1. The Global Stage of Beauty Packaging

Each year, Cosmoprof North America (CPNA) in Las Vegas stands as a pivotal event for the beauty industry, drawing thousands of exhibitors and tens of thousands of professionals and brand owners from around the world. As a flagship in the renowned Cosmoprof series—which also includes Cosmoprof Asia, Bologna, and other major hubs—each show reflects the distinct commercial, cultural, and regulatory dynamics of its region. For packaging innovators and suppliers like Othilapak, understanding these differences is not just advantageous, but essential for delivering solutions that match the evolving demands of global beauty brands.

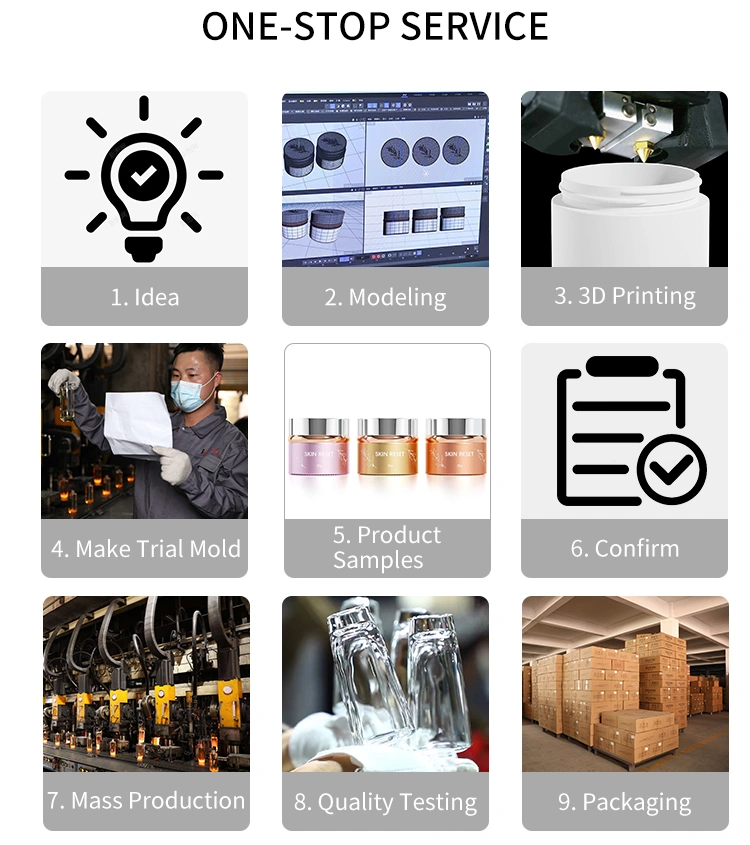

In July 2025, Othilapak returned to the Las Vegas Convention Center with a suite of new packaging innovations: new design eco-friendly cosmetic packaging set, biodegradable replaceable packaging, various plastic materials for personal care packaging and turnkey ODM/OEM services. In three days, we will communicate with many buyers—indie beauty founders, U.S. e-commerce leaders, global distributors, and contract manufacturers. Each interaction provided a window into shifting packaging trends, regulatory landscapes, and partnership models.

Drawing on experience from multiple Cosmoprof Asia events (Hong Kong, Bologna, Bangkok), we observe distinct contrasts in buyer priorities, exhibit strategies, and regulatory expectations. This article expands on these differences, integrating professional industry knowledge and actionable insights for packaging suppliers and beauty entrepreneurs aiming to thrive globally.

2. Buyer Profiles: Supply Chain Focus in Asia vs. Brand Realization in Las Vegas

Asia: The Engine Room of Beauty Supply

Cosmoprof Asia is recognized as the premier B2B beauty event in the Asia-Pacific region, hosting thousands of exhibitors from dozens of countries and drawing key decision-makers from global brands like Amorepacific, L’Oréal, and Walgreens Boots Alliance. The atmosphere is heavily transactional, with buyers—often established brands, private labelers, and mass retailers—arriving with precise RFQs, technical requirements, and a focus on price-performance.

The event’s Buyer Programme is designed to foster meaningful partnerships and unlock new market opportunities, connecting exhibitors with over 600 key decision-makers. The dialogue is direct and efficiency-driven, with technical specifications and cost optimization at the core.

Las Vegas: The Launchpad for Brand Innovation

By contrast, CPNA is a launchpad for brand innovation, serving as the premier B2B beauty exhibition in the Americas. The show is characterized by its dynamic growth and unique programs, offering the entire beauty industry an opportunity to make new relationships and foster collaborations. The floor is populated by founders of emerging beauty brands, digital-first retailers, Amazon sellers, and DTC specialists. These buyers seek packaging partners who can elevate their brand narrative and deliver differentiated, market-ready solutions—not just components.

Strategic Takeaway

To achieve maximum impact at Cosmoprof Asia and Las Vegas, packaging suppliers must strategically adapt to each region’s business culture and buyer expectations: in Asia, success hinges on demonstrating technical excellence, cost efficiency, and compliance to meet the needs of established brands and mass retailers who value detailed specifications and reliable supply chains; in the U.S., brands and founders are drawn to immersive storytelling, innovative design, and turnkey solutions that help differentiate their products and foster consumer loyalty. Leveraging each show’s networking, education, and matchmaking programs further enables companies to build strategic partnerships, stay ahead of regulatory and sustainability trends, and position themselves as leaders in both functional and creative packaging solutions. This dual-market approach not only addresses immediate buyer needs but also ensures long-term growth and relevance in the rapidly evolving global beauty packaging industry.

3. Packaging Preferences: Functionality in Asia, Aesthetics & Sustainability in the U.S.

Asia: Prioritizing Technical Performance

Asian beauty packaging buyers place a premium on technical performance, demanding solutions that deliver durability, leakage resistance, robust barrier properties, and efficient logistics. This is especially critical given the complexity of distribution channels and the rapid growth of e-commerce and cross-border sales in the region. Features such as tamper-evident seals, child-proof caps, and UV-blocking inserts are highly sought after, as they ensure product integrity and regulatory compliance throughout the supply chain. The focus is on packaging that can withstand rigorous handling, prevent contamination, and meet strict export standards, making technical specifications and reliability the top priorities for procurement decisions.

Las Vegas: Visual Impact and Sustainability

In contrast, buyers at Cosmoprof North America in Las Vegas are driven by the visual and emotional impact of packaging, as well as its sustainability story. Minimalist, tactile, and mono-material designs are trending, along with features like magnetic closures and high PCR (post-consumer recycled) content. Sustainability claims and certifications—such as ISCC, FSC, and PCR content—play a decisive role in purchasing, as U.S. retailers and platforms like Amazon increasingly incentivize recyclable, easy-to-open, and minimal packaging. The market is rapidly shifting toward biodegradable, compostable, and refillable solutions, with leading brands setting ambitious targets for recycled content by 2025–2030. Packaging is viewed not just as a protective vessel, but as an extension of brand identity and a key factor in consumer engagement and loyalty.

Othilapak’s Strategy: Dual-Track Solutions

To address these divergent market demands, Othilapak implements a dual-track packaging strategy: offering function-first, technically robust designs tailored for Asia’s supply chain-driven buyers, while developing design-forward, sustainable packaging solutions for the North American market. This approach ensures that Othilapak can meet the stringent technical requirements of Asian clients and the brand-building, eco-conscious needs of U.S. partners—positioning the company as a versatile, global packaging leader.

4. Show Rhythm: Planned Procurement (Asia) vs. Experiential Innovation (U.S.)

Asia: Highly Structured and Transactional

At Cosmoprof Asia, the show rhythm is driven by a methodical and transactional approach. Buyers typically arrive with detailed checklists covering minimum order quantities (MOQ), lead times, pricing, and requests for technical samples. Meetings are scheduled in advance, and interactions are formal, focused on efficiency and rapid decision-making. The environment prioritizes speed and throughput, with an emphasis on fulfilling procurement needs and moving quickly through potential suppliers. This structure supports Asia’s supply-chain-centric market, where reliability and process adherence are critical for large-scale business operations.

Las Vegas: Exploration and Engagement

In contrast, Cosmoprof North America (CPNA) in Las Vegas fosters a dynamic, exploratory atmosphere. Here, founders, creatives, and brand managers are encouraged to interact with products through live demonstrations, augmented reality (AR) mockups, and hands-on co-creation kits. Booths often feature interactive experiences and digital engagement tools such as QR codes and AR overlays to captivate and retain visitors. The focus is on sparking inspiration, encouraging collaboration, and allowing buyers to visualize how packaging can enhance their brand story. This experiential approach aligns with the U.S. market’s appetite for innovation and brand differentiation.

Lesson

- Success at Cosmoprof Asia requires a methodical, efficiency-driven approach—be prepared with detailed technical information, clear pricing, and readily available samples to support buyers who value speed, structure, and formal interactions.

- Booth operations in Asia should be optimized for quick throughput and high-volume procurement, reflecting the region’s emphasis on supply chain reliability and process rigor.

- In Las Vegas, the emphasis shifts to creating an engaging, interactive environment—use live demonstrations, digital tools like AR and QR codes, and hands-on activities to encourage exploration and creativity among visitors.

- U.S. buyers respond well to informal, story-driven engagement that highlights brand differentiation and invites collaboration, so adapt communication styles accordingly.

- Ultimately, customizing trade show strategies to the unique expectations and rhythms of each region is key to building strong connections and maximizing results at both events.

5. Partnership Models: Transactional in Asia, Integrated Solutions in North America

Asia: Price-Driven Negotiations

In Asia’s packaging market, negotiations are fundamentally anchored in achieving the most competitive unit costs and favorable delivery terms. Buyers—often representing established brands, large-scale manufacturers, and mass-market retailers—arrive at the table with detailed cost breakdowns and clear volume expectations. The region’s mature and dense supply chain infrastructure means that suppliers must demonstrate not only aggressive pricing but also the ability to scale production efficiently and deliver on tight schedules. Discussions frequently revolve around minimizing lead times, securing bulk discounts, and ensuring consistent quality at high volumes. Suppliers are expected to provide transparent cost structures, flexibility in order quantities, and robust logistics solutions to meet the demands of fast-moving consumer goods sectors. Trust is built through a proven track record of reliability, operational efficiency, and the capacity to handle complex, multi-country distribution networks.

North America: Integrated, Solution-Oriented Partnerships

In North America, the packaging landscape is shaped by a demand for comprehensive, value-added partnerships rather than purely transactional relationships. Clients increasingly expect packaging suppliers to deliver integrated solutions that address a broad range of needs beyond the product itself. This includes expertise in regulatory compliance—such as FDA requirements for cosmetics and food packaging, California’s Prop 65 for chemical disclosures. Buyers also seek support for drop-shipping, labeling, and logistics, as well as access to turnkey ODM (original design manufacturing) and OEM (original equipment manufacturing) services. The growing prevalence of digital mockup tools allows clients to visualize packaging concepts before committing to production, streamlining the design and approval process. This solution-oriented approach is particularly valued by emerging brands and e-commerce players who require speed, flexibility, and regulatory assurance to succeed in a competitive, fast-evolving market.

Othilapak’s Offer: Bundled, Branded Solutions for U.S. Clients

To address these evolving expectations, Othilapak has developed a bundled service model for its U.S. clients. This approach combines regulatory support—ensuring all packaging meets FDA and Prop 65 standards—with referrals to trusted fulfillment partners and the provision of digital assets such as 3D mockups and interactive prototypes. By integrating these services into branded packaging programs, Othilapak positions itself as a strategic partner capable of supporting clients through every step of the product journey, from initial concept and compliance to logistics and market launch. This comprehensive offering not only streamlines the procurement process for clients but also enhances brand consistency, accelerates time-to-market, and provides peace of mind in navigating the complex regulatory and operational landscape of North America.

6. Market Orientation: Supply-Cluster vs. Brand-Innovator Mindsets

Asia: A Powerhouse for Growth and Scale

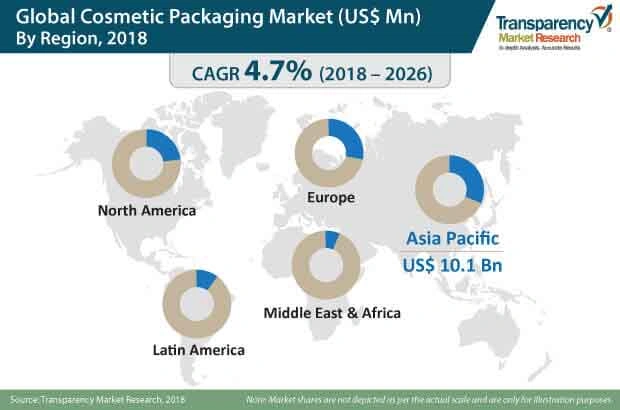

The Asia-Pacific beauty market is experiencing rapid and sustained growth, with industry value expected to climb from US$191 billion in 2024 to nearly US$214 billion by 2028—a trajectory powered by the region’s sophisticated and mature supply chain networks. These networks are designed for scalability, allowing exporters and buyers with well-established infrastructures to manage complex logistics and consistently deliver high-volume production. The market’s priorities are clear: operational excellence, reliability, and strict adherence to regulatory compliance are non-negotiable, making Asia an ideal environment for brands and suppliers who can guarantee efficiency and quality at scale.

Las Vegas: Brand Creators and Startups

In stark contrast, Cosmoprof North America in Las Vegas draws a different crowd—brand creators, indie founders, and startups who see packaging as a vital extension of their brand identity and a tool for consumer engagement. For these innovators, packaging is not just about containment but about storytelling, differentiation, and creating memorable experiences. Their purchasing decisions are heavily influenced by interactive elements such as live product demos, mood boards, and hands-on samples, which enable them to envision and co-create packaging solutions that align with their unique brand narratives.

For packaging suppliers, this means adopting a dual approach: in Asia, the focus must be on delivering operational excellence, scalability, and compliance to meet the demands of a high-volume, supply-chain-driven market; in the U.S., success depends on fostering creativity, collaboration, and experiential engagement to support the needs of emerging brands and startups seeking to stand out in a crowded marketplace.

Regulatory Requirements: Diverging Compliance Landscapes

North America: Complex Regulatory Landscape

The U.S. and Canadian markets impose rigorous, multi-layered compliance demands on packaging suppliers:

- FDA & Health Canada Regulations:

Strict material safety standards for cosmetics, skincare, and food-contact packaging, requiring documentation of chemical inertness and migration limits.

- California’s Prop 65:

Mandates clear warnings for 900+ chemicals linked to cancer or reproductive harm, impacting labels, inks, and adhesives.

- Amazon’s Packaging Compliance:

Enforces Frustration-Free Packaging (FFP) standards—demanding minimal material use, 100% recyclability, and drop-test durability for e-commerce.

- Recycled Content Mandates:

Laws like California’s Plastic Pollution Prevention Act (SB 54) require 30% PCR in plastic packaging by 2028, with similar rules in New Jersey and Washington.

- Eco-Label Enforcement:

FTC Green Guides penalize vague claims (e.g., “eco-friendly”); third-party certifications (ISCC, FSC) are now essential to verify sustainability assertions.

Asia: Export and Technical Compliance

Asia’s regulatory framework prioritizes technical precision and cross-border adaptability:

- Export Markings:

Mandatory symbols for recycling, material codes (e.g., PET ♳), country of origin, and multilingual safety instructions.

- Barrier Specifications:

Stringent requirements for oxygen/moisture resistance (e.g., ISO 15378 standards for pharmaceutical packaging) and UV protection.

- Child-Resistant Features:

ISO 8317 certification for closures on cosmetics, supplements, and CBD products, with rigorous torque and tamper-evidence testing.

- REACH & ISO Compliance:

Adherence to chemical restrictions (REACH Annex XVII) and quality management systems (ISO 9001/22716) for EU-bound exports.

- Be Sustainable with Beauty” Initiative:

Cosmopack Asia’s flagship program spotlights innovations like mono-material PCR tubes, seaweed-based bioplastics, and refillable modular systems.

Key Takeaway:

Navigating global packaging regulations requires a bifurcated strategy: a precision-focused framework for Asia’s export-driven technical demands, and a solutions-oriented ecosystem for North America’s evolving sustainability and compliance landscape. By automating compliance and embedding innovation into regulatory templates, suppliers can turn complexity into competitive advantage.

7. Communication Culture: Formality vs. Storytelling

Asia: Formal and Process-Driven

In Asia, business communication is characterized by a high degree of formality and a structured, process-driven approach. Negotiations are typically meticulous, focusing on details such as price, specifications, and timelines, with efficiency and accuracy prioritized over personal rapport. Relationship-building, while important in the long term, often takes a back seat to transactional objectives during initial interactions. This culture values respect for hierarchy, clear documentation, and adherence to established protocols, which helps ensure smooth operations within complex supply chains.

U.S.: Informal and Story-Driven

In contrast, the U.S. business environment—especially in the packaging and beauty sectors—leans toward informal, conversational communication that emphasizes storytelling and relationship-building. American buyers and partners are interested not just in the technical merits of a product, but also in the narrative behind the brand and the packaging. They appreciate when suppliers share the inspiration, sustainability journey, or creative process behind their offerings, as this helps forge emotional connections and trust. Spontaneity, open dialogue, and personal engagement are seen as assets in building long-term partnerships.

Training for Success

Recognizing these differences, Othilapak invests in training our teams to seamlessly navigate both cultural contexts. Staff are equipped to switch between formal, data-driven presentations for Asian buyers and story-rich, collaborative conversations for U.S. audiences. This dual approach ensures that the same booth can effectively engage diverse visitors, meeting each market’s unique expectations and maximizing partnership opportunities.

8. Trade Shows as Innovation Platforms

Cosmoprof trade shows have transformed from traditional transactional marketplaces into dynamic innovation platforms, now featuring co-creation opportunities, on-site prototyping, and virtual demonstrations as standard elements. This evolution is driven by the integration of advanced smart packaging technologies—such as QR codes, NFC chips, and augmented reality (AR) overlays—which not only enhance consumer engagement at the booth but also improve transparency and traceability throughout the supply chain.

A notable industry trend, especially prominent in Europe, is the rapid adoption of track-and-trace solutions and digital product passports. These technologies are increasingly demanded by both regulators and brands to ensure end-to-end supply chain visibility, support anti-counterfeiting efforts, and provide consumers with verifiable product information at every stage of the product lifecycle.

As a result, Cosmoprof events have become essential arenas for brands and suppliers to showcase innovation, collaborate on new concepts in real time, and demonstrate the latest advancements in packaging technology and supply chain transparency.

9. Expanded Industry Knowledge & Strategic Takeaways

Sustainability Mandates

Major global beauty brands such as L’Oréal, Unilever, and Estée Lauder are driving industry transformation by setting ambitious targets for recycled content—particularly high-purity rPET—in their packaging by 2025–2030. These mandates are accelerating the adoption of closed-loop systems and circular economy principles, compelling suppliers to deliver packaging that is not only recyclable but also compostable and reusable. As a result, the entire value chain is being restructured to prioritize material recovery, waste minimization, and transparent sustainability reporting.

Smart Packaging

The integration of digital technologies—including QR codes, NFC chips, and augmented reality—has become a key differentiator in beauty packaging. These features enhance consumer interaction by providing instant access to product information, authenticity verification, and immersive brand experiences. For brands, smart packaging offers valuable data for personalization, compliance tracking, and anti-counterfeiting, while also supporting supply chain transparency and traceability.

Material Innovation

Advances in material science are rapidly reshaping packaging performance and sustainability. Innovations such as nanomaterials, advanced barrier coatings, and bio-based polymers are being adopted to improve product protection, extend shelf life, and reduce environmental impact. Leading companies are investing in R&D to develop packaging that meets both rigorous functional requirements and the growing demand for eco-friendly solutions.

Quality Assurance

Global market access and consumer trust hinge on robust quality assurance frameworks. Certifications like ISO 9001 (quality management), ISO 14001 (environmental management), ISO 22716 (cosmetic GMP), BRC (food safety), and ISCC PLUS (sustainable sourcing) are becoming standard requirements for beauty packaging suppliers. These certifications ensure compliance with international standards, facilitate cross-border trade, and signal a commitment to excellence and safety.

Circular Economy

The shift toward a circular economy is being reinforced by both regulatory and market forces. Brands and regulators are prioritizing packaging solutions that support traceability, recyclability, and lifecycle management. The adoption of blockchain technology and digital markers is enabling transparent, auditable supply chains, making it easier to track recycled content, validate sustainability claims, and prevent counterfeiting.

Consumer Trends

Consumer preferences are reshaping packaging design and strategy. Minimalist aesthetics, refillable formats, and inclusive designs resonate strongly with Gen Z and Millennial consumers. The demand for personalized and experiential packaging is driving innovation in both structure and graphics, as brands seek to offer unique unboxing experiences and foster deeper emotional connections with their audience.

Strategic Takeaways:

- Align with Brand Mandates: Suppliers must proactively invest in recycled, recyclable, and reusable materials to meet the evolving sustainability targets set by leading global brands.

- Embrace Digitalization: Integrating smart packaging technologies not only enhances consumer engagement but also delivers operational benefits in compliance, traceability, and anti-counterfeiting.

- Prioritize Advanced Materials: Continuous R&D in nanomaterials and bio-based solutions will be essential to deliver packaging that is both high-performing and environmentally responsible.

- Ensure Quality and Compliance: Obtaining and maintaining internationally recognized certifications is critical for market access and building client trust.

- Support Circularity: Leverage digital tools and transparent supply chain practices to align with circular economy principles and regulatory expectations.

- Respond to Evolving Consumer Demands: Design packaging that is minimalist, refillable, inclusive, and customizable to capture the loyalty of younger, values-driven consumers.

By integrating these strategies, packaging suppliers can position themselves at the forefront of industry innovation, regulatory compliance, and consumer relevance in the global beauty market.

10. Case Study: Othilapak at Cosmoprof 2025

At Cosmoprof North America 2025, Othilapak will showcase packaging solutions that blend functionality and aesthetics, attracting buyers from different regions of the world. This will lead to meaningful conversations with buyers seeking innovation and brand differentiation. This experiential approach highlights Othilapak’s commitment to blending technology, design and user engagement to meet the evolving expectations of North American beauty brands.

In the Asian market, Othilapak strategically emphasized technical performance, regulatory compliance, and the use of sustainable materials. By investing in eco-friendly packaging and obtaining relevant certifications, the company resonated with buyers who prioritize reliability, scalability, and environmental responsibility. This focus positioned Othilapak as a leader in sustainable packaging solutions, aligning with the region’s increasing emphasis on operational excellence and green practices.

Othilapak’s dual-market strategy—prioritizing experiential, design-led innovation in the U.S. and technical, compliance-driven sustainability in Asia—demonstrates its agility in addressing distinct regional demands and regulatory landscapes. This approach has not only strengthened Othilapak’s global presence but also deepened its partnerships with brands seeking tailored, future-ready packaging solutions.

11. The Future of Beauty Packaging: Global Trends and Opportunities

Digital Transformation

The beauty packaging sector is undergoing rapid digitalization, with brands increasingly integrating smart technologies such as QR codes, NFC chips, and augmented reality into their packaging. These innovations not only enhance the unboxing experience and consumer engagement but also provide instant access to product information, authenticity verification, and interactive brand storytelling. Digital tools are also improving supply chain transparency and traceability, enabling brands to build trust and differentiate themselves in a crowded market.

Regulatory Evolution

Governments worldwide are enacting stricter regulations on packaging materials, recyclability, and labeling accuracy. In North America and Europe especially, brands must now comply with evolving mandates on recycled content, eco-labeling, and sustainability certifications. The ability to quickly adapt to these complex and changing regulatory landscapes is becoming a key competitive advantage for global packaging partners, as compliance is now a critical expectation rather than a value-add.

Market Expansion

The Asia-Pacific region continues to be a powerhouse for beauty market growth, with forecasts projecting the market to exceed US$214 billion by 2028. This region’s expansion is driven by scalable, compliant packaging solutions that can meet the needs of high-volume, fast-growing markets. Meanwhile, North America remains a global hub for packaging innovation, with brands focusing on sustainable materials and digital solutions to drive brand differentiation and consumer loyalty.

Sustainability as Standard

Sustainability has shifted from a market differentiator to a baseline expectation in beauty packaging. Leading brands are investing in recycled and compostable materials, embracing circular economy principles, and building transparent supply chains to meet consumer and regulatory demands. Companies that embed sustainability into every aspect of packaging design and supply chain management are best positioned for long-term success in the global market.

Strategic Outlook

The future of beauty packaging will be defined by the seamless integration of digital technologies, proactive regulatory compliance, expansion in high-growth regions like Asia-Pacific, and a holistic commitment to sustainability. Companies that excel in these domains—by leveraging innovation, ensuring compliance, and embedding environmental responsibility—will shape the next era of global beauty packaging leadership.

12. Conclusion: Bridging Worlds, Shaping the Future

Cosmoprof Las Vegas and Cosmoprof Asia have evolved into much more than industry trade shows—they are now global benchmarks for beauty and packaging trends, each reflecting the unique priorities and innovations of their respective regions. Las Vegas sets the pace for brand-centric, sustainability-driven packaging, where storytelling, digital engagement, and eco-conscious materials are essential for differentiation and consumer loyalty. Meanwhile, Asia’s events underscore the region’s strengths in precision, scalability, and compliance, with a focus on technical excellence, operational reliability, and the ability to meet the demands of high-volume, rapidly growing markets.

For packaging partners, true global success requires more than simply attending these events; it demands a nuanced understanding of regional business cultures, regulatory landscapes, and consumer expectations. Companies must invest in continuous innovation—embracing advances in smart packaging, sustainable materials, and digital tools—while also ensuring that their solutions are robust, compliant, and tailored to the needs of each market. The ability to bridge these worlds with agility and expertise is what sets leading suppliers apart in today’s interconnected beauty ecosystem.

Othilapak exemplifies this dual-market approach. By blending immersive, design-forward experiences and sustainability leadership for North American brands with technical rigor and scalable, compliant solutions for Asian partners, Othilapak empowers clients to thrive in a fast-changing global landscape. Whether supporting a startup with a few thousand bespoke bottles or a multinational with millions of high-precision pumps, Othilapak’s mission is to deliver more than just packaging—it is to enable brands to tell their stories, achieve their sustainability goals, and seize new opportunities for growth and impact worldwide.

As the beauty industry continues to expand and diversify, the role of packaging as a strategic asset will only grow. The future belongs to those who can bridge worlds—combining creativity and compliance, innovation and operational excellence—to shape the next generation of beauty brands and inspire progress across the globe.