The world of pet care has transformed dramatically in recent decades. Once considered luxuries, pet grooming products such as shampoos, wipes, deodorizing sprays, paw balms, and dental hygiene tools are now regarded as everyday essentials for millions of households worldwide. The humanization of pets—treating them not just as companions but as beloved members of the family—has in turn reshaped consumer expectations. Today’s pet owners expect their furry companions to enjoy high-quality toiletries that parallel human personal care in terms of safety, formulation, and even aesthetics.

Yet, the factor that bridges the gap between product and consumer is not only what’s inside the bottle but how it is packaged. Packaging plays a central role in safety (ensuring formulas remain uncontaminated), sustainability (reducing waste and carbon footprints), and marketing (capturing consumer trust and loyalty at first glance). Functional design is especially important in the pet toiletries sector, where convenience matters—a single-handed pump during bath time or secure resealable wipes can mean the difference between a smooth or stressful grooming session.

This essay explores the story of pet toiletries packaging: its historical evolution, functional innovations, material science, design trends, sustainability considerations, global market dynamics, and future possibilities. By understanding packaging as more than a container, we see its deeper cultural role as a vessel of trust, identity, and responsibility within the broader pet care economy.

1. Historical Overview of Pet Toiletries Packaging

The packaging of pet toiletries reflects the gradual maturation of the pet care industry. For much of the early 20th century, pet grooming relied on generic tools—basic soap bars, multipurpose powders, and home remedies often packaged in plain tins or boxes. These were utilitarian and unbranded, with packaging meant simply to protect the product from moisture or damage.

The rise of industrial plastics in the mid-20th century transformed accessibility. Simple HDPE and PET bottles became the standard containers for shampoos, sprays, and conditioners. Unlike glass jars or tins, plastics were shatter-resistant—essential when products might be jostled during energetic grooming sessions. These plastic packages prioritized function over aesthetics, aligning with a time when pets were largely seen in service roles (herding, guarding, hunting) rather than as pampered companions.

By the 1980s and 1990s, however, cultural shifts elevated pets into the realm of family life. The “pet humanization” movement began encouraging the development of pet-specific toiletries. Packaging evolved to resemble human toiletries but with playful twists—bright paw graphics, cartoon mascots, or friendly fonts designed to reassure owners.

The 2000s deepened this convergence. Brands began offering premium packaging inspired directly by human beauty or baby care products. Sleek pumps, travel kits, and child-resistant closures entered the category, embedding both safety and style. By the late 2010s, sustainability became a dominant driver amid growing global concerns about plastic waste. Compostable wipes pouches, refillable shampoo bottles, and post-consumer recycled plastics gained traction.

Today, pet toiletries packaging sits at a crossroads of multiple influences: humanization, functionality, sustainability, and cultural narratives. Its journey from simple tins to luxury refillables mirrors our evolving relationships with animals and with the planet.

2. Functional Aspects of Packaging

The functional aspects of pet toiletries packaging are crucial because unlike human products, they must address challenges related to unpredictable animal behavior, ingredient sensitivity, and stressful usage scenarios. The three main pillars—safety, hygiene, and convenience—are supported by specific packaging technologies and material innovations.

Safety and Dispensing

Pet grooming sessions are often dynamic, so packaging materials must withstand chewing, scratching, and rough handling. High-density polyethylene (HDPE) is widely used because it resists splintering, has good chemical compatibility with liquid formulas, and is widely recyclable. PET is also common for transparent bottles but is less chew-resistant than HDPE.

Dispensing systems are engineered to minimize waste and ease stress. Pump dispensers with controlled output give measured amounts of shampoo, preventing excess use while simplifying bath time. Mist sprays with fine nozzles distribute product evenly while calming anxious pets by avoiding the sudden burst that aerosol cans create. Notably, aerosols are declining in this category due to environmental regulations (propellants linked to VOC emissions) and because pets are sensitive to sudden sounds and sprays.

For medicated products like anti-flea shampoos or tick treatments, child-resistant closures and tamper-evident caps play a dual role: preventing ingestion accidents and reassuring consumers of professional-grade safety. This aligns with regulations in markets such as the EU, where veterinary-care-adjacent grooming products must meet higher safety standards.

Hygiene and Preservation

Many pet toiletries contain natural actives (oatmeal, aloe vera, tea tree, or herbal extracts) that degrade quickly if exposed to light, air, or cross-contamination. Packaging design compensates through:

- UV-blocking bottles (often amber or opaque HDPE) to protect photosensitive actives.

- Air-tight seals and inner liners to prevent evaporation and bacterial contamination.

- Thicker-walled jars or black glass packaging (emerging in premium paw balms) to mimic the protection used in human skin creams.

Wipes are especially dependent on packaging design for efficacy. If seals fail, moisture content evaporates, rendering wipes unusable. Adhesive flap seals are being replaced by rigid flip-top closures, which retain freshness longer and reassure consumers with audible “click” closure cues. This packaging feature directly correlates with repeat purchase patterns—if wipes dry out, brand trust is damaged.

Convenience for Pet Owners

Practicality often determines customer loyalty in pet care toiletries. Bathing or grooming typically involves handling a restless animal, so packaging innovations aim to allow single-handed usability:

- Foamer pumps pre-lather product, reducing time during bathing.

- Bottles with ergonomic grips or silicone sleeves reduce slippage when hands are wet.

- Squeezable silicone tubes enable precise application, even in awkward positions.

Mobility is another trend reshaping packaging. Travel-sized bottles, resealable pouches of wipes, and compact paw spritzers address “on-the-go” needs for car rides, dog parks, or vacations. In some markets, brands even launch pocket-sized deodorizing sprays that fit in a handbag—mirroring the lifestyle segmentation seen in human cosmetics and personal care.

In essence, functional packaging transforms pet toiletries from simple commodities into solutions for real-world pet-care stress points. By merging material resilience, preservation, and ergonomic convenience, packaging becomes a critical factor in consumer satisfaction and brand competitiveness.

Would you like me to expand this into a side-by-side comparison of materials and closure types, showing which are best suited for each product (e.g., shampoos, wipes, sprays, balms)? That would give a very practical reference.

3. Materials Used in Packaging

The materials used in pet toiletries packaging have a direct impact on product performance, consumer trust, and environmental footprint. Choices are shaped by cost efficiency, functionality, market positioning, and increasingly by sustainability regulations. Each material brings distinct strengths and limitations, which determine where it is best applied in the pet toiletries sector.

Traditional Plastics (HDPE, PET)

High-density polyethylene (HDPE) and polyethylene terephthalate (PET) dominate pet toiletries packaging because of their durability, chemical resistance, and affordability.

- HDPE: Common for opaque shampoo bottles, conditioners, and sprays. It resists impact, is chew-resistant, and prevents splintering if pets paw or bite at containers. Its matte appearance also conveys sturdiness.

- PET: Favored for clear bottles to showcase the color and clarity of shampoos or cleansing liquids. PET bottles are lightweight and shatterproof, offering a glossy appearance that mimics glass but with fewer safety risks.

Drawback: Both are fossil fuel-derived, and PET in particular is scrutinized for its role in single-use plastics waste, making sustainability an ongoing question despite recyclability in many regions.

Glass

Glass is gaining traction in premium and luxury grooming lines, especially for products like paw balms, grooming oils, or sensitive shampoos.

- Amber or black glass jars block UV light, protecting natural actives like aloe or chamomile extracts from degradation.

- Glass conveys high-end brand positioning, signaling purity and ingredient quality.

Drawback: Safety is the biggest concern. Glass containers can break if dropped during grooming—a scenario that poses risks in wet, high-activity environments such as baths. This limits its use to small, non-liquid formats where durability is less critical.

Metal

Aluminium tins and occasionally steel canisters are popular for compact toiletries such as paw balms, deodorizing powders, and solid shampoo bars.

- Aluminium is lightweight, rust-resistant, and 100% recyclable without quality loss, making it an eco-favored option.

- The material gives products a sturdy, minimalist appearance that appeals to eco-conscious and design-conscious consumers alike.

Drawback: Metal dents more easily than plastic, which can compromise sealing. It is also less suitable for large liquid formats due to corrosion risks if protective coatings degrade.

Bio-based Plastics

Bio-based plastics derived from sugarcane ethanol, corn starch, or cellulose are marketed as renewable alternatives to fossil fuel-based plastics.

- PLA (polylactic acid) and bio-PET mimic traditional plastics in structure, allowing similar production processes and container shapes.

- They are especially suited for shampoo and conditioner bottles where consumers value eco-friendly labeling.

Drawback: Despite their reduced carbon footprint, they face scalability challenges and may cost significantly more to produce. Furthermore, some bio-plastics require industrial composting, limiting actual environmental benefits in regions without proper infrastructure.

Compostable Packaging

Particularly relevant for wet wipes and single-use packets, compostable films and laminations made from plant fibers or starch provide breakthrough opportunities.

- These materials enable consumers to feel less guilty about disposables, especially when paired with bamboo-based wipes or biodegradable substrates.

- Compostable resealable pouches are positioned as “plastic-free”alternatives in premium and sustainability-driven markets.

Drawback: True compostability depends heavily on waste management infrastructure. Many regions lack the commercial composting facilities that can properly degrade these materials, leading to consumer confusion or “greenwashing.”

Balancing Trade-offs

Traditional plastics remain dominant because of cost efficiency and wide availability, but niche and premium brands increasingly use glass, aluminium, or bio-based solutions to attract environmentally aware buyers. The challenge lies in creating packaging that:

- Preserves product safety and shelf stability.

- Resists breakage or leakage under real-world pet use.

- Meets growing sustainability expectations without inflating prices excessively.

4. Packaging Design Trends

Packaging design trends in pet toiletries have become increasingly specialized, reflecting evolving consumer expectations around visual identity, emotional resonance, and cultural relevance. Brands now view packaging as a primary tool to convey product benefits and differentiate in a crowded marketplace.

Visual Aesthetics

Colors and forms are chosen to trigger immediate psychological associations. Pastel hues—such as pale blues and pinks—are used for sensitive skin and gentle formulations, borrowing cues from baby-care sectors to imply safety and nurturing. Bright greens signal eco-friendliness and natural ingredients, making them popular among brands emphasizing sustainability. Lavender or purple bottles denote calming features, central to anti-stress shampoos and wipes for anxious pets. For luxury positioning, brands employ sleek black packaging, metallic foils, and modern silhouettes to evoke exclusivity and high quality.

Two conflicting design strategies are visible:

- Minimalist, wellness-focused packaging uses simple fonts, clean white or light backgrounds, and discreet icons, appealing to premium buyers who value sophistication and subtlety.

- Playful, cartoon-inspired packaging incorporates bold colors, paw prints, and animal characters to attract family consumers and foster a sense of fun, approachability, and warmth.

Storytelling & Branding Through Packaging

Effective packaging tells a story before customers read the label. Trust-building taglines (“Vet-approved,” “Dermatologist-tested,” “Eco-pure”) establish expertise or ethical commitment. Light-hearted branding with paw illustrations or playful fonts projects friendliness and accessibility—especially for multi-pet or all-ages products. In contrast, premium lines echo human skincare and wellness brands with claims about ingredient sources, dermatological benefits, or artisan quality.

Transparency is increasingly crucial: see-through sections of bottles or jars allow buyers to inspect color and consistency, enhancing perceived honesty and product purity. Technologies such as QR codes or NFC tags offer access to ingredient information, animal welfare certifications, or educational videos, allowing brands to deepen relationships through interactive, transparent communication.

Cultural Influences

Here are specific brand examples that illustrate how packaging adapts to regional styles and values in the pet toiletries industry:

Asia

- Cathy Cat (Japan) and Inaba (Japan) often use mascot characters, soft pastel colors, and playful shapes on their bottles and pouches, appealing to a sense of cuteness and emotional bonding.

- Brands like Petio and Unicharm include “kawaii”designs and tactile textures, encouraging positive interactions and brand memorability.

Europe

- Lily’s Kitchen (UK) is known for its minimalist packaging, using recyclable paper labels, muted earth tones, and featuring eco-certifications clearly on the packaging to reflect sustainability commitments.

- Edgard & Cooper (Belgium) uses compostable pouches, simple graphics, and natural hues to convey environmental values and regulatory compliance.

North America

- Wild One (USA) and Kin+Kind (USA) feature sleek black bottles, metallic accents, and modern typography, drawing direct inspiration from high-end beauty and wellness products.

- Burt’s Bees for Pets integrates collaborative design and recognizable brand associations to create an aspirational, lifestyle-first package.

Cultural Flexibility

These packaging approaches are not only functional; they’re powerful tools for communicating brand values and connecting emotionally with local consumers. Whether through playful mascots, eco-minimalist labels, or upscale aesthetics, packaging in each region acts as an ambassador for the brand’s story and resonates with specific market expectations.

5. Sustainability in Pet Toiletries Packaging

Sustainability in pet toiletries packaging has become a major focus due to rising environmental concerns and shifting consumer expectations. The industry is under pressure to reduce its reliance on single-use plastics and offer alternatives that align with broader sustainability movements in personal care and food markets.

Environmental Concerns

Pet toiletries packaging, especially plastic wipes packets and shampoo bottles, is a significant contributor to landfill waste and ocean plastic pollution. As awareness of environmental impact grows, today’s pet owners are increasingly proactive in seeking packaging that is recyclable, reusable, or biodegradable. Consumer choices are being shaped by eco-labels, visible recyclability disclosures, and brand commitments to reducing carbon footprints.

Sustainable Practices

Innovative brands are employing several strategies to address environmental impact:

- Refill Systems: Some companies now offer shampoo and grooming products in refillable pouches or bulk stations at pet stores. These systems significantly reduce plastic waste by allowing consumers to reuse durable bottles.

- PCR Plastics: Bottles made from post-consumer recycled (PCR) plastics help close the recycling loop, using materials recovered from household waste. This offers a balance between resilience and reduced environmental burden.

- Biodegradable Wipes: Pet wipes manufactured from bamboo fibers, wood pulp, or compostable cellulose substrates are often packaged in recyclable film. These options cater to consumers who wish to avoid synthetic fibers but depend on proper composting facilities to realize environmental benefits.

- Packaging-Light Accessories: Accessories such as bamboo toothbrushes, soap bars in paper sleeves, and paw balm sticks wrapped in compostable paper are emerging as “lighter footprint”alternatives to traditional plastic-heavy formats.

6. Consumer Behavior and Packaging Psychology

Consumer behavior around pet toiletries packaging is shaped by psychology, perceived value, and personal identification. For pet owners, packaging isn’t just practical—it’s a signal of trust, quality, and shared values.

Trust and Transparency

Trust begins with packaging details: visible ingredient lists, veterinary endorsements, and recognizable eco-labels like “biodegradable” or “PCR recycled.” These signals reassure cautious buyers and serve as a shortcut for selecting ethical, safe products. Consumers are far more likely to buy—and remain loyal to—brands that make it easy to verify quality, ethics, and safety at the point of sale.

The Power of Premium Packaging

Premium packaging has a measurable impact on willingness to pay. According to industry research, elevated packages—such as frosted pump bottles with metallic accents—are associated with greater reliability, higher product efficacy, and increased desirability. Many shoppers will pay two or three times as much for a product if its packaging effectively conveys premium positioning, as seen with luxury toiletries and treat brands.

Humanization: Identity and Emotional Resonance

The “humanization” trend drives owners to project their own care preferences onto their pets, leading brands to adopt design cues from wellness, baby-care, and prestige beauty. This results in packaging that:

- Mimics human products in color, texture, and label layout

- Uses mascots, soothing colors, and familiar fragrance cues to create emotional warmth

- Appeals to owners’desire to reflect their own personality and values in product choices

Packaging as Extension of Owner Identity

Ultimately, pet toiletries packaging becomes an extension of the owner’s identity—a public declaration of careful stewardship, love, and responsibility. Packaging choices are motivated not purely by product efficacy, but also by status, aspirational emotions, and lifestyle alignment. For a growing segment, packaging is the deciding factor in building lasting loyalty and repeat purchase behavior.

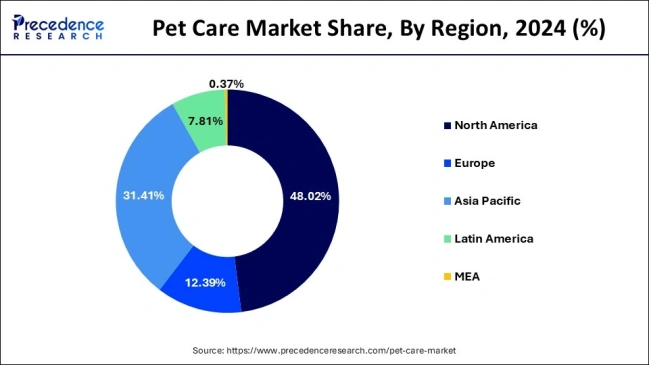

7. Global Packaging Market Landscape

Regional packaging differences in the pet toiletries market reflect diverse cultural values, consumer priorities, and regulatory landscapes. These factors shape both the form and function of packaging globally, requiring companies to adapt their strategies for each major region.

North America

In North America, premiumization is a dominant trend—with boutique brands emphasizing stylish aesthetics, multi-functional closures, and packaging that fits seamlessly into home environments.

- Dry food packaging (bags, pouches, containers) is especially important and increasingly designed for omni-channel retail (online and in-store).

- Brands compete on innovation, introducing attractive formats, calming agents, and personalized solutions for discerning buyers.

- Sustainability is now a major competitive edge; manufacturers promote recyclable, compostable, and plant-based options—but premium appearance and functional innovation drive consumer decisions.

Europe

Europe’s packaging landscape is strongly shaped by sustainability and regulatory pressure.

- Over 69% of pet owners actively prioritize sustainable packaging, influencing purchasing behavior toward eco-friendly materials and minimalist designs.

- EU directives target reductions in single-use plastics and mandate minimum recycled content in plastic bottles, driving brands toward innovation in recycled and compostable solutions.

- Many products now feature certifications, recycled paperboard, and organic labeling, with visual restraint to convey credibility and environmental leadership.

Asia

Asian markets favor visual storytelling, cuteness, and fragrance-forward design.

- Brightly colored bottles, playful illustrations, and “kawaii”mascots dominate shelf appeal, making products stand out in retail environments.

- Packaging often doubles as identification for product features, with vivid illustrations and segmentation for coat types or skin needs.

- Functional innovation includes leak-proof bottles and convenient portion packs tailored for smaller living spaces and frequent travel.

Emerging Markets: Latin America and Africa

In Latin America and Africa, affordability and practicality are key, but eco-consciousness is rising.

- Simple HDPE bottles, pouches, and refill packs are most common due to cost constraints and the need for durable packaging in varied climates.

- As middle-class pet ownership rises, there’s increased demand for premium and health-focused products, stimulating gradual improvements in packaging design and materials.

- Growing urban populations and sustainability awareness are driving investments in recyclable and innovative options, particularly in Brazil, Mexico, South Africa, and India.

Strategic Implications

These differences highlight the importance of cultural adaptation and regulatory flexibility. Global brands must tailor their packaging design and materials to local consumer preferences, environmental legislation, and market realities—or risk falling behind competitors in fast-shifting markets.

8. Conclusion

Pet toiletries packaging today stands as a vibrant, transformative element in the world of pet care, weaving together innovation, wellness, sustainability, and emotional connection. Packaging is no longer just a practical wrapper—it’s a storytelling platform, a mark of quality, and a symbol of how deeply owners care for their pets.

From the earliest utilitarian containers, the industry has evolved to embrace luxury UV-protected bottles, biodegradable refill systems, smart freshness indicators, and breed-personalized designs. These advancements mirror the changing roles of pets in our lives, as well as the growing desire for eco-consciousness and transparency in every purchase.

Looking ahead, packaging will only become more integral—smarter, greener, and more emotionally engaging—turning each grooming routine into a cherished ritual of care. The next generation of pet toiletries packaging will not only protect and present products but will also celebrate the bond between pets, people, and the planet.