While the first part of our exploration into Cosmoprof Bologna 2026 examined the fundamental reasons why physical trade show participation remains essential, this continuation focuses on how to maximize that participation’s value. Beyond simply attending, success at Bologna requires understanding the intelligence-gathering opportunities, economic dynamics, and strategic approaches that separate transformative show experiences from merely adequate ones.

The beauty industry’s most successful companies approach Cosmoprof Bologna not as a four-day event but as a year-round strategy with Bologna as its centerpiece. They leverage the show for competitive intelligence, professional development, and relationship deepening that compounds over multiple editions. They understand the specific value propositions for different stakeholder types and align their participation accordingly. Most importantly, they recognize that return on investment extends far beyond immediate transactions to encompass the long-term partnerships and market insights that shape strategic direction.

This article provides a comprehensive guide to extracting maximum value from Cosmoprof Bologna 2026, whether you’re an emerging brand seeking visibility, an established corporation maintaining market leadership, a supplier showcasing innovation, or a retailer curating next season’s offerings. We’ll explore how different segments derive distinct benefits, examine the economic case for participation, address common challenges and their solutions, and look ahead to emerging trends shaping the show’s evolution.

1. Industry Intelligence and Educational Value

Cosmoprof Bologna functions as an intensive professional development opportunity concentrated into four days. The Cosmotalks conference series brings together industry leaders, trend forecasters, and market analysts presenting insights on the beauty landscape. Topics range from consumer behavior shifts to retail strategy evolution to sustainability imperatives to technology integration. These presentations offer perspectives valuable for strategic planning, with speakers including CEOs of major beauty corporations, founders of disruptive indie brands, and consultants with cross-market visibility.

Trend presentations covering color forecasts, ingredient innovations, and retail evolution provide actionable intelligence for product development and merchandising decisions. Color authorities preview the palettes that will dominate upcoming seasons, allowing brands to align their formulations with predicted preferences. Ingredient suppliers showcase novel actives and botanical extracts backed by clinical efficacy data. Retail analysts dissect channel shifts, from beauty specialty growth to department store challenges to e-commerce marketplace dynamics. This concentrated learning saves countless hours of independent research while offering higher-quality insights from recognized experts.

Regional market deep-dives illuminate the specific dynamics shaping beauty demand in different geographies. A session on Chinese beauty consumers might explore the social commerce phenomenon, ingredient preferences shaped by Traditional Chinese Medicine, and the role of K-beauty influences. A presentation on African markets could examine the hair care opportunities, shade range imperatives, and distribution challenges in diverse countries across the continent. These insights prove invaluable for brands planning geographic expansion or suppliers seeking to serve brands in specific markets.

Competitive intelligence gathering happens naturally as attendees observe rivals’ booth strategies, product presentations, and promotional approaches. Which brands invested in larger, more prominent booth spaces? What messaging themes recur across competitors? Which products draw the biggest crowds? How are prices positioned across the competitive set? These observations inform strategic adjustments, from pricing decisions to product portfolio gaps to marketing message refinement. The concentrated view of the competitive landscape that Cosmoprof provides would require months of market visits to assemble independently.

Identifying market gaps represents another intelligence-gathering benefit. An attendee might notice that dozens of brands showcase face serums but few feature eye creams, signaling an opportunity. Or observe that sustainability messaging focuses heavily on packaging while formulation stories receive less attention, suggesting a differentiation angle. Or recognize that male grooming brands cluster in basic categories—shaving, deodorant, hair—while leaving beard oil, skincare, and color cosmetics underdeveloped. These pattern recognitions emerge from the comprehensive view that walking the show floor provides.

Pricing structure intelligence helps brands position offerings appropriately for target markets. Seeing how premium brands price products relative to mass brands, how European brands compare to Asian competitors, and how new categories establish pricing norms informs strategic decisions. For retailers, understanding the margin structures across product categories and brand tiers supports assortment planning and negotiation strategies. This market intelligence proves difficult to gather systematically outside the concentrated marketplace that Cosmoprof creates.

Professional development extends beyond formal presentations to include workshops, demonstrations, and certification programs. Makeup artists demonstrate techniques using new products, showing retailers and distributors how to train their staff. Formulation chemists explain the science behind novel ingredients, building credibility for their efficacy claims. Business consultants offer workshops on export documentation, international trademark protection, and cross-border e-commerce strategies. These practical learning opportunities build the skills that support successful beauty businesses.

Mentorship opportunities abound as industry veterans and emerging entrepreneurs mingle throughout the event. A young brand founder might find themselves in conversation with a seasoned beauty executive who offers advice on scaling production or navigating retail negotiations. These informal knowledge transfers, happening over coffee or while waiting for meetings, provide guidance money cannot buy. The cross-generational and cross-cultural knowledge sharing that occurs at Cosmoprof Bologna enriches the entire industry, building collective capabilities that drive progress.

2. Segment-Specific Value Propositions

For emerging brands, Cosmoprof Bologna represents a visibility accelerator otherwise unattainable. A small indie skincare company from New Zealand gains immediate international exposure by exhibiting, putting their products before thousands of potential distribution partners, retailers, and media representatives. This visibility boost would require years of digital marketing investment and individual sales outreach to approximate. The concentration of decision-makers at Bologna collapses the timeline from unknown startup to recognized brand.

Access to distributors and retailers transforms emerging brand trajectories. A beauty buyer for a major European department store chain might never encounter an emerging brand through normal channels—their inboxes overflow with pitches, and their calendars fill with established supplier meetings. At Cosmoprof Bologna, that same buyer explores the Cosmoprime section specifically seeking new brands to differentiate their assortment. The playing field, while still competitive, becomes more level when all brands compete for attention through their booth presence and product merit rather than existing relationships or marketing budgets.

Learning from established players provides informal education through observation. An emerging brand can study how heritage luxury brands structure their booths, train their staff, present their products, and engage visitors. These lessons in professionalism and presentation prove invaluable for first-time exhibitors. The contrast between effective and ineffective booth strategies becomes apparent, offering immediate feedback that shapes future participation. Many successful brands credit their eventual market success to lessons learned from early Cosmoprof Bologna exhibitions.

Investment opportunities emerge from the concentrated presence of potential financial backers. Private equity firms seeking beauty portfolio additions, strategic corporate investors exploring acquisition targets, and angel investors passionate about the beauty industry all attend with capital to deploy. An emerging brand with strong products, clear brand vision, and capable leadership might connect with investors who propel their growth to the next level. These financial relationships form more naturally through in-person meetings where investors can assess founder capabilities and vision alignment beyond what pitch decks reveal.

For established global brands, maintaining visible presence at Cosmoprof Bologna signals continued industry leadership. Absence raises questions about brand health, market commitment, and innovation pipeline strength. The show provides a stage for demonstrating thought leadership through prominent booth locations, impressive product launches, and participation in conference programs. This positioning affects everything from supplier negotiations to retailer partnership terms to consumer perception of brand vitality.

Launching hero products at Bologna creates maximum impact by concentrating media attention, buyer interest, and industry conversation around the debut. A prestige skincare brand introducing a revolutionary anti-aging technology at the show generates coverage across trade publications, beauty media, and potentially mainstream press. The attention gained from a Bologna launch exceeds what individual press events or digital announcements typically achieve. This amplification effect makes the show an attractive launch vehicle for products central to brand strategy.

Retailer relationship reinforcement happens through the face-time that sustains partnerships. While established brands maintain regular contact with major retail partners, the informal interactions at Cosmoprof Bologna strengthen relationships in ways formal business reviews cannot. Shared dinners, booth visits, and candid conversations about market challenges build the personal connections that weather business difficulties. These relationship investments pay dividends when competition intensifies or market conditions shift.

Recruiting talent becomes easier when brands showcase their culture and opportunities at the show. Ambitious beauty professionals attend Cosmoprof Bologna precisely because they want careers at innovative, growing companies. Brand presence attracts these potential employees, with booth interactions serving as informal preliminary interviews. Similarly, brands scouting acquisition targets can observe potential companies in action, assessing their capabilities, culture, and strategic fit more effectively than through documents and formal presentations.

For suppliers and manufacturers, Cosmoprof Bologna offers concentrated access to current and potential clients representing diverse product categories, markets, and business models. A packaging supplier might connect with skincare brands, color cosmetics companies, haircare manufacturers, and fragrance houses during a single show—diversity impossible to achieve through targeted sales efforts. This broad exposure increases the likelihood of finding ideal client matches while demonstrating market versatility.

Showcasing capabilities to this diverse client base requires effectively communicating technical expertise, production capacity, quality standards, and innovation pipeline. Suppliers use their booths to demonstrate these qualities through product samples, technical documentation, case studies, and knowledgeable staff ready to discuss specifications. The ability to assess supplier credibility in person, through both what they present and how they present it, proves invaluable for brands making critical partnership decisions.

Contract manufacturing opportunities represent a major business development avenue for manufacturers attending Bologna. Brands increasingly outsource production to focus on marketing and brand building, creating demand for reliable manufacturing partners. For manufacturers, securing contract clients provides production volume stability and opportunities to showcase innovation capabilities. The relationships formed at Cosmoprof Bologna often evolve into long-term partnerships spanning multiple product launches and category expansions.

Understanding brand needs and market demands informs supplier innovation pipelines. By observing which packaging styles generate excitement, which ingredient claims resonate, and which price points brands target, suppliers gain intelligence that guides their development priorities. A packaging manufacturer might recognize growing demand for refillable systems and invest in expanding those capabilities. An ingredient supplier might notice brands struggling to find natural preservatives and prioritize developing botanical alternatives. This market feedback loop drives the supplier innovation that enables brand innovation.

For retailers and distributors, Cosmoprof Bologna streamlines the challenging task of curating next season’s offerings. Rather than evaluating brands sequentially through individual meetings, retailers can compare dozens or hundreds of options over several days, making more informed selections. The efficiency gains prove substantial, particularly for buyers responsible for multiple categories or geographic markets. The compressed evaluation timeline also allows faster market response as trends emerge and consumer preferences shift.

Discovering exclusive brands for competitive advantage motivates retailer attendance. A specialty beauty chain seeks brands unavailable to competitors, creating assortment differentiation that drives customer loyalty. The Cosmoprime section, along with less-traveled areas of the exhibition, yields these discoveries. The first-mover advantage of identifying promising brands before rivals find them can define retail success in competitive markets. Many of today’s best-selling indie brands trace their retail success to early adoption by buyers who discovered them at Cosmoprof Bologna.

Negotiating terms and building supplier relationships benefits from the informal, relationship-focused environment that trade shows create. While formal negotiations happen in offices and conference calls, the foundation for favorable terms often forms through the personal rapport developed at events like Cosmoprof Bologna. A supplier might offer better pricing or exclusive arrangements to a retailer they’ve built genuine relationship with versus an unknown entity submitting a request for proposal. These relationship dynamics influence deal structures in ways purely transactional approaches cannot capture.

Understanding global trends to inform local strategies helps retailers adapt international successes to their home markets. A European retailer might observe Korean beauty innovations at Bologna and consider how to introduce similar concepts to their consumers. A Middle Eastern distributor might discover European sustainable beauty brands and recognize opportunity for positioning them as premium imports. This cross-pollination of ideas and products, facilitated by Bologna’s international scope, drives beauty retail evolution worldwide.

For service providers including marketing agencies, consultants, and technology solutions companies, Cosmoprof Bologna presents concentrated access to potential beauty clients. A digital marketing agency specializing in beauty e-commerce can meet with dozens of brands seeking to strengthen their online presence. A business consultant offering international expansion support connects with brands ready to enter new markets. A technology provider with AI-driven product recommendation tools demonstrates their platform to retailers seeking competitive advantages.

Demonstrating ROI to potential beauty clients requires understanding industry-specific challenges and opportunities. Service providers attending Bologna gain this understanding through observation, conversations, and formal conference sessions. The investment in understanding beauty business dynamics, from regulatory challenges to retail margin structures to consumer behavior patterns, positions service providers to offer genuinely valuable solutions rather than generic offerings adapted superficially to beauty contexts.

Partnership opportunities across the value chain emerge from the comprehensive industry presence at Bologna. A marketing agency might connect with a photography studio seeking collaboration on beauty campaigns. A packaging designer might partner with sustainability consultants to offer integrated services. A logistics company specializing in beauty distribution might connect with brands and retailers needing their expertise. These ecosystem partnerships strengthen service offerings while expanding market reach.

3. Innovation Spotlight: Othilapak’s Sustainable Packaging Revolution

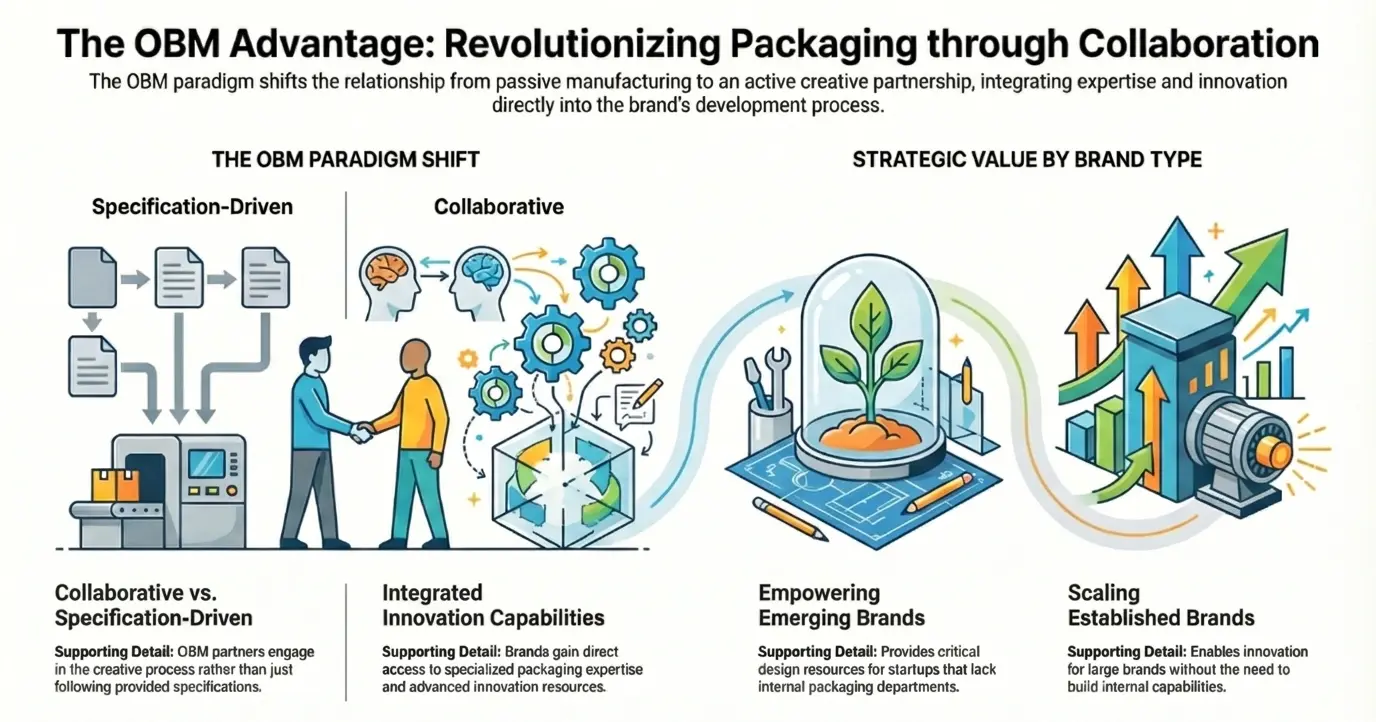

Among the innovative suppliers showcasing at Cosmoprof Bologna 2026, Othilapak stands out as a compelling example of how packaging innovation drives beauty industry evolution. This Chinese packaging company is dedicated to providing OBM (Original Brand Manufacturer) services to major international cosmetics brands, with the ultimate ambition of becoming a leading brand in innovative beauty and personal care packaging solutions.

At the 2026 exhibition, Othilapak showcases an impressive array of new designs addressing the industry’s most pressing packaging challenges. Their vacuum refillable bottles represent a breakthrough in sustainable luxury packaging, combining the premium aesthetics that prestige brands demand with the circular economy principles that consumers increasingly expect. The vacuum technology ensures product integrity while enabling multiple refills, reducing single-use packaging waste without compromising the user experience or product efficacy.

The company’s plastic packaging designs demonstrate that sustainability and aesthetic excellence need not conflict. Utilizing post-consumer recycled materials and designing for recyclability, Othilapak proves that environmentally responsible packaging can deliver the visual impact and functional performance that beauty brands require. Their design philosophy recognizes that consumers, particularly in premium segments, will not sacrifice beauty or functionality for sustainability—successful solutions must deliver all three.

Othilapak’s upgraded packaging solutions address specific pain points that brands face in contemporary beauty markets. Smart packaging with authentication features combats counterfeiting while enabling consumer engagement through connected experiences. Modular systems allow brands to offer customization options without requiring entirely separate SKUs. Lightweight designs reduce shipping costs and carbon footprints while maintaining structural integrity. These innovations reflect deep understanding of the commercial realities that packaging suppliers must address to become true brand partners rather than mere vendors.

The company’s OBM positioning differentiates them from traditional contract manufacturers. Rather than simply producing designs that brands specify, Othilapak collaborates in the creative process, bringing packaging expertise and innovation capabilities to partnerships. This approach proves particularly valuable for emerging brands that may lack in-house packaging design resources, and for established brands seeking to differentiate through packaging innovation without building internal capabilities.

For international cosmetics brands exploring sustainable packaging transitions, Othilapak represents the type of supplier relationship that Cosmoprof Bologna facilitates. Meeting face-to-face at the show allows brands to evaluate not just the packaging samples but the company’s design philosophy, technical capabilities, and cultural fit. The vacuum refillable bottles can be examined in person, with their mechanisms tested and aesthetic impact assessed. Conversations with Othilapak’s team reveal their understanding of brand requirements, regulatory compliance across markets, and commitment to continuous innovation.

The company’s presence at Bologna 2026 illustrates how Chinese suppliers have evolved from being primarily cost-focused manufacturers to innovation leaders offering sophisticated design and OBM capabilities. This evolution reflects broader shifts in global beauty supply chains as brands seek partners who can contribute to product innovation rather than simply execute specifications. Othilapak’s ambition to become a leading packaging brand signals confidence in their differentiated value proposition and recognition that successful suppliers must build brand equity alongside manufacturing excellence.

Companies like Othilapak exemplify why Cosmoprof Bologna remains essential even in an age of digital connectivity. While initial research might happen online, the assessment required for packaging partnerships—evaluating design sophistication, understanding production capabilities, gauging innovation commitment, and establishing personal rapport—demands in-person interaction. The show creates the conditions where these critical relationships form, mature, and eventually transform into the partnerships that bring innovative products to market.

4. The Economic Impact Argument

Return on investment analysis favors Cosmoprof Bologna participation when compared to the alternative of individual sales trips across markets. Consider a brand seeking distribution across ten European countries: scheduling meetings with potential partners in each market would require multiple international trips, hotel stays, and weeks away from business operations. The total cost easily reaches six figures while spreading relationship-building over months. At Cosmoprof Bologna, those same meetings happen over four days, with total costs including booth space, travel, and accommodations typically falling below individual outreach costs while delivering superior outcomes.

The efficiency of centralized meetings and negotiations accelerates business development timelines. Speed matters in competitive beauty markets where trends shift rapidly and windows of opportunity close quickly. The compressed timeline that Bologna offers—multiple partner meetings daily for four consecutive days—can advance business objectives by months or even years compared to sequential approaches. This velocity advantage compounds over time as brands enter markets faster, launch products sooner, and respond to opportunities more nimbly.

Long-term value of relationships initiated at Cosmoprof Bologna extends far beyond immediate transactions. A distributor partnership established at the show might generate revenue for years or decades. A supplier relationship begun at Bologna could support a brand’s entire product pipeline. An investor connection made at the event might fund multiple growth stages. When evaluating show ROI, these long-term relationship values dwarf the immediate participation costs, making Bologna attendance among the highest-return investments available to beauty businesses.

Deal-making velocity increases in the face-to-face environment that trade shows create. The dynamics of being physically present with time constraints and competitors nearby creates urgency absent from email exchanges or video calls. A buyer evaluating multiple brands for a category opportunity can conduct back-to-back meetings, make comparative assessments, and finalize decisions before leaving Bologna. The ability to say “let’s get the contracts started before we leave the show” transforms preliminary interest into committed partnerships with remarkable frequency.

On-site negotiations and contract discussions move more productively than remote conversations. When issues arise or terms need adjustment, the parties can reconvene within hours rather than waiting days for calendar alignment. This fluidity keeps momentum going and prevents deals from stalling over minor obstacles. Legal and financial advisors attending with clients can provide immediate guidance, removing delays that kill transactions in remote settings. The concentration of decision-makers with authority to commit creates an environment where deals close efficiently.

Follow-up conversion rates from trade show meetings significantly exceed those from cold outreach or digital marketing. A brand meeting buyers at their booth has already cleared the awareness and interest hurdles that consume most sales cycles. The buyer has invested time to attend, walked specifically to their booth, and engaged in conversation—all signals of genuine interest. Converting these qualified leads requires effective follow-up but starts from a much stronger position than initial outreach efforts. Industry data suggests trade show leads convert at three to five times the rate of marketing-generated leads.

Market entry economics favor Cosmoprof Bologna participation for brands expanding internationally. The alternative market research required to identify partners, vet their credibility, understand local market dynamics, and negotiate appropriate terms costs substantial time and money while remaining imperfect. At Bologna, brands compress this learning curve dramatically. Direct conversations with potential partners reveal their capabilities, values, and cultural fit. Observations of how they interact with other brands and present themselves indicate professionalism levels. References can be checked with other exhibitors encountered at the show. This accelerated due diligence reduces expensive market entry mistakes.

Avoiding costly market research mistakes through direct feedback saves brands from potentially devastating errors. A brand might believe their natural positioning resonates in a particular market, only to discover through Bologna conversations that local competitors have saturated that positioning or consumer preferences differ from assumptions. Discovering this before committing resources to market entry prevents wasted investment. Similarly, a brand might identify unexpected market opportunities through buyer enthusiasm for products they considered secondary rather than lead offerings. These insights recalibrate strategy before resources are committed.

Test marketing and pilot program initiation become possible through Bologna connections. A brand might agree with a retailer to test products in select locations before full-line adoption. A distributor might commit to a trial period in two countries before expanding across their territory. These structured pilots, negotiated face-to-face where terms can be discussed and adjusted collaboratively, reduce risk for both parties while creating pathways to larger partnerships. The willingness to pilot test runs higher when relationships form through personal connection rather than remote negotiation.

Economic impact on Bologna and the broader Italian economy underscores the show’s significance. The quarter-million visitors spending on accommodations, dining, transportation, and entertainment inject substantial revenue into the local economy. Hotels book solid for miles around the fairgrounds. Restaurants benefit from business dinners and celebratory meals. The employment generated for event services, hospitality, and transportation creates thousands of jobs. Italian government support for Cosmoprof Bologna reflects recognition of these economic benefits.

Global business generated through show connections totals billions annually. While precise attribution proves impossible, industry estimates suggest that partnerships formed at Cosmoprof Bologna drive over ten billion euros in annual beauty product transactions worldwide. This includes not just immediate orders but the ongoing revenue streams from distribution agreements, manufacturing contracts, and retail partnerships initiated at the show. The multi plier effects as products reach consumers, generate employment, and circulate through economies amplify the impact further.

Growth trends in attendance and exhibitor investment indicate confidence in the show’s value proposition. Post-pandemic recovery saw attendance return to pre-2020 levels by 2024, with 2025 exhibitor numbers reaching record highs. Brands and suppliers vote with their budgets, and the increasing investment in booth spaces, elaborate displays, and large delegations attending signals that ROI calculations favor Bologna participation. The waiting lists for prime booth locations and the expansion of exhibition space to accommodate demand demonstrate that Cosmoprof Bologna has maintained its position as the industry’s must-attend event.

5. Challenges and How Cosmoprof Addresses Them

Sustainability concerns around large trade shows merit serious consideration as the beauty industry pursues environmental responsibility. The carbon footprint of hundreds of thousands of international visitors flying to Bologna, the waste generated from booth construction and promotional materials, and the energy consumption of massive exhibition halls present legitimate challenges. Critics question whether the environmental costs justify even the substantial business value trade shows create.

Cosmoprof Bologna has responded with increasingly ambitious sustainability initiatives. The 2026 edition features carbon offset programs for attendees, with options to calculate and compensate for travel emissions. Renewable energy powers a growing percentage of the fairgrounds’ electrical needs. Booth construction guidelines encourage sustainable materials and reusable structures rather than single-use builds. Digital badge systems eliminate paper waste from credential printing. While environmental impact cannot be eliminated, these measures demonstrate commitment to continuous improvement aligned with industry sustainability values.

The digital integration strategy reduces certain environmental impacts while maintaining in-person benefits. Virtual participation options for specific content allow some stakeholders to benefit from Bologna without traveling. Digital catalogs and exhibitor profiles minimize printed materials. Post-show digital platforms reduce the need for follow-up travel as relationships develop through video calls rather than requiring additional in-person meetings. These hybrid approaches acknowledge that some environmental impact remains necessary to achieve irreplaceable in-person benefits while minimizing avoidable waste and emissions.

Cost considerations pose challenges particularly for smaller brands and suppliers with limited budgets. Booth space rental, travel expenses, accommodations, and staff time away from operations create substantial financial commitment. For bootstrapped startups or businesses in developing markets, these costs can seem prohibitive. The risk that participation might not generate sufficient business to justify investment causes understandable hesitation among resource-constrained companies.

Cosmoprof Bologna has developed tiered participation options addressing cost barriers. Shared booth spaces in the Cosmoprime section reduce individual brand costs while maintaining valuable visibility. Group pavilions organized by countries or regions allow multiple companies to share space and expenses. Virtual exhibitor profiles provide basic presence at minimal cost, allowing companies to be discovered even without physical booths. These options democratize access, ensuring that promising brands and suppliers can participate regardless of budget limitations.

Support programs for emerging businesses include mentorship, educational sessions on maximizing show participation, and promotional opportunities through the show’s media channels.

Start with Part 1: Discover why Cosmoprof Bologna 2026 still matters in a digital age, examining in-person networking power, innovation hub dynamics, geographic advantages, and the sensory realities that make physical trade shows irreplaceable for beauty businesses.

FAQs

What competitive intelligence can I gather at Cosmoprof Bologna?

You can observe competitor booth investments and positioning strategies, analyze product presentations and pricing structures across the competitive set, identify which innovations generate buyer excitement versus indifference, recognize market gaps where competitors have limited presence, assess messaging themes and sustainability claims, and understand how different brands approach various geographic markets. This concentrated competitive view would require months of individual market research to assemble independently.

How does Cosmoprof Bologna support emerging versus established brands differently?

Emerging brands gain visibility acceleration through the Cosmoprime section, access to distributors actively seeking new brands, learning opportunities from observing established players, and connections with potential investors. Established brands benefit from thought leadership positioning, maximum impact for hero product launches, retailer relationship reinforcement, talent recruitment opportunities, and visibility for acquisition target scouting. The show’s structure accommodates both growth stages effectively.

What should suppliers showcase to attract international beauty brands?

Suppliers should demonstrate technical expertise through product samples and documentation, communicate production capacity and quality standards clearly, present innovation pipeline and R&D capabilities, provide case studies from successful client partnerships, showcase understanding of regulatory compliance across markets, and staff booths with knowledgeable team members who can discuss specifications. Physical presence allows brands to assess credibility through both presentation quality and personal interaction.

How can retailers maximize their buying efficiency at the show?

Retailers should use pre-show digital tools to identify priority brands and schedule appointments, organize their visit by focusing on relevant sections (Cosmoprime for emerging brands, Cosmoprof Green for sustainable products), conduct back-to-back meetings to compare options efficiently, take organized notes using the platform’s save and tag features, negotiate terms while decision-makers are present, and establish pilot programs or test marketing arrangements that reduce risk while creating pathways to larger partnerships.

What makes Othilapak's packaging innovations significant for beauty brands?

Othilapak’s vacuum refillable bottles combine luxury aesthetics with circular economy principles, addressing sustainability demands without compromising premium positioning. Their plastic packaging designs utilize post-consumer recycled materials while maintaining visual impact. The company’s OBM approach means they collaborate in creative development rather than simply executing specifications, providing particular value for emerging brands lacking in-house packaging design resources and established brands seeking differentiation through innovation.

How does Cosmoprof Bologna address sustainability concerns about large trade shows?

The 2026 edition includes carbon offset programs for attendee travel emissions, renewable energy powering fairgrounds operations, booth construction guidelines encouraging reusable materials, digital badge systems eliminating paper waste, and virtual participation options reducing unnecessary travel. While environmental impact cannot be eliminated, these measures demonstrate continuous improvement aligned with industry values. The hybrid digital-physical approach minimizes avoidable impacts while preserving irreplaceable in-person benefits.