In the highly competitive world of retail, e-commerce, and global logistics, paper boxes have evolved into far more than simple containers. They’re now strategic tools for brand communication, sustainability commitments, and supply chain efficiency. From the sturdy corrugated boxes that deliver fragile electronics halfway around the world to the luxuriously rigid gift boxes that cradle fine fragrances, paper packaging is a $390+ billion global industry — and growing.

The rise of e-commerce has turbocharged demand for durable, lightweight, and customizable packaging. Consumers, driven by environmental awareness, increasingly prefer paper over plastic alternatives, viewing it as both biodegradable and recyclable. Meanwhile, brands recognize that the packaging is often the first physical interaction a customer has with their product — making it a critical component of the unboxing experience.

This blog takes a deep dive into paper boxes in three dimensions:

The Product — An in-depth look at types, materials, features, and advantages.

The Packaging Medium — How design, printing, and sustainability trends shape consumer perception.

The Market — Data-backed insights into global trends, regional growth patterns, competitive landscapes, and future opportunities.

By the end, you’ll see how a product category that might seem ordinary at first glance is actually a dynamic driver of consumer engagement, environmental stewardship, and corporate profitability.

1. The Product: Understanding Paper Boxes

Paper boxes come in a broad spectrum of forms and constructions, each tailored for specific product categories, supply chain requirements, and brand positioning. While their core function is to protect the contents, modern paper boxes also serve as a primary brand touchpoint and a signal of environmental responsibility.

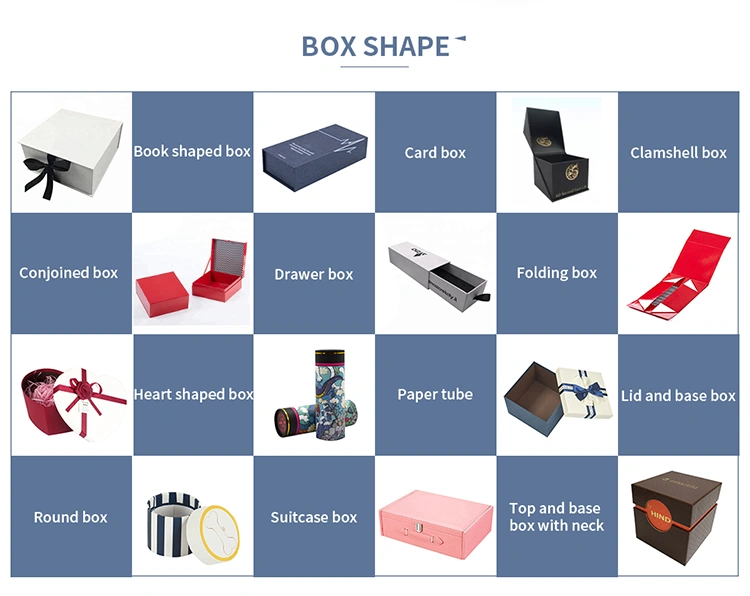

Types of Paper Boxes

1. Folding Cartons

Material: Typically manufactured from 250–450gsm paperboard, often Solid Bleached Sulfate (SBS) or similar grades, which can be coated on one or both sides for printability.

Uses: Widely applied in pharmaceuticals, cosmetics, frozen foods, cereals, and a host of other consumer packaged goods.

Key Advantage: Delivered flat to manufacturers, folding cartons can reduce logistics and warehousing costs by up to 50% compared to rigid packaging.

Design & Branding: Highly compatible with offset printing, special coatings, and embellishments.

Example: L’Oréal’s mascara cartons—premium folding cartons with glossy lamination and metallic foiling that catch light and attention on retail shelves.

2. Corrugated Boxes

Structure: Made of a fluted paper medium (which provides cushioning) sandwiched between linerboards. Corrugation grades range from:

- E-flute (1.2 mm): Thin profile, excellent for retail displays and subscription boxes.

- A-flute (5 mm): Thick, ideal for heavy-duty shipping and industrial goods.

Uses: E-commerce mailers, export cartons, bulk packaging, industrial product transportation.

Example: Amazon’s “Frustration-Free Packaging”—entirely recyclable corrugated cartons with minimal ink usage, designed to protect goods in transit and reduce waste.

3. Rigid (Set-Up) Boxes

Material: Dense 1–3 mm chipboard wrapped in decorative printed paper or specialty materials.

Uses: Luxury products such as high-end electronics, watches, perfumes, spirits.

Construction Note: Do not fold flat; their permanence and sturdiness are part of their premium appeal.

Example: Apple’s iPhone box—precision-engineered with a controlled lid-to-base friction fit, giving users a slow, luxurious reveal.

4. Die-Cut Boxes

Description: Fully customizable shapes produced via die-cutting technology. Often used for point-of-sale product presentation and gift packaging.

Design Elements: May incorporate transparent windows (historically PET, now often replaced by cellulose film for sustainability concerns).

Applications: Retail gift packs, promotional displays, electronics.

5. Sleeved Boxes

Structure: Combines a folding or rigid base unit with a sliding decorative sleeve.

Uses: Premium chocolates, consumer electronics accessories, wellness kits.

Branding Potential: The sleeve offers extra printable surface area and can act as a tamper seal.

6. Specialty Gift Boxes

Features: Reusable, designed for premium presentation; can have magnetic closures, ribbon pulls, velvet linings, or hidden compartments.

Market: Confectionery, jewelry, boutique apparel.

Material Composition and Performance

The choice of substrate defines the box’s functional attributes, print performance, and environmental footprint.

- Kraft Paper:

- Unbleached for natural appeal.

- High tensile strength suitable for heavy or rugged goods.

- Favored by eco-conscious brands for its minimal processing.

- Duplex Board:

- Coated on one side for vibrant printing, gray on reverse.

- Common in frozen foods, detergents, and other mid-tier retail packaging.

- Art Paper:

- Smooth, glossy finish ideal for high-resolution imagery and full-color branding.

- Used heavily in cosmetics and promotional sleeve printing.

- Recycled Paperboard:

- Contains up to 100% post-consumer fiber.

- Supports sustainable brand positioning, though may need coating for moisture resistance and premium finish.

Material selection depends on:

- Bursting Strength: Ability to withstand internal pressure before puncturing.

- Surface Quality: Determines achievable print fidelity.

- Moisture Barrier Requirements: Frozen and chilled goods often need special coatings or laminations.

Functional Features of Paper Boxes

Well-designed paper boxes balance aesthetics with critical performance factors:

Compression Strength:

- Especially for corrugated boxes used in pallet stacking.

- Measured by Edge Crush Test (ECT)—higher ECT means better stacking strength.

Tear Resistance:

- Crucial for products shipped through humid regions or handled multiple times during transport.

Print Fidelity:

- Smooth, coated surfaces maximize color sharpness and branding clarity, crucial for beauty, tech, and luxury markets.

Environmental Compliance:

- Large retailers like Walmart and Tesco now require primary and secondary packaging to be curbside recyclable or certified compostable.

Advantages of Paper Boxes

Eco-Friendly:

- Renewable materials, recyclable in most municipal systems.

- Often integrated into closed-loop fiber recovery systems where used boxes become feedstock for new boxes.

Lightweight:

- Reduces transportation energy use and costs, improving supply chain efficiency.

Versatile:

- Adaptable to products from bulk industrial shipments to luxury gifting.

Brandable:

- Entire surfaces serve as marketing space. Special textures, laminations, and structural techniques can enhance perceived product value.

2. Paper Box as Packaging

Design & Aesthetics

A well-designed paper box transforms packaging from a simple container into a dynamic extension of a brand. As a physical touchpoint, it instantly conveys the product’s positioning, values, and target audience. For premium cosmetics, rigid boxes are favored for their substantial feel and ability to house advanced finishing: think soft-touch matte laminations, gold foil or metallic accents, and even vividly printed interiors. Such details create an immersive “unboxing” ritual that fuels social media shares and brand loyalty.

In food packaging, vibrant offset printing on folding cartons is used to communicate freshness, flavor, and visual appeal—bright fruit imagery, mouthwatering bakery illustrations, and playful fonts grab attention from shelves or delivery bags alike.

Minimalist branding—pioneered by eco-focused brands like Everlane—leans into the natural appeal of raw kraft board, using understated logos and subtle embossing for a clean, ethical look that appeals to conscious consumers.

Printing Techniques

The choice of printing not only affects visual impact but also communicates brand intent and product quality:

Offset Lithography: The gold standard for vivid, consistent color reproduction (CMYK or Pantone-matched), ideal for high-volume runs on folding cartons and luxury packaging where exact color matters.

Digital Printing: Best for short runs or personalized packaging; brands can adapt graphics, messaging, or even customer names with minimal lead time, perfect for fast-moving campaigns and small-batch runs.

Flexography: Durable and efficient for corrugated boxes, especially those requiring high-speed production like mailers or retail displays.

Screen Printing: Adds bold, tactile layers in spot colors, suited for specialty boxes or limited editions wanting a handcrafted feel.

Advanced enhancements like spot UV (for glossy highlighted areas), foil stamping (for metallic shine), and embossing/debossing (for raised or recessed logos and graphics) dramatically increase shelf presence and elevate the customer experience.

Customization Trends

Modern packaging thrives on customization, allowing brands to create unique experiences and drive consumer engagement:

Personalized Subscription Boxes: E-commerce brands print customer names and unique artwork directly onto boxes, turning each package into a bespoke experience that customers love to share online.

Event & Seasonal Packaging: Leading retailers like Starbucks have extended their holiday design concepts to bakery cartons and sleeves, harnessing packaging as a key seasonal marketing channel.

Limited Edition Collector Packaging: Footwear and luxury brands (such as Nike) release high-profile products in special-edition boxes featuring exclusive artwork, die-cuts, or hidden compartments—making even the packaging collectible.

These strategies foster emotional connections and help brands stay top-of-mind in competitive markets.

Sustainability Integration

Sustainable packaging practices have become industry imperatives as both consumers and regulators demand greener solutions:

Replacing Plastic Inserts: Brands such as IKEA and Dell have swapped out Styrofoam with custom-molded paper pulp inserts in corrugated boxes, reducing landfill waste and improving recyclability.

Responsible Sourcing: Boxes crafted from FSC-certified paperboard ensure that raw materials come from responsibly managed forests, addressing growing consumer concern about deforestation.

Maximizing Recyclability: By eliminating plastic lamination and coatings, brands like Lush Cosmetics use “naked” or uncoated kraft board that breaks down easily in recycling or composting ecosystems.

These steps not only align with global sustainability standards but also position brands as forward-thinking and environmentally responsible—attributes increasingly sought by modern consumers.

3. Manufacturing Processes & Quality Control in Paper Box Production

Producing high-quality paper boxes involves a series of precise, standardized processes to ensure functional performance, brand presentation, and compliance with industry requirements. Here’s an in-depth look at the modern workflow and how advanced quality control integrates at every step:

Manufacturing Stages

Structural Design

The process begins with specialists creating detailed CAD dielines—digital blueprints that define every dimension, fold, and cut. This ensures exact fit for the intended product and compatibility with automated machinery.

Material Procurement

Manufacturers select from virgin fiber, recycled board, or hybrid substrates based on strength, sustainability targets, and print requirements. Sourcing often involves working with FSC- or PEFC-certified suppliers to guarantee environmental compliance.

Printing

The chosen board is printed using the technique best suited for the job:

- Offset Lithography: Best for high-volume, high-precision color jobs like folding cartons.

- Digital Printing: Used for personalized short runs, prototypes, or limited editions.

- Flexography: Ideal for corrugated surfaces and large-scale logistics packaging.

Die-Cutting

Steel-rule dies—custom-shaped blades—stamp the printed sheets into box blanks, creating precise shapes, tabs, windows, and features dictated by the dieline.

Folding & Gluing

Highly automated production lines can process up to 200,000 cartons per day, applying adhesives and folding with accuracy at high speed. Robotics and real-time monitoring further reduce error rates and labor.

Finishing

Final touches include coatings (gloss/matte for protection and aesthetics), foil stamping (for metallic effects), or embossing (for raised graphics and tactile branding).

Quality Control (QC) Tests

Modern paper box production incorporates rigorous QC throughout:

- Box Compression Test (BCT): Measures how much pressure a box can withstand before collapsing, critical for safe stacking during storage and transport.

- Cobb Test: Evaluates a material’s water absorption over a set period, ensuring packaging can withstand humid environments or condensation.

- Ink Rub Test: Assesses the durability of printed images/graphics against abrasion—a key indicator for shelf-life and handling.

Automation & Innovation

Advanced manufacturers have adopted:

- AI-powered vision systems: These instantly detect printing or assembly defects, color inaccuracies, or misaligned cuts on production lines—improving both consistency and output rates.

- Robotic folding/gluing: Robots maintain tight tolerances on repetitive tasks, decrease downtime, and further elevate production speeds, especially on complex or multi-part boxes.

In summary, the combination of robust design, high-speed automated production, and multilayered quality control ensures today’s paper boxes not only meet the practical demands of logistics and presentation but also pass rigorous strength, durability, and compliance standards—making them a vital component of modern packaging supply chains.

4. Market Analysis of the Paper Box Industry

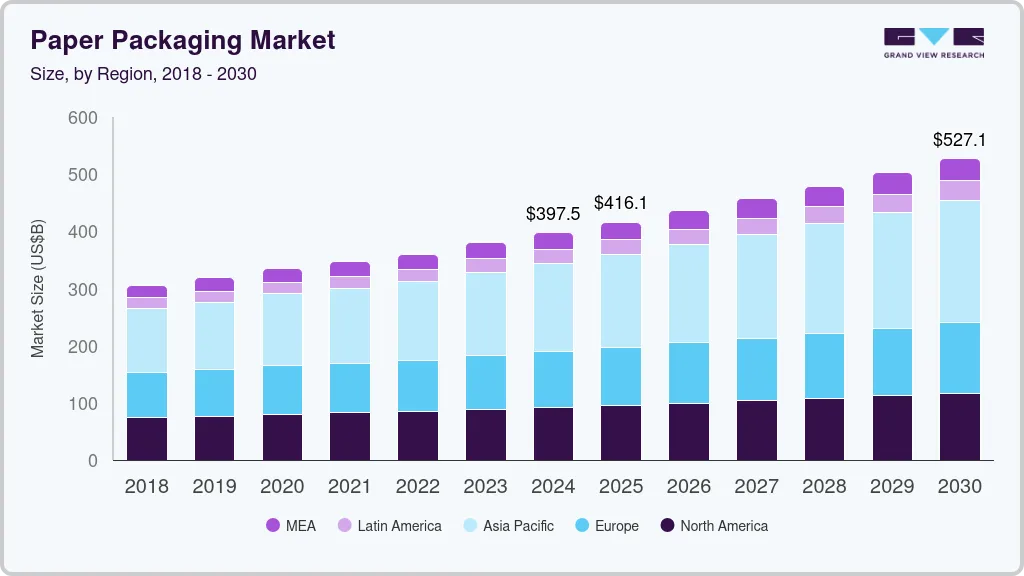

Global Size

The global paper box and paper packaging market was valued at approximately $397billion in 2024 and is projected to reach $527billion by 2030, reflecting a steady compound annual growth rate (CAGR) of 4.8%. Corrugated boxes are the dominant product segment, accounting for around 43% of total market value. Their continued popularity is attributed to their protective capabilities, cost effectiveness, and heightened demand from e-commerce fulfillment, grocery, and general retail.

Regional Markets

Asia-Pacific (38–40% market share):

The region leads in both production and consumption, largely due to the rapid expansion of e-commerce in China and India. Asia-Pacific’s cost-competitive manufacturing and vast logistics sector drive large-scale demand for corrugated and folding cartons.

North America (27–29%):

This market is defined by a preference for premium packaging and high compliance with sustainability standards. North American brands emphasize recycled content, innovative printing, and rigid boxes for luxury/premium goods.

Europe (20–22%):

European markets are distinguished by strict recycling mandates and a stronger demand for luxury rigid boxes—especially in cosmetics, confectionery, and high-end retail. Stringent EU regulations further push the adoption of recyclable and compostable materials.

Sector Segmentation

Food & Beverage remains the largest sector, as brands shift to paper-based grease-resistant coatings while phasing out plastic liners.

Cosmetics/Personal Care focus on upscale presentation, leveraging elaborate rigid cartons.

E-Commerce continues robust expansion, with brands investing in strong, branding-rich corrugated shippers to improve customer experience and protection in transit.

Electronics, Apparel & Footwear demand high-quality print and structural inserts to protect and showcase higher-value goods.

Competitive Landscape

The industry is highly consolidated at the top, with leading companies including International Paper, Smurfit Kappa, DS Smith, and Mondi setting benchmarks for global supply, innovation, and environmental compliance.

Major innovation frontiers include:

Smart packaging: Boxes embedded with QR codes, NFC, or wireless tracking for consumer engagement and logistics management.

Plant-based coatings: Alternatives to traditional petroleum-based barriers, making cartons both food-safe and easily recyclable or compostable.

Challenges

Despite robust growth, the industry navigates several headwinds:

Fluctuating pulp prices create uncertainty for manufacturers and can compress margins, forcing frequent repricing of finished goods.

Overcapacity in corrugated plants, particularly in rapidly industrializing regions, can lead to price competition and lower factory utilization rates.

Plastic-free barrier coatings, critical for food and some e-commerce applications, still command a higher cost than legacy solutions. Cost and scalability remain obstacles to full adoption, although ongoing R&D efforts are driving down prices.

Summary:

The global paper box sector is rapidly evolving, with growth driven by e-commerce, food service innovation, and brand-focused luxury goods. While sustainability demands and regulatory shifts offer clear opportunities, raw material volatility, technology costs, and competitive pressures present ongoing challenges. The market’s trajectory will be shaped by advances in materials science, automation, and the ability of brands and manufacturers to balance sustainability, performance, and cost-efficiency.

5. History & Evolution of Paper Boxes

The history of paper boxes is a fascinating chronicle of innovation, adaptation, and reflection of wider shifts in commerce, technology, and environmental consciousness.

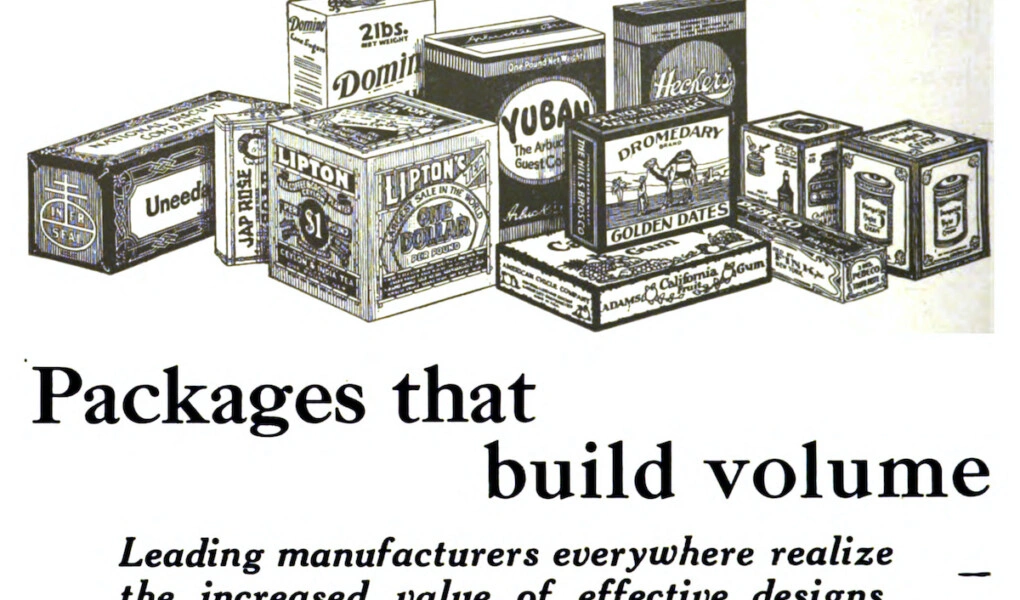

The Birth of the Folding Carton

The story begins in 1890, when Brooklyn printer Robert Gair accidentally discovered that scoring and cutting paperboard in a single operation made it possible to mass-produce prefabricated cartons. Gair’s “folding carton” revolutionized the packaging world. For the first time, companies could package goods efficiently for shipping and branding, leading to the explosive growth of branded consumer products from breakfast cereals to cosmetics.

Key Milestone:

1890 — First folding carton patent (Robert Gair): Enabled standardized, flat-packed boxes that could be easily transported and assembled at scale.

Expansion and Early Standardization

In the early 20th century, the popularity of Gair’s invention inspired rapid innovation:

Corrugated board was adapted for stronger, shipping-grade boxes in the 1900s, replacing heavier and costlier wooden crates.

By the 1920s and 1930s, streamlined folding and die-cutting methods allowed for more intricate and visually appealing retail packaging, making the paper box a marketing tool as much as a functional one.

Post-War Growth and Technological Advancements

After World War II, global manufacturing and retail underwent dramatic expansion. The need for reliable, lightweight, and brandable packaging made paper boxes a staple for everything from groceries to pharmaceuticals.

Technological leaps in this era included:

- The introduction of offset printing for sharper graphics.

- More sophisticated coating and finishing techniques.

- Integration of recycled fibers in response to growing ecological awareness in the 1970s and 1980s.

The E-Commerce Era

The dawn of e-commerce in the late 1990s and early 2000s brought new demands for robust, right-sized, and customizable packaging. Companies like Amazon became the world’s largest single consumers of corrugated cartons, ushering in:

- “Frustration-Free Packaging”: Branded, easy-to-open, fully recyclable boxes.

- Data-driven optimization: Amazon deployed algorithms to assign the smallest viable box for each order, slashing shipping costs, void space, and packaging waste at global scale.

Sustainability and Smart Packaging

- Sustainability mandates: Laws and consumer sentiment demanding recyclable, compostable, and responsibly sourced materials.

- Innovation in coatings: Shift away from plastic lamination to plant-based or water-based alternatives for easier recycling.

- Smart packaging: Integration of QR codes, NFC tags, and other technologies turning boxes into digital engagement tools.

Today’s Landscape

Paper boxes now embody over a century of iterative innovation:

- They are lighter, stronger, more visually rich, and more sustainable than ever before.

- Production leverages automation, robotics, and AI-powered quality control.

- Regulatory compliance, environmental certifications (like FSC, PEFC), and the rise of personalized, branded experiences keep pushing the envelope.

From the folding carton’s humble origins in Gair’s print shop to today’s Amazon-optimized, data-driven shippers, the evolution of the paper box has mirrored the changing tides in retail, logistics, and sustainability.

As packaging continues to shape—and be shaped by—societal priorities, paper boxes stand as both a testament to industrial ingenuity and a foundational tool for a more circular, brand-savvy, and connected future.

6. Regulatory & Certification Landscape for Paper Boxes

The regulatory environment and certification standards for paper boxes have become increasingly rigorous, reflecting global priorities around sustainability, product safety, and responsible sourcing. Below is an overview of the key frameworks and certifications that shape the industry:

FSC & PEFC: Responsible Fiber Sourcing

FSC (Forest Stewardship Council):

- Guarantees that wood and paper fiber come from forests managed to high environmental, social, and economic standards.

- FSC-certified paper boxes can display the FSC logo, signaling to consumers and partners that the packaging supports sustainable forestry and is traceable through the supply chain.

PEFC (Programme for the Endorsement of Forest Certification):

- PEFC is another widely recognized certification that ensures responsible forest management practices.

- Especially prevalent in Europe and Asia, PEFC standards are equivalent in rigor to FSC, providing additional assurance of non-deforestation, biodiversity protection, and legal compliance throughout the fiber supply chain.

ISO 9001 & ISO 14001: Management Systems

ISO 9001 (Quality Management System):

- Establishes globally recognized processes for quality assurance in production.

- Paper box manufacturers certified under ISO 9001 demonstrate a commitment to consistent product quality, continuous improvement, and customer satisfaction.

ISO 14001 (Environmental Management System):

- Focuses on a company’s operations to minimize environmental impact, comply with regulations, and improve sustainability performance.

- ISO 14001 certification signals that a manufacturer systematically manages waste, emissions, and resource use—critical as brands are increasingly held accountable for their environmental footprint.

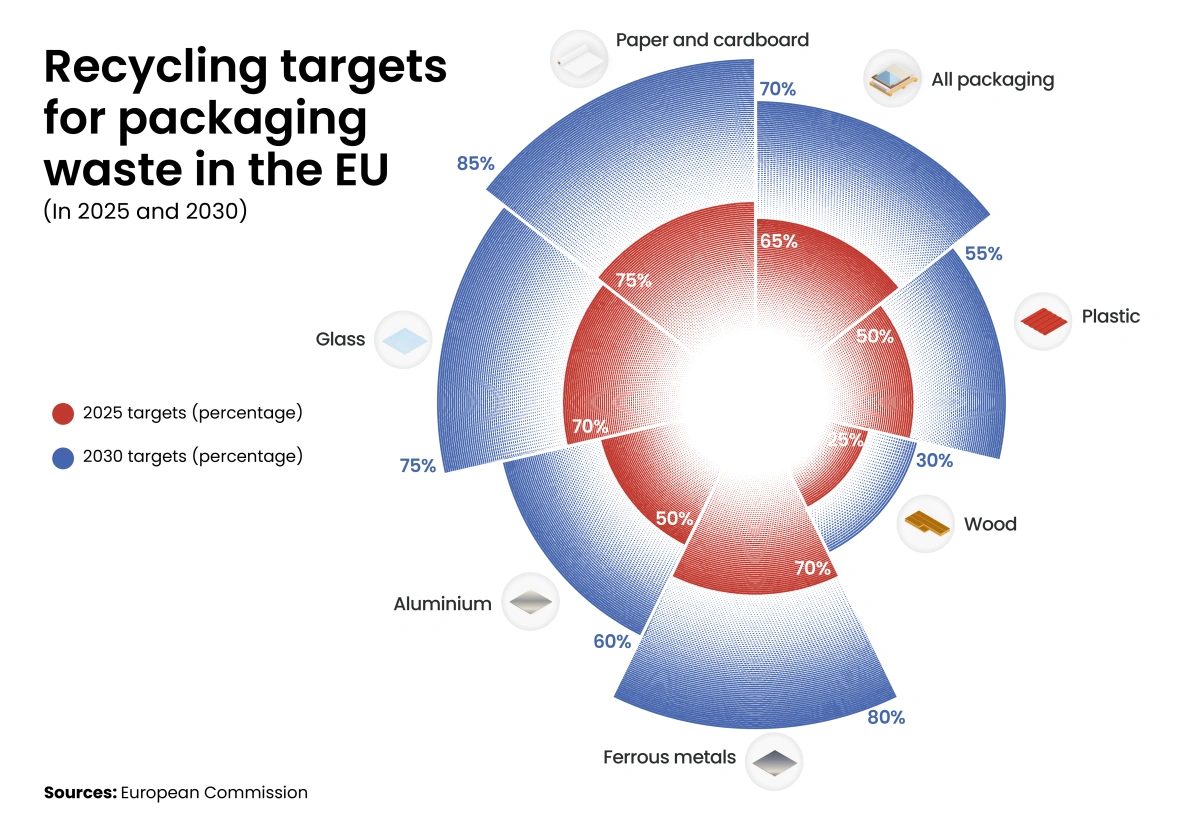

EU Packaging Directive: Recycling Rate Targets

The European Union Packaging and Packaging Waste Directive sets strict requirements for minimizing packaging waste and increasing recyclability across member states.

- Recycling Rate Targets: By 2025, the EU mandates a minimum 65% recycling rate for overall packaging, with specific targets for paper and board packaging.

- Design for Recycling: Companies must use materials and formats that facilitate easy collection, sorting, and recycling, which has boosted demand for uncoated, mono-material paper boxes throughout the supply chain.

- Non-compliance can result in penalties, market withdrawal, or mandatory redesigns.

FDA 21 CFR: Compliance for Food-Contact Paper

For paper boxes and cartons intended for food or pharmaceutical use in the United States, compliance with FDA 21 CFR (Title 21 of the Code of Federal Regulations) is mandatory.

- These rules govern the use of materials, adhesives, inks, and coatings, ensuring that all substances in contact with food are proven safe and do not migrate harmful chemicals.

- Manufacturers must perform migration testing, maintain documentation, and adhere to Good Manufacturing Practices (GMPs) to retain compliance.

The Bottom Line

Modern paper box manufacturing is shaped by an evolving landscape of certifications and regulations. These frameworks don’t just ensure legal compliance—they communicate quality, safety, and sustainability to consumers, retailers, and global markets. Businesses that invest in robust certification and regulatory adherence are better positioned to access premium markets, minimize supply chain risks, and drive positive environmental outcomes.

7. Case Study: Lush Cosmetics — Sustainable Paper Box Innovation

Lush Cosmetics exemplifies a leading-edge approach to sustainable packaging within the beauty and personal care sector. Their philosophy revolves around reducing waste at every stage, with a particular focus on the materials and lifecycle of their iconic paper boxes.

Use of Unbleached Kraft Paper

Lush opts for unbleached kraft paper in much of their secondary packaging (like gift boxes), prioritizing:

- Minimal processing: Reduces environmental footprint compared to bleached or heavily coated substrates.

- Natural appearance: Appeals to eco-conscious consumers and reinforces the brand’s identity as an ethical, “clean” beauty pioneer.

- High recyclability: Unbleached kraft is widely accepted in municipal recycling streams and compostable in most regions.

Packaging for Reuse and Return

Taking sustainability further, Lush encourages customer participation through a clear return and reuse program:

- Customers can return select packaging—including sturdy paper boxes and plastic “black pots”—to Lush stores.

- Returned paper boxes, if in reusable condition, are either sanitized for reuse as gift packaging or recycled using fiber recovery systems.

- This creates a closed-loop packaging model, significantly cutting down on single-use waste and helping Lush drive customer loyalty through eco-friendly incentives (such as rewards for returned packaging).

Brand Impact

- By promoting the return and reuse of packaging, Lush not only reduces its own material consumption but also educates consumers — making sustainability a shared responsibility.

- The use of bold, simple kraft boxes and minimal external inks underscores their transparency and anti-waste ethos, differentiating Lush in a crowded cosmetics market.

Industry Influence

Lush’s practices have prompted other brands in beauty, food, and retail to review their packaging choices, proving that scalable, low-waste packaging is not only feasible but can become a core component of brand storytelling and customer engagement.

8. Conclusion

From the perspective of a carton packaging manufacturer, paper boxes represent both a proven product line and a strategic growth opportunity in a rapidly evolving packaging landscape. Over the years, they have shifted from being simple protective containers to multifunctional assets that deliver durability, brand impact, and environmental benefits. With a portfolio that includes folding cartons, corrugated shippers, rigid boxes, and specialty gift packaging, manufacturers can serve diverse sectors—from food and beverage to e‑commerce, cosmetics, luxury goods, and electronics—offering tailored solutions that balance structural strength, cost efficiency, and design flexibility. Advances in printing, finishing, and structural engineering have allowed manufacturers to help clients turn packaging into an on‑shelf differentiator and a memorable unboxing experience.

The continued global push for sustainability and regulatory compliance fuels demand for responsibly sourced, recyclable, and compostable materials, making certified carton packaging a competitive advantage. Industry trends such as AI-driven box optimization, plant-based barrier coatings, and smart packaging features create opportunities for manufacturers to innovate while meeting stricter performance and eco-standards. By aligning design expertise, production efficiency, and environmental responsibility, carton packaging manufacturers can position themselves not only as suppliers but as strategic partners—helping brands protect their products, communicate values, enhance consumer loyalty, and succeed in a competitive, sustainability driven marketplace.