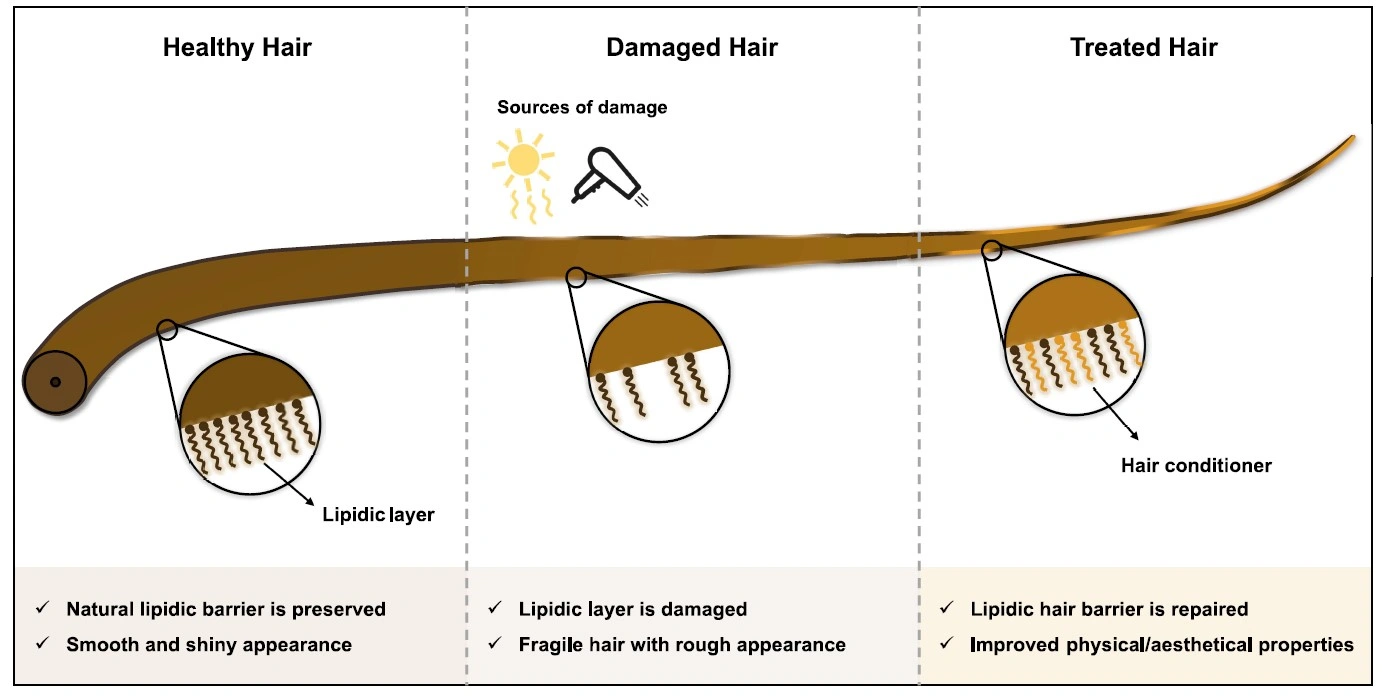

The importance of hair care extends far beyond aesthetics, encompassing both physical health and psychological well-being. Proper hair care is essential for maintaining scalp health and hygiene, as regular cleansing removes excess sebum, dead skin cells, and product buildup that can lead to infections and scalp conditions. Additionally, appropriate hair care practices help prevent premature hair loss and damage by strengthening the hair shaft, preventing breakage, and protecting against environmental damage. Research shows that 88% of women connect their hair directly to their self-confidence, demonstrating how good hair days can positively influence personal relationships, professional opportunities, and social interactions.

Hair care also serves as a form of self-care that contributes to mental well-being, providing a therapeutic ritual that offers a sense of control and normalcy. For hospitalized patients, hair care becomes particularly significant in maintaining a sense of identity and humanity during recovery. Moreover, hair condition often reflects overall health, with changes in texture or excessive shedding potentially signaling underlying health issues like nutritional deficiencies or hormonal imbalances. Beyond these benefits, proper hair care offers practical advantages including better styling options and long-term cost savings by preventing damage that would require expensive treatments or products to address.

The hair care industry is undergoing significant transformation in 2025, with innovations in ingredient technology and shifting market dynamics. Let’s explore the professional aspects of these developments in greater detail.

1. Advanced Fermentation Technology in Hair Care

Fermentation has emerged as a revolutionary process in hair care formulations, offering enhanced benefits beyond traditional ingredients. The fermentation process breaks down complex nutrients in plant-based ingredients into simpler forms that can be more readily absorbed by the hair and scalp. This biotransformation creates smaller molecules that penetrate the hair shaft and scalp more effectively, increasing bioavailability of active ingredients.

Scientific Benefits of Fermented Ingredients

Fermented ingredients in hair care provide multiple scientifically-backed advantages:

- Enhanced Nutrient Absorption: The smaller molecular structure allows for deeper penetration into the hair cortex, delivering nutrients where they’re most needed

- Increased Bioavailability: Nutrients become 400% more bioavailable through fermentation, requiring 75% less active material while matching or exceeding traditional formulations

- Natural Preservation: Fermentation significantly improves nutrient absorption, enabling effective formulations with less active material in many cases

- Strengthening Properties: Fermented proteins and amino acids strengthen the hair shaft at a structural level, reducing breakage and split ends

Key Fermented Ingredients

Several specific fermented ingredients are making significant impacts in professional formulations:

- Lactic Acid: A mild alpha hydroxy acid produced during fermentation that serves as a natural exfoliator for the scalp while also functioning as a humectant to draw moisture into the skin

- Rice or Kombucha Ferments: Deliver soothing and antimicrobial benefits, tackling scalp inflammation and reducing sebum production without stripping natural oils

- Carrot Root Ferment Filtrate: Contains high concentrations of antioxidants that protect hair from environmental damage

- Grape, Black Tea, and Ginseng Ferments: Provide unique healing properties to repair damaged hair and improve overall condition

2. Microbiome-Centered Scalp Care

The scalp microbiome has become a central focus in professional hair care for 2025, with formulations designed to balance microbial diversity and promote a healthy foundation for hair growth.

Scientific Approach to Microbiome Health

Professional microbiome-centered products incorporate:

- Prebiotics: Feed beneficial bacteria on the scalp to maintain a balanced microbiome

- Probiotics: Introduce beneficial bacteria to restore balance and fight harmful microorganisms

- Postbiotics: Utilize beneficial compounds produced by probiotic bacteria to reduce scalp irritation

- Advanced Diagnostics: Emerging technologies allow for detailed analysis of individual scalp microbiomes, enabling truly personalized treatment protocols

These formulations address visible concerns while establishing optimal conditions for long-term hair health by fostering a balanced scalp environment.

3. Marine-Derived Ingredients

Ocean-sourced ingredients are revolutionizing professional hair care with their unique properties and benefits.

Professional Applications of Marine Ingredients

- Red Algae (Palmaria palmata): Rich in bioavailable protein and antioxidants that reinforce hair density and improve elasticity, particularly beneficial in postpartum and menopausal hair restoration regimens

- Marine Collagen: Derived from fish skin, this peptide-dense ingredient restores structural proteins essential for hair strength and shine, integrating into the hair shaft when hydrolyzed to smaller molecular sizes

- Brown Sea Kelp Ferment (Laminaria digitata): Offers detoxification properties by binding to metal ions and pollutants, purifying the scalp environment while rebalancing natural sebum production

- Sea Algae: Contains bioactive compounds that support hair growth and scalp care, providing hydration, strengthening weakened hair, and combating environmental damage

- Peruvian Marine Plankton Extract: Enhances mitochondrial activity in follicle cells, boosting both growth and repair processes for improved volume and reduced shedding

4. Breakthrough Botanical Ingredients for 2025

The botanical ingredient landscape for hair care is expanding with innovative extracts that deliver specific therapeutic benefits.

Advanced Botanical Formulations

- Adaptogenic Herbs: Ginseng, rhodiola, and ashwagandha are becoming key ingredients in hair nourishment formulations, reducing environmental stressors, regulating sebum production, and improving scalp health

- Saw Palmetto Berry Extract: A natural DHT blocker that combats androgenic hair thinning without triggering irritation, ideal for sensitive scalps

- Licorice Root Extract: Contains glycyrrhizin compounds that reduce redness and reactive flare-ups in stressed scalp skin

- Tickseed (Coreopsis tinctoria) Flower Extract: Provides antimicrobial and oil-balancing properties, beneficial for oily scalps or those with recurrent product buildup

- Rhodiola Rosea: An adaptogen renowned for mitigating oxidative stress, protecting follicular integrity while calming overactive sebaceous glands

- Marshmallow Root Extract: Forms a protective film that locks in hydration and soothes flaky skin conditions

5. Next-Generation Ingredients Transforming Hair Care

Several innovative ingredients are set to revolutionize professional hair care in 2025.

Cutting-Edge Ingredient Technologies

- Bio-Fermented Bamboo Extract: Rich in strengthening silica with enhanced bioavailability through fermentation, delivering a polished, touchable finish ideal for post-color services and smoothing treatments

- Cupuacu Butter: The “plant alternative to silicones” that enhances slip without buildup, improving manageability in both coily and chemically treated hair

- Arctic Cloudberry Oil: Prized for its rare balance of omega fatty acids and vitamin C, replenishing dry scalps without coating strands in residue

- Hydrolyzed Quinoa Protein: A complete amino acid complex that mimics inner protein structures of human hair, rebuilding weakened cuticles and improving tensile strength

- Apple Cider Vinegar Micro-Emulsion: Precision-engineered for salon use to rebalance scalp pH, enhance light reflection, and clarify product buildup without stripping color

- Niacinamide: Increases follicular hydration and reduces inflammation, particularly effective for clients battling tension alopecia or stress-induced shedding

- Encapsulated Caffeine: Nanoencapsulation technology allows deeper and faster penetration, helping preserve hair density for clients experiencing hormone-driven thinning

6. Hair Care Market Analysis: Professional Insights

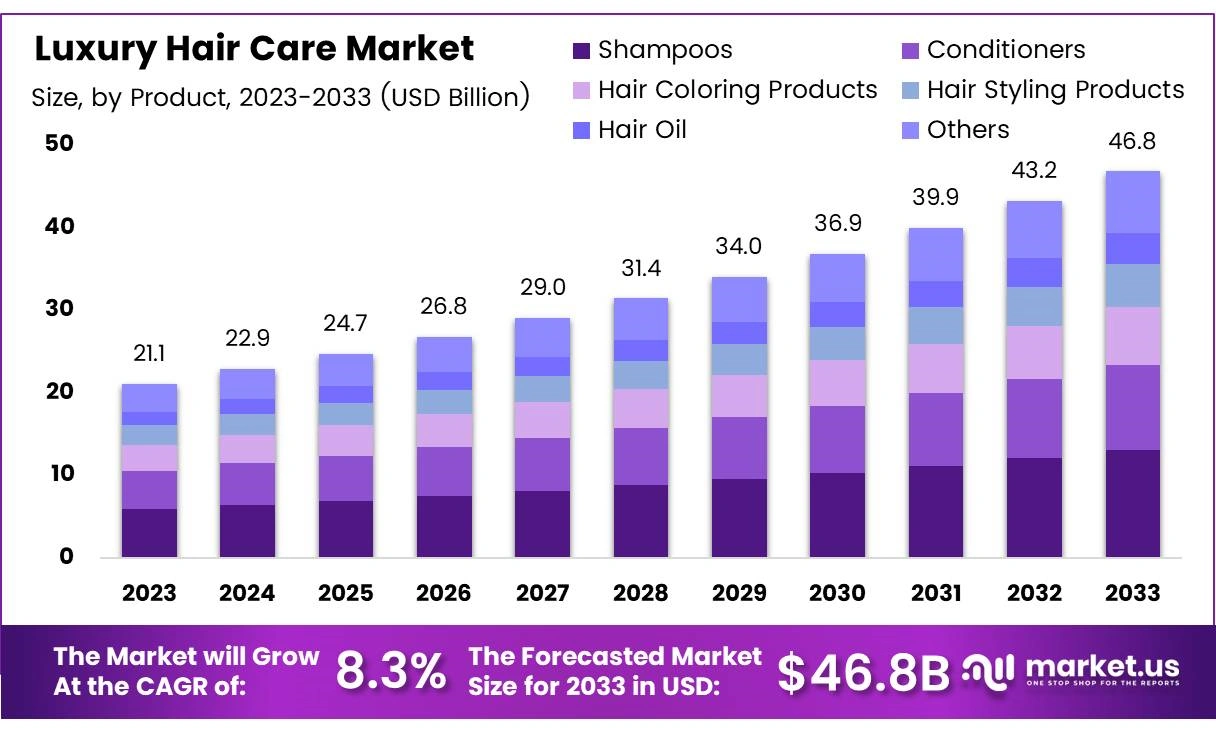

The global hair care market is experiencing significant growth in 2025, with various segments showing robust expansion. As of April 2025, the market demonstrates strong potential for continued development through the next decade.

Market Size and Growth Projections

The global hair care market is currently valued between USD 99.84 billion and USD 102.86 billion in 2025, with projections indicating substantial growth in the coming years. The market is expected to reach USD 147.06 billion by 2037, growing at a CAGR of 3.2% over this period. In the near term, the market is anticipated to grow by USD 18.28 billion from 2025-2029, with a slightly higher CAGR of 3.7% during this timeframe.

The professional hair care segment shows varying valuations across different research sources. Recent data indicates professional hair care market values ranging from USD 23,466.9 million to USD 38.28 billion in 2025. This segment is projected to grow at rates between 4.6% and 5.8% CAGR through the early 2030s, outpacing the overall hair care market growth rate.

Growth Drivers and Trends

Several key factors are driving the hair care market’s expansion:

- Social media and blogging influence has emerged as a significant driver of market growth

- Growing adoption of home salon services represents a notable trend in consumer behavior

- Digital transformation has revolutionized the retail landscape, with e-commerce becoming a crucial distribution channel

- Product premiumization and personalization are gaining traction as consumers seek tailored solutions for specific hair types and concerns

- Environmental consciousness and sustainability have become central themes in product development and packaging strategies

The market faces some challenges, including concerns about adverse health effects from chemical or synthetic components used in hair care products. However, the overall trajectory remains positive as companies adapt to changing consumer preferences and technological advancements.

As we progress through 2025, the hair care market continues to evolve, with significant opportunities for brands that can effectively address consumer demands for personalization, sustainability, and product efficacy.

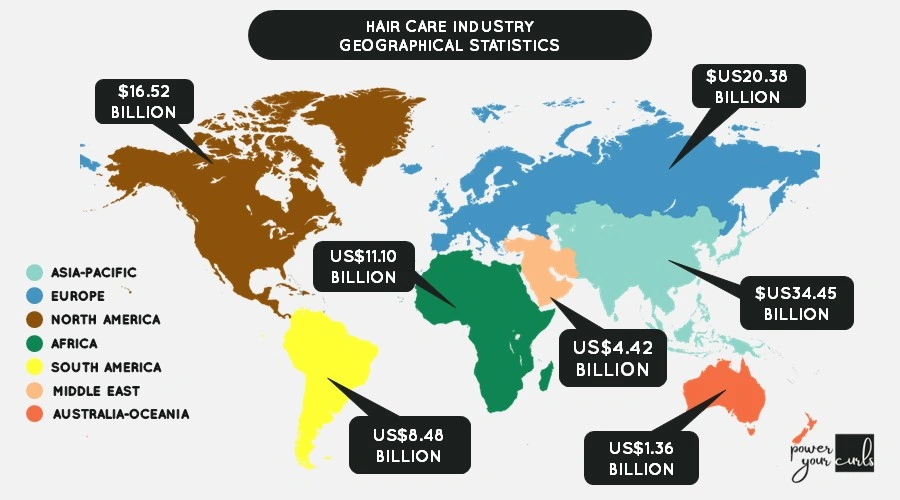

Regional Market Analysis

Asia Pacific

Asia Pacific holds the largest share of the global hair care market at approximately 36%, driven by rapid urbanization, rising disposable incomes, and evolving consumer demographics. Urban migration has concentrated demand in major cities, where consumers show a strong preference for premium, salon-grade, and customized hair care solutions. The region’s growth is further fueled by increased awareness of hair care procedures, especially among millennials and Gen X, who are spending more on hair and scalp care products. Environmental concerns, such as urban pollution, have also led to demand for protective and restorative products. China dominates the regional market, accounting for about 36% of APAC’s share, with robust growth supported by e-commerce, innovative product launches, and a shift toward natural and organic ingredients. India is another dynamic market, growing at around 7% CAGR, with consumers favoring herbal and sulfate-free products and strong competition between multinational and local brands.

North America

North America is projected to hold a 27% share of the global hair care market by 2037, with particularly high consumer spending on premium products. The region is characterized by a large, affluent customer base, a strong presence of international brands, and a highly systematized professional salon industry. The U.S. leads the market, with demand driven by fashion-conscious consumers, growing male grooming trends, and a preference for organic and high-quality hair care solutions. The premium segment is expanding rapidly, supported by social media influence, technological innovation in product formulation and packaging, and a shift toward specialized hair care regimens. Despite challenges such as health concerns over certain ingredients and the presence of counterfeit products, North America remains a key market for both mass and professional hair care.

Europe

Europe dominates the global natural hair care products market, holding a 38% revenue share in 2024. The region’s growth is driven by a strong consumer preference for natural and organic formulations, with increasing demand for products containing ingredients like coconut oil, shea butter, and tea tree oil. Millennials are prominent consumers, seeking holistic, ingredient-driven solutions and driving the shift away from synthetic products. Physical retail channels remain important, though online sales are growing rapidly. Italy, Germany, and France are expected to lead the market, with Germany experiencing a CAGR of 4.5% and a focus on product differentiation through packaging and innovation. Europe’s emphasis on sustainability, ingredient transparency, and regulatory compliance continues to shape the region’s hair care landscape.

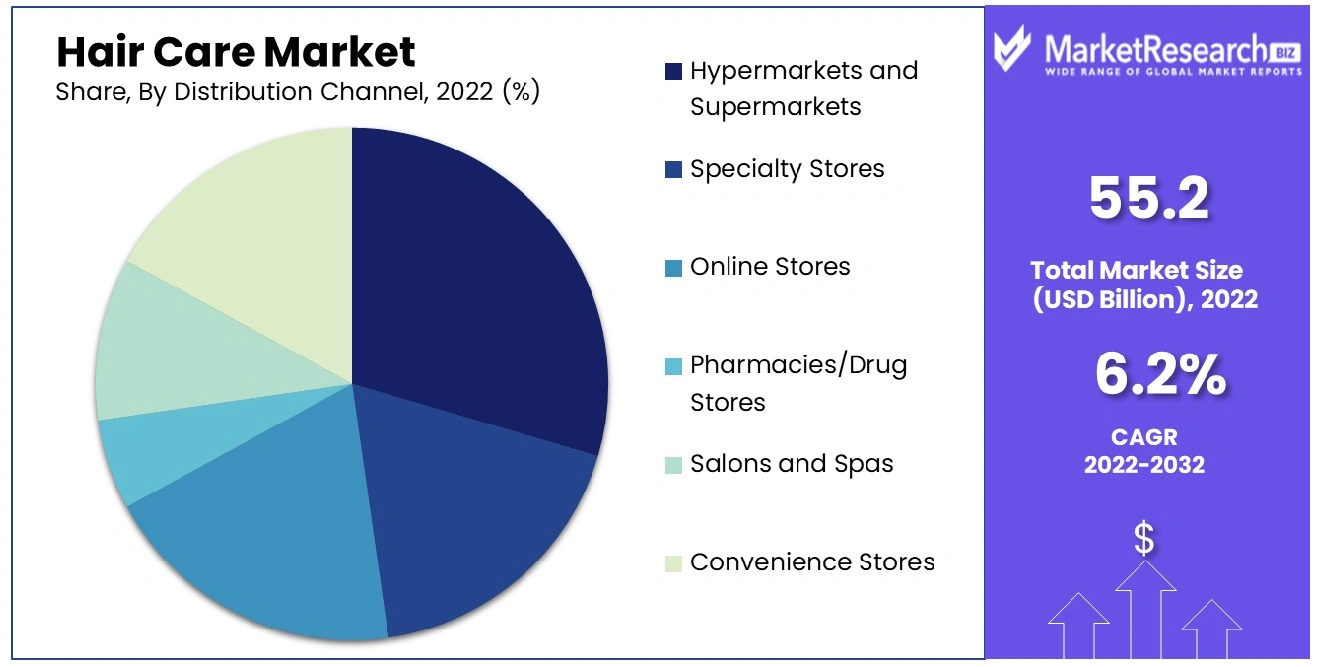

Distribution Channel Dynamics

Supermarkets/Hypermarkets Dominance

Supermarkets and hypermarkets continue to maintain their dominant position in the hair care distribution landscape, commanding approximately 43-46% of the market share in 2025. This dominance is attributed to several key factors that appeal to consumers:

The supermarket/hypermarket segment holds the largest hair care market share due to the availability of a wide range of products under a single roof, eliminating the need for consumers to browse multiple stores. This one-stop shopping experience provides significant convenience for shoppers purchasing hair care products alongside their regular groceries. Additionally, the ability to physically examine products before purchase reduces the chance of acquiring counterfeit goods, further strengthening consumer trust in this channel.

These retail formats generate an estimated USD 32.6 billion in hair care product sales in 2025, offering competitive pricing due to their bulk purchasing power. Many supermarkets and hypermarkets are also expanding their premium and natural hair care product offerings to cater to evolving consumer preferences, further solidifying their position in the market.

Online Channels: The Growth Leader

The online stores segment is emerging as the fastest-growing distribution channel for hair care products, expanding at 5.5% annually between 2024 and 2029. This rapid growth is driven by several factors:

The e-commerce hair care market is forecast to reach USD 40.1 billion by 2030, growing at a CAGR of 7.7% from 2024 to 2030. This growth is fueled by increasing e-commerce penetration, especially among younger consumers who prefer the convenience of online shopping. The COVID-19 pandemic has accelerated this trend, with more consumers turning to online platforms for their hair care needs.

Online retailers are leveraging technology to enhance the shopping experience, offering features like virtual try-ons for hair colors and personalized product recommendations. The segment is also benefiting from the direct-to-consumer (D2C) trend, with many hair care brands launching their own e-commerce platforms to build direct relationships with consumers.

Specialty Stores: The Premium Channel

Specialty stores continue to play a crucial role in the hair care market, particularly for premium and professional-grade products:

These stores offer a curated selection of hair care products, often accompanied by expert advice and personalized recommendations. The segment is benefiting from growing consumer interest in specialized hair care routines and high-quality products. Many specialty stores focus on niche markets, such as natural and organic hair care or products for specific hair types.

Premium hair care products are widely utilized in salons, spas, upscale retail venues, and online platforms. They cater to individuals seeking top-notch products to maintain the health and vibrancy of their hair. Professional hairstylists often favor premium hair care lines for their exceptional performance in achieving desired results for their clients, solidifying their position as a staple in the beauty industry.

The experiential aspect of shopping in specialty stores, including product demonstrations and in-store treatments, adds value for consumers seeking a more personalized approach to hair care. This segment is also adapting to the digital age by offering omnichannel experiences, combining the benefits of in-store shopping with online convenience.

Product Segment Analysis

Shampoo

Shampoo remains the dominant product segment in the global hair care market, holding the largest share at approximately 47% in 2025. This leadership is driven by the essential role of shampoo in basic hair cleansing routines and its ability to address a broad range of hair and scalp concerns, including dandruff, oiliness, hair fall, and damage. Modern shampoos are formulated with a variety of hair-enriching components such as vitamins, botanical extracts, minerals, and nourishing oils, which help stimulate growth from scalp follicles and promote overall hair health. The high frequency of use and the wide availability of specialized shampoos for different hair types and concerns further support the segment’s growth. Additionally, consumer demand is shifting toward natural and organic formulations, with a growing preference for products free from silicones, parabens, and sulfates.

Natural Hair Care

The natural hair care segment is experiencing robust expansion, reflecting rising consumer awareness about the potential risks of synthetic chemicals and a growing preference for clean, sustainable beauty products. Valued at USD 10.17 billion in 2024, the natural hair care market is projected to reach USD 16.99 billion by 2030, registering a strong CAGR of 9.4%. Millennials and women are leading this trend, seeking products with naturally hydrating, protecting, and strengthening properties. Brands are responding with innovative formulations featuring plant-based ingredients and eco-friendly packaging. The men’s segment is also growing rapidly as awareness of the benefits of natural hair care increases among male consumers.

Hair Coloring

Hair coloring products dominate the professional hair care segment, followed by shampoos and styling agents. The popularity of hair coloring is fueled by consumer desire for personalization, frequent style changes, and the growing acceptance of hair color as a form of self-expression. Professional salon treatments such as color correction and advanced coloring techniques are significant growth drivers, especially in North America and Europe. The demand for ammonia-free, plant-based, and less-damaging color formulations is also rising as consumers become more health- and environment-conscious. The professional segment benefits from strong loyalty to salon-exclusive brands and the expertise offered by stylists, although e-commerce is making premium hair coloring products more accessible to home users.

7. Future Trends and Innovations

The hair care industry is evolving rapidly with several key trends shaping its future.

Design Trends in Hair Care Packaging

Packaging design has evolved beyond mere functionality to become a key element of branding and consumer experience.

Minimalist and Premium Designs

Clean, simple designs are dominating the market:

Streamlined aesthetics with uncluttered looks, simple typography, and muted color palettes reflect modern sophistication

Premium materials such as glass, superior plastics, and metals are being used to enhance shelf appeal and create a perception of luxury

Functional minimalism focuses on user-friendly features while maintaining sleek appearances

Bold and Distinctive Designs

At the other end of the spectrum, some brands are embracing eye-catching designs:

Vibrant colors ranging from pastels to rich jewel tones are being used to convey brand personality and stand out on shelves

Unique bottle shapes including curved, sculptural designs help create memorable visual identities

Distinctive packaging formats help brands differentiate in a competitive marketplace

Functional Innovations

Functionality remains a core consideration in hair care packaging design, with significant advancements in how products are dispensed and used.

Advanced Dispensing Systems

Innovative dispensing solutions enhance user experience:

Airless bottles use vacuum technology to dispense products efficiently while preventing air contamination

Pump dispensers continue to be popular for thicker products like conditioners and hair masks

Twist-lock caps prevent spillage during travel and improve overall usability

A critical aspect of packaging functionality is emptiability-the amount of product residue left in emptied containers. Research shows significant variation depending on packaging type, with jars and airless pump dispensers retaining less than 1% of product residues for hand cream products, while standard pump dispensers can leave up to 26% of product unused[7]. This not only represents economic loss for consumers but also environmental waste and potential recycling challenges.

Packaging Formats

Various packaging formats serve different product needs:

Bottles remain the dominant format, holding a 25% market share in 2025, particularly for shampoos and conditioners

Tubes, jars, sachets, and pumps each serve specific product types and consumer preferences

Solid product formats like shampoo bars are driving innovation in plastic-free packaging solutions

Interactive and Personalized Packaging

Technology is enabling more engaging packaging experiences, aligning with the broader trend of personalization in hair care.

Personalization Features

The “hair intellectualism” movement has transformed how consumers approach hair care, with a growing demand for personalized solutions:

Personalized labels allow consumers to customize products with their names or messages

Customizable collections like Function of Beauty’s hair boosters enable consumers to create personalized formulations for specific hair types and concerns

Interactive features such as augmented reality (AR) integrated through QR codes provide tutorials and product information

Regional Market Insights

Different regions show distinct trends in hair care packaging:

USA holds a 28.3% market share in 2025, with consumers showing increasing interest in high-quality, customized hair care solutions for specific hair types, textures, and concerns

UK market is expanding due to increasing demand for sustainable and eco-friendly packaging solutions, particularly among younger consumers

Germany is experiencing a 4.5% CAGR, with emphasis on product differentiation through packaging innovations in a competitive market

Challenges and Considerations

Despite innovation, the industry faces several challenges:

Higher costs of eco-friendly packaging materials can be prohibitive, especially for smaller brands

Material suitability remains a challenge as packaging must protect product integrity while meeting sustainability goals

Product waste from insufficient emptiability of packaging represents both economic losses for consumers and environmental waste

The hair care packaging industry continues to evolve with a focus on sustainability, design innovation, and enhanced functionality. As brands strive to meet consumer expectations while reducing environmental impact, we can expect further advancements in materials, designs, and technologies that will shape the future of hair care packaging.

8. Technological Advancements

Biomimetic Technology: Mimics natural components in the skin and scalp, emerging as an exciting trend in professional formulations

Encapsulation Technology: Enables targeted delivery of active ingredients to the hair and scalp, resulting in maximum efficacy and prolonged release

Nanotechnology: Used for targeted delivery of active ingredients, with nanoparticles and nanoemulsions penetrating the hair shaft to deliver nutrients and repair damage from within

Genetic Testing: Advances may result in truly personalized hair care solutions based on individual genetic profiles, identifying genetic factors that contribute to hair concerns

9. Sustainability and Clean Beauty

Natural Ingredients Preference: Consumers increasingly seek products free from harsh chemicals and artificial additives, driving development of plant-derived ingredients

Sustainable Sourcing: By 2030, 95% of beauty ingredients are expected to come from bio-sources or abundant minerals

Ethical Production: Brands emphasize recyclable packaging and ethical sourcing practices to meet growing consumer demands for environmental responsibility

10. Final Note

Our belief that packaging is an extension of the brand experience is fully aligned with the most influential trends shaping the hair care industry in 2025. Packaging today is not just a protective vessel-it is a strategic tool for storytelling, differentiation, and consumer engagement. Brands are leveraging packaging to communicate their values, such as sustainability and ethical sourcing, through the use of recyclable, biodegradable, and refillable materials. Visual storytelling, minimalist aesthetics, and premium finishes help convey a sense of luxury and purpose, while inclusive and gender-neutral designs broaden a brand’s appeal.

Moreover, the integration of smart and personalized packaging is elevating consumer interaction to new heights. Features like QR codes, NFC tags, and augmented reality offer interactive tutorials, product information, and even anti-counterfeiting measures, making the packaging experience as intelligent and engaging as the product itself. Customization through digital printing and tailored formulations allows consumers to feel uniquely connected to the brand, while innovative dispensing solutions-such as airless pumps and precision droppers-ensure both product integrity and ease of use. By embracing these innovations, packaging manufacturers like Othilapak can become indispensable partners for brands, helping to shape a future where beauty, responsibility, and technology coexist seamlessly-delivering holistic, memorable experiences both inside and outside the bottle.