality cosmetics and perfume packaging—designed to inspire and elevate the brands attending from every corner of the world.

With their showcase of luxurious glass bottles, sustainable refillable jars, and inventive packaging solutions, Othilapak sets new standards for both visual allure and functional integrity. By merging artistry with eco-conscious design, their offerings help beauty and fragrance brands tell compelling product stories while meeting the growing demand for durability and environmental responsibility.

For participants and visitors, Othilapak brings not just products but opportunities for partnership and collaboration. Their stand at BWME 2025 is much more than a display—it’s a creative hub, where manufacturers, designers, and entrepreneurs can discover how exceptional packaging enhances the entire beauty experience, shaping the future of the industry and consumer engagement.